Consumer applications boost laser sales 10%

The Laser Focus World 2005 annual review and forecast of the laser markets is conducted in conjunction with Strategies Unlimited (Mountain View, CA). Part I of the review reports on the state of the overall market and focuses on nondiode laser applications. Part II, written by Robert Steele of Strategies Unlimited, covers the diode-laser marketplace and will be published next month.

In 2002, first at the OFC conference and then again at Opticon, industry luminary Kevin Kalkhoven stood before hundreds of disheartened engineers, manufacturers, analysts, and investors and told them that the key to rekindling the optoelectronics business was the consumer. From storage peripherals and cell-phone displays to sensors and optics for security and medicine, Kalkhoven was adamant that the best strategy for renewed growth was to pursue end-user applications that would provide some revenue in the near term while stimulating broad-based high-bandwidth needs in the long run.

While many listeners were skeptical at the time, this trend has since been confirmed by others-and by the market itself. Speaking at the Boston University Photonics Center last November, Fred Welsh, former executive director of the OIDA (Optoelectronics Industry Development Association; Washington, D.C.), noted that consumer electronics is now the fastest growing segment of optoelectronic component sales. At the same meeting Waguih Ishak, director of the Photonics and Electronics Research Laboratory at Agilent Laboratories (Palo Alto, CA), described how the emerging “digital home” is driving a convergence of communications, computing, and consumers.

In fact, photonics technologies are moving into the mainstream, beyond printers, pointers, and mice-think cameras, cell phones, flat-panel TVs, cars, computers, lighting, chip manufacturing, genetics, proteomics, and drug discovery. In each case, optical technology is playing a central role in the development of products designed to improve the quality of our lives-or at least, of our electronic goods. And today’s consumers have become as important to the growth of the laser and optoelectronics industry as they are to driving continued expansion of the U.S. economy.

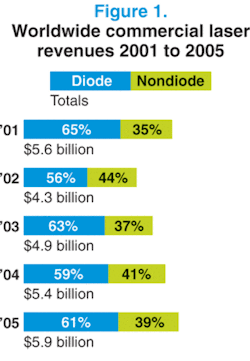

For the laser markets, this year’s review indicates that, despite ongoing selected market and average sales price (ASP) contractions, the industry is once again growing at a moderately healthy rate-total global revenues increased 10% in 2004 (see Fig. 1). And continued growth is forecast for 2005, with the overall market expected to reach total sales of $5.9 billion.

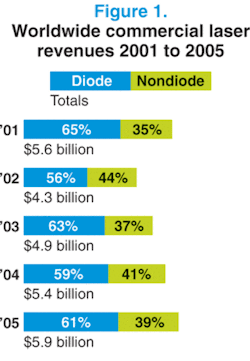

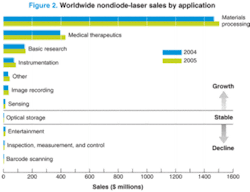

Nondiode-laser sales data for 2004 and 2005 are charted in detail by application and by type in Figures 2 and 3, respectively. Nondiode-laser sales data by unit shipment and dollar revenues are shown in Tables 1 and 2, respectively-corresponding charts and tables for diode lasers will appear next month. For an explanation of our methods, see “Where the numbers come from” [below].

The data presented in the tables here are available with additional commentary in the January 1 issue of Optoelectronics Report. The survey data will also be analyzed at the 18th annual Laser and Photonics Marketplace Seminar on Jan. 24, 2005. Held in conjunction with Photonics West (San Jose, CA) the seminar is sponsored by Laser Focus World in conjunction with Strategies Unlimited. (For more information, see Laser Focus World, December 2004, p. 123, and www.marketplaceseminar.com).

North American market strong

A number of economic and political issues have had a mixed effect on the high-tech markets, both in the United States and abroad. The conflict in Iraq-and related emphasis on homeland security-have not yielded the general boon to the optoelectronics industry that many expected, although the military situation did play a significant role in the U.S. presidential election, the outcome of which gave the stock market a boost in the latter part of 2004. And while U.S. economic growth may not be as broad based as some would like, the U.S. economy has been expanding for the past three years, which has helped create a generally upbeat outlook; surging consumer demand-as evidenced by a 20% increase (versus 2003) in debit card charges made over the 2004 Thanksgiving weekend-and a revival in labor markets is expected to push the gross domestic product (GDP) in the United States to 4.4% growth in 2004, compared to 3.2% worldwide. In addition, the expanding economy, combined with rising core inflation, prompted the Federal Reserve Board to begin raising interest rates in late June; by October, the Federal Funds interest rate had risen to 2%.

“There can be no doubt that President (George W.) Bush’s tax relief, combined with good monetary policy, the strength of our small-business sector, and our outstanding workforce, has led to a growing economy that is producing good jobs for American families,” said U.S. Treasury Secretary John Snow in October 2004. “The growing strength of the U.S. economy is further evident in (the most recent) employment report. With the addition of 337,000 jobs in October and upward revisions to August and September, roughly 2.4 million jobs have been created since August of 2003.”

Despite such rosy projections, however, the latter part of 2004 also brought increasing oil and commodity prices, a depreciating U.S. dollar, and a record U.S. trade deficit-all of which could affect the overall economic outlook. As the U.S. dollar hit a new all-time low against the Euro, concern about potential inflation is growing based on a number of factors, including “recent inflation data, and anecdotal evidence of businesses raising prices,” according to the Wall Street Journal. So further interest rate increases may be in the offing-though it’s by no means a sure thing.

All of this translated into a bumpy ride for public companies in 2004, especially in the high-tech sector. After gaining 25% in 2003, by late 2004 the S&P 500 Index was trading close to where it began in 2004. There were declines of 8% during the year in the S&P 500, 19% in the NASDAQ, 11% in the S&P 400 Midcap Index, and 14% in the Russell 2000 Smallcap Index. For the most part, however, the publicly traded laser and optoelectronics companies bucked this downward trend, at least in the first three quarters of the year. But there were anecdotal reports in late 2004 of a softening market, particularly for semiconductor capital equipment, which has become an increasingly important market for laser makers. Concerns about the near-term future of the semiconductor equipment business were confirmed by Cymer’s (San Diego, CA) October announcement that, despite a profitable and record third quarter, it planned to cut 14% of its workforce in anticipation of a slowdown in business.

Other laser manufacturers-especially those with broader product portfolios-seem more optimistic. Coherent (Santa Clara, CA) reported net income of $17.7 million on sales of $495 million for FY2004 (ended Oct. 2, 2004), a 22% increase over FY2003. According to president and CEO John Ambroseo, these results were “directly attributable to the strategic investments in R&D and acquisitions made over the preceding 24 months (and) we will continue to focus on fundamentals that should allow us to drive margin expansion and increase profitability into FY2005 and beyond.” As a result, the company’s stock price stayed between $25 and $30 per share throughout most of the year.

On the systems side, one of the most profitable laser companies in 2004 was Rofin-Sinar (Plymouth, MI, and Hamburg, Germany), which reported a 25% increase in sales and a 112% increase in net income for FY2004 (ended Sept. 30, 2004), both record highs. The company recorded net income of $32.4 million on net sales of $322.6 million for the year. While net sales were up only 1% for macro applications such as autobody welding and cutting, the company saw a 58% increase in sales for marking and microelectronics applications. This success was also reflected in Rofin-Sinar’s stock price, which jumped from around $20 per share in August 2004 to nearly $40 per share in November.

“Fiscal year 2004 was characterized by a strong electronics and semiconductor business and a recovery of the North American market,” said Peter Wirth, chairman and CEO. “Our increased Asian activities are also greatly contributing to the group’s success. Although we did see some softening of demand in the semiconductor sector, we do not consider it an indication of a larger downward trend. Based on our large product portfolio and our diversified customer base, we are very well prepared for the future.”

World markets mixed

In Europe most laser manufacturers experienced another subdued year. Many companies are still waiting for renewed growth in the telecom market, but others are finding some success in industrial and electronics markets. Although Bookham (Abingdon, England) reported positive growth in the metro market, the company continues its strategy of diversification, “leveraging its core optical competencies across [other] markets.” Recently launched nontelecom products from Bookham include optical filters for the life sciences and optical components for projection displays. In addition, the company has developed a range of high-power laser-diode bars for key industrial sectors.

Meanwhile, former telecom industry giant Marconi (London, England) appears to be making a comeback. In September the company announced that it had completed the full repayment of the $1.2 billion debt that it assumed upon completion of its financial restructuring in May 2003. This debt was originally due for repayment by 2008. Interim half-year results posted the same month show fairly flat sales, but good growth in profitability and a healthy investment in R&D. The company expects just single-digit growth in sales and has a 34% adjusted-gross-margin target based on higher volumes, cost savings, and improved business mix.

Lambda Physik (Goettingen, Germany) also experienced a turnaround of sorts, following a drop in sales of 21% at the beginning of 2004. Although revenues were up by 3% in lithography, a significant downturn in the rest of the industrial segment, including the flat-panel-display industry, and drops in scientific and medical applications more than compensated for it. Toward the end of 2004, Lambda Physik reported October year-to-date comparisons showing a growth in sales of 5% over 2003, and a growth in incoming orders of 39%.

Some of the smaller optoelectronics companies are also showing strength. Intense Photonics (Glasgow, Scotland) announced in February that it had expanded staff and facilities to handle demands from new markets, namely printing, defense, and telecom. Having increased its workforce from 50 in late 2003 to 65, and extended its clean-room facilities by 15%, the company expected this trend to continue. Diode-pumped solid-state laser specialist Elforlight (Daventry, England) has tripled its production capacity by moving into a new facility. Ultra-low-loss optical-switch maker, Polatis (Cambridge, England) has also moved to larger premises and gained some new funding. Oxxius (Lannion, France) also added more space in May 2004 and received €2.4 million ($3.2 million) in first-round financing from Sofinnova Partners; the company’s first product, launched in 2003, is a monolithic continuous-wave 473-nm laser. French nonlinear-crystal specialist Cristal Laser (Messein) has moved into a new production facility; an investment of €2 million ($2.6 million) from the regional government should allow the company to triple its crystal growth capacity.

As in the United States, the display business is also proving fertile for many smaller European companies. Microdisplay developer CRL Opto (Dunfermline, Scotland) was acquired by venture-capital firms Amadeus Capital and Doughty Hanson Technology Ventures and given $19 million in funding by its new owners. MicroEmissive Displays (MED; Edinburgh, Scotland), which designs and manufactures low-power microdisplays based on light-emitting polymers announced its intention to float on the Alternative Investment Market of the London Stock Exchange; in May MED received a further investment of U.S. $3 million from venture-capital and private investment.

The other major world market for lasers and optoelectronics is, of course, Asia. China’s booming economy is expected to expand 8.6% in 2004 and 7.7% in 2005 (GDP), adding to inflationary pressures. As a result, the Chinese government has adopted measures to put a brake on the runaway economic growth, such as forcing banks to increase their reserve requirements. Japan is benefiting from the strength of the Chinese economy and the improving U.S. performance this year. Real GDP growth of 4.1% is forecast in 2004, before Japanese growth weakens to less than 2% in 2005. The Japanese economy relies on exports to China, so even a modest decline in Chinese growth would hurt Japan’s outlook.

And while laser manufacturers generally remain nervous about the long-term impact of China on their business, particularly in terms of outsourcing and price erosion, for the most part this region is still a net end-user of lasers and laser systems rather than a producer. Most of the country’s investment in laser equipment remains in lower-power marking and cutting systems for localized applications such as textiles. According to David Belforte, editor in chief of Industrial Laser Solutions (ILS), while unit sales of low-power lasers remain strong and the beginning of a substantive market for high-power lasers is apparent, on a revenue basis China lags the other producing, consuming, and exporting nations. Still, Belforte notes that some analysts peg Chinese manufacture of CO2 lasers at more than 10,000 units annually.

A look at the lasers . . .

Before discussing individual market segment trends, a brief look at global revenues by laser technology reveals that lamp-pumped solid-state lasers still hold “first place” in terms of global sales, driven by their significant materials-processing applications. Total revenues of $645 million for 2004 were 11% higher than in 2003. And even with increasing competition from diode-pumped solid-state (DPSS) devices, the trend for lamp-pumped system sales is still upward-an additional 8% increase is projected for 2005.

The impact of DPSS lasers on the overall market continues to gain momentum. Hailed as an enabling technology when first introduced, DPSS laser sales growth has taken longer than many observers expected. Early predictions that DPSS lasers would quickly displace their lamp-pumped cousins proved (in retrospect) ridiculously optimistic. Nonetheless DPSS laser sales have now reached $270 million, a whopping 48% gain over 2003, and should top the $300 million mark in 2005.

Total excimer laser sales are in roughly the same ballpark as DPSS lasers and they too made a significant jump between 2003 and 2004. The 40% increase to $421 million was primarily due to healthy sales of high-ASP systems for photolithography-a situation not reflected in the rather conservative forecast of last year. And similar concerns this year for 2005 mean that sales are expected to drop back to about $370 million in 2005 (-12%).

In the “up and coming” department, two laser types are worthy of note. Both hailed as enabling technologies (an overused term for sure) for different reasons, fiber lasers and the emerging low-power “solid-state” devices are having or will have a significant impact on the overall laser business. We started reporting on fiber laser sales only a few years back and in 2004 total sales reached $84 million-about 14% over 2003. Additional growth of 47% is expected in 2005. There are several reasons for this strong growth and most, if not all, can be found in the underlying technology.

Fiber lasers have become the “hotbed of solid-state laser development” with advances in power output, better ways to generate ultrashort pulses at high powers, and more efficient production of wavelengths that had previously been hard to produce by other means, according to contributing editor Jeff Hecht (see Laser Focus World, December 2004, p. 81). The driving forces, he says, are a critical mass of new technology and ideas-steady improvements in pump diodes and the properties of ytterbium-doped fibers, as well as improvements in fiber design and fabrication, new specialty fibers, and other optical technology developed during the telecommunications bubble.

A less well developed but equally intriguing technology is the “solid-state” low-power blue-emitting (and green-emitting) lasers that have been appearing in the commercial arena over the past couple of years. The actual laser technologies vary somewhat and include DPSS lasers, optically pumped vertical-cavity surface-emitting lasers (VCSELs), electrically pumped VCSELs, and upconversion fiber lasers (and laser diodes). There are many and varied opinions in the market as to the short-term outlook for these devices but they appear to offer, for the first time, a viable laser to compete with air-cooled ion systems emitting at 488 nm. According to one manufacturer, market penetration of these lasers (in terms of replacing argon systems) is currently about 15% and will likely double in 2005. Also, photofinishing, though limited to a couple of major users in terms of customers, represents a significant market segment for these devices.

The bioinstrumentation market is typically cited as the most promising “new” near-term opportunity for these small lasers, and if the cost is right such lasers could lead to radical changes in the design of many instruments such as flow cytometers. In terms of other potential applications, at least one company has cited laser displays as a long-term goal.

For the time being we have decided not to report these lasers separately-they are, for the most part, either DPSS lasers or diode devices with value added, but breaking them out of these categories is currently beyond the scope of this report. For more information about the technologies underlying these lasers and some of their applications see Laser Focus World, October 2004, p. 79.

...and a measure of the markets

As noted elsewhere this month, 2005 marks the 40th year of Laser Focus World (see “40 Years: Then and Now,” p. 65). During that time the laser market has grown to reach almost $6 billion and has spawned an entire industry-sales of optoelectronic-enabled products exceeded $140 billion in 2003, according to Fred Welsh. As the laser and optoelectronics technologies have broadened during that time, so too have the applications covered by what are now, in fact, rather vague market groupings such as “materials processing” or “medical therapy” that we use in the market review. The former has grown to include a plethora of applications big and small, ranging from cutting steel to marking fresh fruit without damaging it (see Laser Focus World, October 2004, p. 85). And one can certainly argue that, in most cases, aesthetic surgery such as hair removal is anything but therapy-facts to keep in mind as we review the market segments.

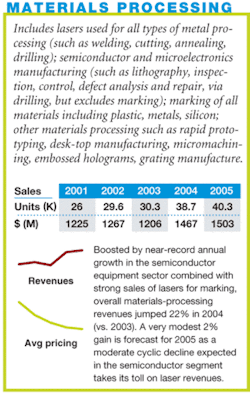

Materials processing

This year’s Laser Focus World market review indicates that total laser sales in materials processing grew 22% in 2004 versus 2003, with worldwide revenues of $1.47 billion in 2004 compared to $1.2 billion in 2003. Looking ahead, our survey respondents anticipate revenues in this sector to increase only slightly (3%) in 2005, to $1.5 billion.

Early 2004 saw most economic indicators pointing to sustained growth in the industrial laser sector, and the majority of companies that supply products into this market were, for the most part, upbeat in their view of prospects for the year. This forecast proved true, according to Belforte. The annual ILS survey, which focuses on systems sales, indicated that sales of industrial laser systems rose 10% in 2004 to $1.125 billion. The adjusted unit production numbers for 2004 (31,000) is a 16% increase over 2003; this increase was lead by substantial gains expected in China and Japan, coupled with nominal growth in North America and Europe. For 2005 ILS expects unit sales to increase by at least 7%.

The semiconductor equipment market grew strongly for the first three quarters of 2004, with SEMI (www.semi.org) projecting 63% growth in semiconductor equipment and materials sales for the year (SEMI Mid-Year Semiconductor Equipment Consensus Forecast, July 2004). Toward the end of 2004, however, several laser companies reported that the market was softening again and the industry’s book-to-bill ratio dropped back below one in September.

Commenting on Cymer’s results, CEO Bob Akins said in October, “Over the past few weeks, the reported decline in chip fab utilization has caused some chipmakers to begin delaying equipment purchases, including the purchase of lithography tools. Cymer has also received light-source push-outs from two of our direct customers in the past few weeks. Additionally, while our light-source utilization rates were up overall for the third quarter, they did drop off appreciably in the last month of the quarter. As a result of this uncertainty in the industry, our visibility has become limited to less than one quarter. In these circumstances, we believe the prudent course is to be proactive and take actions that will prepare Cymer to deal effectively with what, at this time, appears to be an industry slowdown that could persist potentially for a few quarters.”

"This market has been in a growth phase for the last year; however, it is leveling off and is probably going to retrench into a contraction,” commented another major supplier. “But the contraction this time around will be much milder because the build-up was not so far out of control; capacity and shipments did not exceed underlying demand in integrated circuits and wafers. So we are seeing a downturn, but it is not as severe as last time around.”

While this downturn is significant as far as lasers are concerned, there are a few bright spots in some other microelectronics arenas. Nanotechnology has seen a major influx of R&D dollars in the past year. According to a Strategies Unlimited report, more than $4 billion in government funded R&D was poured into nanotechnology worldwide in 2004.1 Among the many potential areas likely to benefit from nanotechnology are high-brightness LEDs, moving them into the realm of general illumination, and solar cells, as lower manufacturing costs bring them to levels competitive with other energy sources. According to Strategies Unlimited, companies pursuing carbon nanotube displays may be able to catch the largest bounty of all, a piece of the $60 billion, high-growth flat-panel business.

Even so, primarily because of the softening in chip production and the high ASP of the excimer lasers involved, overall nondiode laser sales for semiconductor and microelectronics manufacturing are expected to decline 12% in 2005. Nondiode laser revenues in this sector grew from $253 million in 2003 to $356 million in 2004; but 2005 revenues are expected to reach only $313 million.

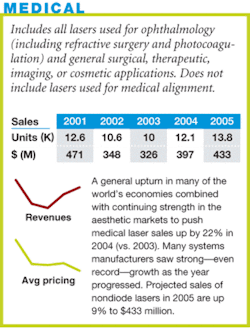

Medical

The significance of the consumer is certainly not news to those watching sales of lasers for medical-therapy applications. Patient-paid therapy (versus insurance paid) has been the primary market driver for several years now and involves both aesthetics and vision correction. The medical-laser market regained a certain amount of buoyancy in 2004, reflecting the general economic upturn in most of the major world markets. Medical-laser systems manufacturers such as Candela, Biolase, Laserscope, Cutera, and IntraLase all saw strong growth-in some cases record growth-throughout 2004, a trend that translated into good news for manufacturers of diode, erbium, holmium, Nd:YAG, alexandrite, and, to a lesser extent, excimer and CO2 lasers.

Much of this gain was driven by the aesthetic market-primarily hair removal and skin rejuvenation. Laser systems for these applications are now being sold not just to dermatologists and plastic surgeons but also to ophthalmologists, gynecologists, and general practitioners. Laserscope has carved a nice niche for its solid-state laser technology and related disposables in the urology market. In ophthalmology, while excimer-laser system sales have stalled somewhat (although IntraLase appears to be on a roll) procedures are up, which means royalty revenues are on the rise as well. Veterinary medicine also represents a growth market, although veterinarians appear to be opting for second-hand rather than new equipment.

As a result of these trends, according to Medical Laser Report (January 2005) the global medical-laser systems market rose 18% in 2004 over 2003, reaching $2.4 billion. This systems growth is expected to continue in 2005, with projected systems sales of $2.7 billion.

Sales of the nondiode lasers for medical-laser systems totaled $397 million in 2004, up 22% from 2003. Projected sales of nondiode lasers in 2005 are up 9% to $433 million.

Readers should note that several medical-laser systems manufacturers do not participate in our survey. To derive the laser source revenues reported here, we track medical-system end-user sales within this market sector. Revenue projections are based on medical-laser system sales to end-users-the laser is only one component of these system sales. The numbers in our tables, however, are based on revenue estimates of the laser source itself. For more specific discussion of the medical market, see Medical Laser Report, January 2005.

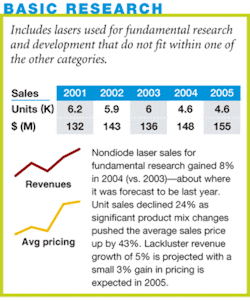

Basic research

This segment includes all areas of basic research involving lasers but the strongest areas of interest currently include ultrafast, biophotonics, nanotechnology, defense-related R&D, and very high-energy systems (see “Petawatt lasers aim for relativistic phenomena,” p. 101) To some degree, sales of lasers for research represent a “staple diet” for the laser suppliers involved. While the demands of the market may push the envelope in terms of product specifications, the relative stability of demand and consequent income has provided many firms with the wherewithal to weather the economic storms that occur from time to time.

Sales of nondiode lasers for fundamental research gained 9% in 2004-about where it was forecast to be last year. Unit sales declined substantially (24%) during the year as significant product-mix changes pushed the ASP up by 43%. Looking forward, and as is typical of this market segment, lackluster revenue growth of 5% is projected with a small 3% gain in ASPs.

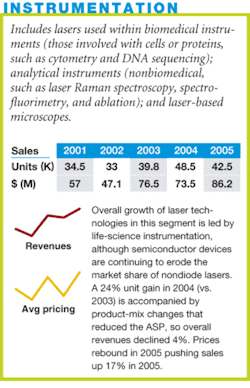

Instrumentation

Within the instrumentation field, individual technology markets continue to show laser sales growth. Leading the way are the life-science technologies, fueled primarily by pharmaceutical research and the medical and food markets. However, many of these markets, which originally emerged in the 1990s, are maturing, and the competition among laser suppliers in the bioinstrumentation market has increased dramatically. After consistently achieving 15% to 20% growth rates year after year, most of the instrumentation markets for lasers are now growing at about 8% to 12%, according to Michael Tice, senior consultant with Strategic Directions International (SDi; Los Angeles, CA) and contributing editor of Instrument Business Outlook, published by SDi. Tice maintains that maturation of the technology and more cautious spending in the pharmaceutical industry are the main reasons behind the slowed growth.

For example, the market for microarray scanners for DNA analysis (and the component lasers that stimulate fluorescence) is growing at about 12% and is projected to slow down to 8% growth within five years. Another sizable life-science market, though slower growing, is DNA sequencing. These instruments typically use laser-scanning confocal microscopy with 488- and 532-nm lasers to perform automated reading of the genetic code in DNA samples; however, diode lasers have already largely replaced argon-ion lasers in this market.

The market for laser-based flow cytometry, particularly for relatively inexpensive benchtop units, has increased fairly dramatically over the past few years, causing a significant increase in unit sales of both diode and nondiode lasers. A leader in these so-called “personal cytometers” is Guava Technologies (Hayward, CA), which is now marketing a diode laser-based system designed for field-based applications such as HIV screening. Flow cytometers with more sophisticated capabilities for traditional lab-based applications can cost five times as much as the Guava system and may include several laser types (diode and nondiode) and associated wavelengths.

Another fast-growing market for lasers is Raman spectroscopy and Raman microscopy, particularly in the pharmaceutical market. Currently, the Raman market for lasers amounts to only a few million dollars, but it will double in the next five years. This should translate into good news for manufacturers of diode and nondiode lasers spanning the ultraviolet, visible, and near-infrared range.

Outside the biotech arena, volatile oil pricing and soft spots in research funding have prompted many analytical instrument companies to lower their outlook for 2004/2005.

Because of the increasing displacement of gas lasers by diode devices in instrumentation and the slow adoption of solid-state blue lasers by instrument manufacturers, the LFW survey indicates a 4% decline in revenues from sales of nondiode lasers for this market between 2003 and 2004. A rebound is projected in 2005 due primarily to a broadening of the types of solid-state laser-based instruments used for drug-discovery and related diagnostic applications.

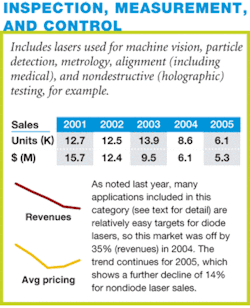

Inspection, measurement, and control

Something of a catch-all category, this segment really consists of multiple niches, ranging from nondestructive testing to wavelength reference sources. In some of these niches the impact of diode lasers (in terms of replacing nondiode devices) has been significant while in others less so. Overall nondiode laser revenues here are off 35% in 2004 versus 2003, mostly because the gas lasers (argon-ion and HeNe) are being phased out: HeNe laser sales dropped 34% or $1.9 million and argon-ion revenues fell by a similar percentage, with the trend continuing into 2005. Though not enough to offset the effect of the gas laser decline, DPSS revenues did increase slightly into 2004. Overall nondiode laser sales for 2005 are projected to fall another 14%

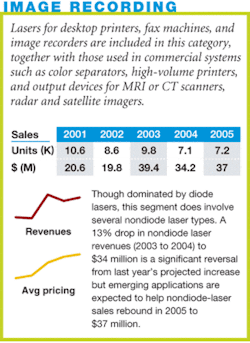

Image recording

There can be few laser applications as technologically diverse (historically speaking) as commercial printing-though the latter term has itself grown in terms of what it includes (see “Diode lasers dominate prepress applications,” p. 145). Over the years the convergence of cheap computing power, new laser types, and increasingly sophisticated end-user demands such as customized on-demand printing and complex product packaging has had a profound effect on the industry, making such technologies as computer-to-plate both a practical reality and a necessity. Almost every type of laser has been involved in commercial printing at some point in time, with the technical trends adjusting as the industry needs have changed.

The influx of red diode lasers for thermal platesetters and violet diodes for computer-to-plate (CTP) applications continues to affect sales of nondiode lasers in this field. Diode-pumped solid-state green lasers are still used for imaging photopolymer plates and also in some niche applications such as holographic printing and film writing. Carbon dioxide lasers (200 to 300 W) are finding application in the engraving of flexo plates, which are used in printing plastic, cardboard, foil, juice boxes, and other packaging and promotional products. Carbon dioxide lasers are also being used for direct imaging on the copper cylinders for gravure printing, an emerging market for lasers. In addition, ultraviolet lasers are finding application in printed-circuit-board imaging.

Nonetheless, diode lasers dominate this market segment. So the LFW survey indicates a 13% drop in nondiode laser revenues (2003 to 2004), from $39 million to $34 million. Some of the emerging applications in printing and packaging, however, are expected to help nondiode-laser sales rebound in 2005, to $37 million.

Military/aerospace

Many laser and instrumentation companies indicate that defense markets played a significant role in their 2004 activities. Besides the relatively well-known applications such as targeting, military R&D projects related to bioterrorism and biosensing also provided a revenue boost. In addition, high-profile projects such as the Airborne Laser and the National Ignition Facility continue to move forward; while both have been beset by various delays, in late 2004 a Boeing-led team successfully achieved “first light” with the Airborne Laser, firing for the first time the chemical oxygen-iodine laser built by Northrop Grumman for this project (see “Airborne Laser achieves ‘first light’ milestone,’’ p. 15 ). The next step is to fly the plane with the beam-control and fire-control optics in it, but not the laser, and to conduct further ground tests of the laser itself. In the meantime, the U.S. Congress authorized President George W. Bush’s request for $474.3 million for the program in fiscal 2005, which began Oct. 1, as part of the $10 billion budgeted for missile defense development and deployment.

But for the most part, in terms of this market review, getting an accurate read on what the military is spending on lasers and related components is difficult at best. Thus, as in years past, our survey numbers for military and aerospace reflect the lack of transparency in this sector and are certainly incomplete; even so, an upward trend can be seen. Nondiode unit sales for 2004 were 1068, up 74% from 2003; revenues gained 55%. According to our findings, sales of nondiode lasers in this market are expected to grow another 33% in 2005.

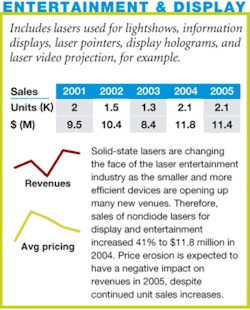

Entertainment and display

For years, the ion laser was the most common type of laser used in light shows. But ion lasers offer several challenges; in particular, they are not inherently robust enough for most entertainment applications. The introduction of the diode-pumped solid-state laser in the late 1990s thus had a profound impact on the laser light-show field. Today, laser-light displays are finding their way into much smaller venues, from corporate events to shopping-mall advertising.

“The real excitement in this industry is the innovations in solid-state lasers,” explained William Benner, president and chief technology officer of Pangolin Laser Systems (Orlando, FL). “Ten years ago, the vast majority of this stuff was done with ion lasers; three years ago, the only solid-state lasers you could find were green. But now red-green-blue (RGB) solid-state lasers are here and you are seeing the availability of 5-W RGB lasers that can plug into a standard outlet. And as these things continue, it makes it easier (and less expensive) to do shows in venues like theaters and ballrooms for sales meetings and other events.”

Our survey reflects this trend, with sales of nondiode lasers for display and entertainment applications increasing 41% to $11.8 million between 2003 and 2004. However, price erosion is expected to have a negative impact on revenues in 2005, despite continued-albeit much slower-unit sale increases.

Other

The bulk of the remaining markets covered in our survey-including telecom, barcode scanning, data storage, and pump lasers-involve diode lasers and will be addressed in detail next month. While HeNe lasers are still used in barcode scanning, sales of these lasers for this application continue to decline-a trend likely to continue into 2005. The use of nondiode lasers for sensing applications, however, experienced a slight increase in both unit sales and revenues in 2004 (4%), a trend that should continue through 2005.

REFERENCES

1. Nanophotonics: Assessment of Technologies and Market Opportunities, Strategies Unlimited, November 2004.

Click here to download Table 1

Click here to download Table 2

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Diode-laser market information is provided by Strategies Unlimited (Mountain View, CA). Industrial-laser market information is provided by Industrial Laser Solutions, and the Medical Laser Report newsletter provides the medical market analysis. This review is the only major survey of its kind in this industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and U.S. government bodies, this report is the only objective summary of major trends in our industry that is readily available. Part I examines the overall market trends with more detail on nondiode lasers. Part II will be published in February and will cover the diode-laser marketplace.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, will be available to attendees at the Lasers and Photonics Marketplace Seminar, held in conjunction with Photonics West (San Jose, CA) on January 24. For more information see www.marketplaceseminar.com or call Lisa Gowern at 603-891-9267.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 2004. We asked manufacturers to provide a confidential estimate of total worldwide market size (dollars and units) for 2004, based on year-to-date actual data, and a forecast for 2005. In addition to the information provided by the manufacturers, we also used data from other more narrowly focused market surveys, and we incorporated commentary provided by industry analysts who added market insight for specific segments. The detailed fiber laser sales information this year was provided by SLI Optics (Southampton, England), whose help over the past couple of years in getting a handle on the fiber-laser business has been invaluable.

Changes from last year

A comparison of last year’s 2004 estimates with this year’s restated 2004 numbers will show differences and occasional discontinuities in the numbers reported as compared to last year. In general, no attempt has been made to explain these differences in detail. We request “bottom-up” market estimates, and the respondents to our survey do vary from year to year-both in terms of the companies involved and the individuals-so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 2004 last year and for 2004 this year may also reflect whatever degree of optimism or pessimism was inherent in last year’s forecast (see Laser Focus World, January 2004, p. 75).

Observant readers will also notice that the “Other” laser category used in the tables in prior years has been replaced this year by the “Fiber” laser category. This change reflects the growing importance of fiber lasers in the overall market picture, and the fact that the other types of lasers previously included in this grouping (such as metal vapor lasers) have increasingly less significance in terms of total laser revenues.

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.

Stephen G. Anderson

Director, Industry Development - SPIE

Stephen Anderson is a photonics industry expert with an international background and has been actively involved with lasers and photonics for more than 30 years. As Director, Industry Development at SPIE – The international society for optics and photonics – he is responsible for tracking the photonics industry markets and technology to help define long-term strategy, while also facilitating development of SPIE’s industry activities. Before joining SPIE, Anderson was Associate Publisher and Editor in Chief of Laser Focus World and chaired the Lasers & Photonics Marketplace Seminar. Anderson also co-founded the BioOptics World brand. Anderson holds a chemistry degree from the University of York and an Executive MBA from Golden Gate University.