Business Forum: Diving into emerging AR/VR markets -- opportunities for optics

While virtual reality promised and failed to hit 2016 expectations, market projections still show that augmented reality and virtual reality will reach $108 billion by 2021. Consumer electronics are a high-volume opportunity for U.S. optical manufacturers, but they often remain elusive because of cost constraints. Does augmented reality (AR) or virtual reality (VR) offer some optics and photonics companies a stronghold? Let's break it down.

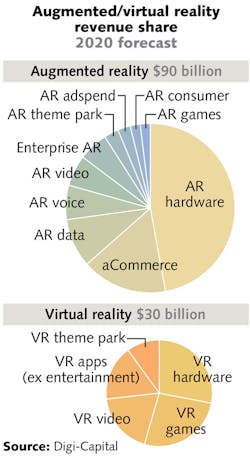

While we tend to think of gaming and entertainment, these segments represent less than half the market projections (see figure). Training, inspection, and health applications provide a far broader mix of end users and a range of emerging requirements.

Regulatory controls in healthcare and military segments, as well as precision concerns in engineering, may offer U.S. manufacturers an advantage. Many of the optics companies we know are actively engaged in prototyping for AR and VR, but full production depends on widespread adoption.

Barriers to adoption

Widespread adoption is understandably slow because of interdependencies such as standardization of platform, pricing tier convergence, and availability of content.

VR platforms like Facebook's Oculus Rift, HTC Vive, and Samsung Galaxy's Gear VR all launched with plenty of barriers, but remain promising. The "hero device" is much clearer for AR, though. Even with the re-emergence of Google Glass, AR is almost certainly going to be smartphone-based. What's more, AR and the optics behind it offer phone manufacturers a critical innovation to overcome slowing replacement cycles.

Proving cost, size, and performance advantages

Optical designers and manufacturers stand to capitalize on this emerging market space if they can prove to offer an advantage in:

• Performance

• Efficiency, contributing to battery life

• Size reduction (particularly in the move from desktop to smartphone, photonic crystals offer promise)

• Cost reduction, as pricing categories take shape

Specifically, AR/VR is a significant opportunity for companies who offer core competencies in:

• Photonic crystals

• Optoelectronic design and engineering

• Diffractive optics

• Proven path to production and ability to scale

• Flexibility in partnering, requiring a sophisticated ability to qualify prospects and technologies, and a well-articulated internal investment policy

The large field of view required for adoption of consumer AR/VR presents a classic industrial design challenge-how to meet cost, size, and weight limitations. Investment is certainly there to fuel this research. In July 2017, WaveOptics raised $15.5 million for its display technology.

Beyond the end user apparatus, creator technologies represent opportunities:

• Camera field of view—aspheres will help to meet FOV needs while keeping cameras compact

• Motion sensors—opportunities for infrared and optical gyroscopes

Regardless of where your capabilities match with market opportunity, do your research, understand customer drivers, and be sure to qualify opportunities to understand scale-up timing and dependencies.