Annual Laser Market Review & Forecast: Lasers enabling lasers

Let’s cut to the chase: the key drivers for the laser market in 2017 were consumer electronics devices and China, and the biggest winners on the technology side were fiber lasers, light detection and ranging (lidar) lasers, and vertical-cavity surface-emitting lasers (VCSELs). These trends resulted in record profits for equipment providers in laser materials processing and semiconductor manufacturing, and many of the suppliers of lasers and photonics devices to these manufacturers. In short, lasers are playing a key role in speeding the fabrication of the semiconductor wafers and consumer appliances that are hungry for yet more lasers. And while industry consolidation continues, with most deals aimed at cherry-picking key enabling technologies, the pace eased in 2017 after 2016’s monster year of mergers and acquisitions.1

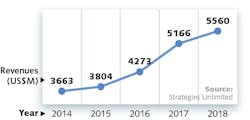

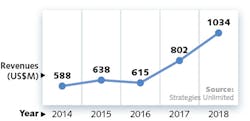

That said, it should come as no surprise that 2017 was a great year for the laser industry. Our numbers show that the estimated worldwide laser revenue for 2017 was up 18.1% over 2016, driven in large part by the materials processing sector, where laser revenues jumped more than 26% year-over-year—fiber lasers alone for materials processing were up a staggering 34%. We do see 2017, however, as an aberration, and expect laser sales growth to return to more moderate growth for 2018 as capital equipment spending cools2 for certain materials processing laser systems.

Judging by the robust 2017 laser sales numbers, Industry 4.0 and Internet of Things have become more than just buzzwords. The Integrated Photonic Systems Roadmap,3 for example, released in March 2017 by the American Institute for Manufacturing Integrated Photonics, anticipates IoT applications to have a particularly large impact in this market. And Industry 4.0 opportunities4 continue to emerge—in 2017, Trumpf (Ditzingen, Germany) opened its smart factory5 in Chicago, with an emphasis on digitally connected production solutions for the sheet metal process chain, and the VDW (German Machine Tool Builders’ Association) introduced an initiative for networked production.

Consider these four bellwether laser manufacturers, all of which performed well beyond expectations in 2017 with $1 billion or more in sales as well as significant year-over-year growth and corresponding stock price jumps:

Coherent (Santa Clara, CA):To say this company had a banner year is an understatement.Coherent reported6 net sales of $490.3 million and net income of $73.8 million for the fourth quarter of FY2017, nearly double its net sales of $248.5 million and net income of $30.8 million for the fourth quarter of FY2016. Net sales for the year were $1.7 billion, up from $857 million in FY2016; net income was $209 million, compared to $88 million the previous fiscal year. Coherent CEO John Ambroseo credited these impressive numbers to microelectronics orders, specifically sustained strength in OLED [organic light-emitting diode] deployment and service and a modest rebound in advanced packaging; materials processing orders from the Rofin acquisition and organic growth; stronger OEM instrumentation sales in the diagnostic and therapeutic space; and growth in the aerospace and defense market.

Han’s Laser (Shenzhen, China): With reported sales7 of RMB 3.1 billion ($452 million) in the first half of 2016 and growing 22.7% year over year, Han’s Laser is expected to reach the billion-dollar mark in 2017. Drivers behind this growth include their acquisition of Canadian fiber provider CorActive HighTech, further solidifying their expertise in fiber laser technology. According to a report8 released in March 2017 by Research in China, of the total worldwide 2016 industrial-laser market (estimated at $3.16 billion), China’s share is more than 17%. And this pattern is expected to continue, according to the report, with China’s share of the global industrial laser market topping 20% in five years.

IPG Photonics (Oxford, MA): This fiber-laser manufacturer’s third quarter revenues of $392.6 million represented a 48% year-over-year increase, pushing its nine-month revenues over $1 billion, up from $726 million in the same quarter in 2016. The bulk of this came from materials processing, with sales increasing 52% year-over-year—key markets here were cutting, welding, and 3D printing applications. Based on its third-quarter performance, the company is anticipating 37–39% revenue growth for the full year—its strongest annual revenue growth in six years, according to CEO Valentin Gapontsev. Not surprisingly, the company’s stock price more than doubled between January and November 2017, from $92/share to more than $200/share.

Trumpf: The Trumpf Group also saw a significant uptick in its 2016/2017 financials, with pre-tax profits up 11.3% to nearly $398 million and sales up 10.8% to a record-breaking $3.6 billion. The company attributes the upturn in sales to the strong global economy, noting that "political developments worldwide have had little impact so far on business in Europe, Asia, and the Americas." However, CEO Nicola Leibinger-Kammüller remains cautious: "The prevailing strength of the global economy has been outweighing potential impediments to investing: pledges of protectionist measures, the Chinese government’s approaches to disseminating information, and the UK’s exit negotiations with the European Union," she said in the company’s October 19, 2017 financials announcement.9 "All the same, we do forecast clouds over the investment landscape in the medium term."

Consumer demand

Much of 2017’s growth can be attributed to the increasing use of lasers and optics in consumer devices, and the manufacture of those devices. For example, assembling an iPhone (or pretty much any smartphone) involves a dozen or more laser-based processes, including cutting glass, engraving parts, and drilling circuit boards.

The iPhone X is also the first iPhone (although not the first smartphone) to feature an organic light-emitting diode (OLED) display, which has Coherent—a major provider of excimer lasers used in the fabrication of these displays—eagerly anticipating "unprecedented demand"10 going forward. The OLED Association agrees,11 projecting OLED smartphone penetration to increase from 20.5% in 2016 to 25.3% in 2017, which translates into around 308 million smartphone OLED displays in 2016 and 410 million in 2017.

In addition, many smartphones—including the iPhone 8—contain VCSELs for 3D sensing and ranging applications, which has become a major driver in the growing sales of these lasers.12 In fact, while VCSELs have been used in many applications outside of smartphones—such as data communications, computer mice and automotive lidar systems—smartphones represent a major new opportunity.

"It is safe to say that 2017 became the year that VCSELs broke out, driven by consumer applications," said John Dexheimer, president of LightWave Advisors [Westport, CT]. "They are the driver for the 3D imaging systems for Apple, Samsung, and everyone else making smartphones." Indeed, Philips Photonics’ (Ulm, Germany) late-2017 completion of a $27 million project to scale up VCSEL production13 capabilities is an indicator that this market is taking off.

The iPhone 8 is also notable for its purported face recognition capabilities, which is expected to be a boon for the mobile depth sensing market—another application that involves VCSELs.

Revenues of 3D camera modules are forecast to reach $6 billion in 2022,14 while the opportunities for the lens and illumination components are expected to reach $1.8 billion and $400 million, respectively. In November, Lumentum (Milpitas, CA),15 which supplies many of the VCSELs used in the iPhone, announced revenues of $243 million for its first quarter, driven primarily by a ramp-up in its 3D sensing business. And with Apple’s new iPhone X and its Face ID feature—based around a VCSEL array projector—it is telling that ams (Premstaetten, Austria) recently became the latest company to reveal plans for a major ramp-up in VCSEL device production,16 following its acquisition of Princeton Optronics (Mercerville, NJ) earlier this year.17

Laser ubiquity redux

While these numbers are impressive, they represent the tip of the iceberg for lasers in the consumer space. It’s been said before, but it’s worth saying again: lasers are increasingly ubiquitous in our everyday lives, to the point where we often don’t realize it. From our daily communications and the design of the products18 we buy to our cars, our homes, our medical care, the grocery store, the golf course,19 a nearby apple orchard20 … they are seemingly everywhere and yet, in many cases, you wouldn’t know they exist.

In addition to VCSELs, one of the emerging frontrunners in the consumer space for lasers is lidar,21 a market that is projected to double in size22 over the next five years, primarily because of a single emerging application: self-driving vehicles. Lidar has been used for years for rangefinders, aerial mapping, 3D scanning of objects and spaces, and aerosol velocity monitoring. But autonomous vehicles are expected to turn this multi-billion-dollar market into a multi-trillion-dollar market, with lidar sensors for these vehicles accounting for a larger share of the market than all other lidar applications combined, according to Austin Russell, CEO of start-up lidar company Luminar (Denver, CO).

In an increasingly competitive space23 (note the acquisition of Princeton Lightwave24 by Ford’s AI unit and General Motors’ purchase of lidar maker Strobe25), Luminar believes its single-laser (1550 nm), single-receiver (InGaAs) lidar sensor, designed and built from the ground up specifically for autonomous vehicles, could be a game-changer. The company is partnering with four autonomous vehicle development programs, including the Toyota Research Institute,26 and is leveraging fab infrastructure originally developed for telecommunications lasers to more quickly scale up mass production of its sensors. At the end of 2017, Luminar was set to begin a 10,000-unit run out of its 70,000-sq-ft. Orlando, FL facility—an unprecedented number compared to conventional lidar sensor production.

Looking ahead, two other emerging application areas are worth keeping an eye on: quantum technologies and augmented reality/virtual reality (AR/VR) applications. In the quantum space, two key initiatives were announced in 2017: the QUTEGA optical single-ion clock project27 led by Toptica Photonics (Munich, Germany) (lasers are seen as a better alternative for cooling atomic clocks), and a $250 million investment by the UK government28 to convert quantum-physics research into commercial products, with a focus on chip-scale atomic clocks for improved GPS communication, quantum-enabled sensors, quantum communications, and quantum computing.

And AR/VR is expected to benefit from substantial investment over the next few years—according to IDC,29 total spending on AR/VR is projected to grow from $11.4 billion in 2017 to more than $200 billion in 2021. While this is should have primary significance30 for photonic crystals, optoelectronics, and diffractive optics, it could also boost the use of laser materials processing equipment for these products and fuel the integration of more lasers into AR/VR headsets for eye tracking31 and projection32 applications—again, lasers enabling yet more lasers.

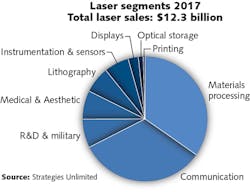

LASER MARKET SEGMENTS

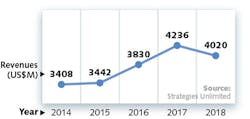

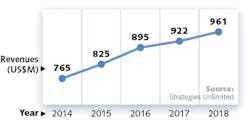

For the first time in our annual laser report, pure industrial laser sales (excluding lithography lasers) topped communications and optical storage laser sales. Telecom grew in accordance with bandwidth demand, while experiencing a short-term revenue drop in late 2017—a trend not expected to repeat in 2018. All other laser segments experienced growth, especially lasers for aesthetic medical and emerging surgical applications.

Materials processing and lithography

In spite of the political, cultural, and social news bombarding us in 2017, it was a mostly quiet economic year with healthy growth almost slipping by unnoticed. In a nutshell, the world’s leading economies turned in a better-than-expected growth rate in 2017, and 2018 is expected to continue this trend. As Bloomberg Businessweek put it in a special issue33 on the year ahead, "The world economy should grow nicely again in 2018. Unless someone does something dumb." This sums it up, allowing us to focus in on the world markets for industrial laser material processing.

Industrial laser activity experienced another growth year led by strong double-digit sales of high-power fiber lasers, a surge in excimer laser revenues led by laser processing of silicon of displays, and significant increases for ultrafast pulse lasers. This growth came at the expense of CO2 laser sales (down 14%) while solid-state (disk) spurted to an 18% growth. High-power direct diode and excimer lasers in the ‘Other’ category gained 56%, with excimer lasers continuing strong short-term gains based on their use in smartphone processing applications.

Materials processing & lithography

Includes lasers used for all types of metal processing (welding, cutting, annealing, drilling); semiconductor and microelectronics manufacturing (lithography, scribing, defect repair, via drilling); marking of all materials; and other materials processing (such as cutting and welding organics, rapid prototyping, micromachining, and grating manufacture). Also includes lasers for lithography.

While political problems continued to worsen around much of the world in 2017, and North Korea threatened to launch nuclear missiles at its enemies, the materials processing laser segment let none of this negative news dampen its party. In fact, from summer 2016 to Q3 2017 when this was written, laser revenue growth was nothing short of phenomenal.

Geographically, China remained strong as usual, but Europe and other most other Asian countries were strong in laser materials processing revenues as well. North America was not as strong as some of these other regions, but did a respectable showing nevertheless. Japan was the only country with shrinking laser markets during the period.

Higher-power fiber lasers were a big part of the growth driver in materials processing. Excimer lasers for lithography had a fairly strong 2017, and revenues for lasers used to produce flat-panel displays were pushed to record levels; unfortunately, not enough manufacturing lasers could be produced to prevent shortages of the OLED screens on the new iPhone X. Additive manufacturing had a slow start in 2017, but by mid-2017, a series of large orders more than made up for the slow months.

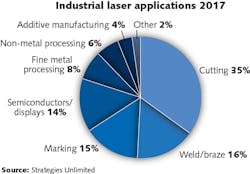

Industrial laser revenues saw continued growth in the automotive, aerospace, energy, electronics, and communications sectors. Marking contributed about 15% of all laser revenues, with growth dominated by fiber lasers. Micro, which includes all applications using lasers with <500 W of power, climbed to 32% of the total laser market, thanks to a 56% growth in the sector that included display applications requiring excimer lasers. Among Macro revenues, cutting is the most important application in terms of revenue generated (66%). In 2017, cutting expanded by 29%—a level the industry says will not be matched in 2018.

In the Micro sector, additive manufacturing—more specifically laser additive manufacturing (LAM) for metal deposition and prototyping—grew 30% in 2017, spurred by acceptance in the aviation engine industry, which is using both intermediate and high-power CO2 and fiber lasers.

Economic projections for manufacturing in 2018 are a repeat of 2017 with pockets of sluggishness (East Asia, South America, and Eastern Europe) continuing. For industrial lasers in 2018, 7% revenue growth is projected because of a calming of the growth spurt in high-power fiber and excimer lasers over the past two years. Marking laser revenues are expected to show a decline (to 6% growth) as unit prices continue to erode. Micro laser revenue will grow 9% as fine blanking and non-metal processing grow in importance. The Macro category levels off to 53% of 2017 total revenues, and high-power direct diode and excimer revenues will pump up (11%) the Other category.

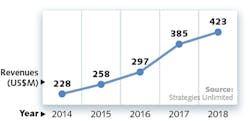

Communications and optical storage

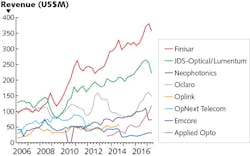

Since 2006, revenues for the largest optical telecommunications companies have followed an admirable average growth curve. And in the two-year period from late 2014 to late 2016, many companies experienced record gains. Finisar (Sunnyvale, CA) saw record revenue34 of $1.45 billion in its fiscal year through April 2017—a 14.7% jump over the prior fiscal year; Oclaro (San Jose, CA) saw phenomenal 47% growth35 to $601 million for its fiscal year ended July 1, 2017; and Lumentum revenue for its fiscal year ended July 1, 2017 grew 11% to reach a record $1 billion.

So, what happened by mid-2017? IHS Markit (London, England) reported36 that the global optical equipment market declined 15% quarter-over-quarter in Q3 2017 as "soft growth in the Asia Pacific region was not sufficient to offset the declines in EMEA, North America and Latin America." While the downward trend is evident in the Q3 and Q4 2017 financials, we don’t expect this to last after reviewing clues in the outlook statements from the major telecom laser suppliers.

Despite its record revenue, Finisar had already reported in June 2017 that its 30% year-over-year growth in 100G transceiver products (as predicted37 by IHS Markit that 2016 would be a ‘breakout’ year for 100G technologies) was not enough to offset declines in telecom purchases by its Chinese OEM customers, causing an overall 6.1% decline in quarter-over-quarter revenue through April 2017. By July 30, 2017, however, quarterly revenue was only down 4.4%,38 trending back to a growth scenario according to CEO Jerry Rawls, who said in his fiscal Q1 2018 earnings call39 that "we expect to increase our revenues in the second half of the fiscal year. This growth will be driven primarily by sales of 100 gigabit QSFP28 transceivers for hyper scale data centers and high power VCSEL arrays for 3D sensing."

Incidentally, Laser Focus World’s forecast for 3D sensing VCSELs is included in the instrumentation and sensors segment and not in the communications and data storage segment, which is reserved for VCSELs incorporated into primarily datacom (850 nm) transceivers.

Like Finisar, Oclaro’s growth was driven by 100G transceivers and it also noted that its Q4 fiscal revenue declined quarter-over-quarter because of "softness in China." But by September 30, 2017, Oclaro quarter-over-quarter revenues were up 4% on strength in 100G transceivers, which represented 81% of its total revenues. And like Finisar, Oclaro expects40 that "revenue growth will resume during the second half of calendar 2018 driven by 100 gig and beyond coherent products."

And finally, more evidence that the recent optical hardware downturn is temporary can be found in Lumentum’s outlook for 2018: "China has been reducing inventory levels for several quarters now. As inventories decline to targeted levels, demand should increase," said Lumentum CEO Alan Lowe in the company’s Q1 2018 earnings call.41

"The high-speed optical networking hardware market, which includes [distributed Bragg reflector] DBR lasers, modulators, and coherent components that comprise the majority of today’s 100G transceiver products, is cyclical," says Clarel Thevenot, general manager at InLC Technology (Madison, NJ),42 manufacturers of wavelength-selective switches (WSSs) used in reconfigurable optical-add-drop multiplexers (ROADMs) that are crucial to 100G and beyond networks. "Telecom service providers begin big infrastructure projects by first deploying optical fiber, amplifiers, some WSSs, and only a few transceivers. Additional transceivers come later as more channels are needed to boost bandwidth until maximum capacity is reached for the deployed system." Thevenot told us that in conversations with global service providers, they are experiencing an acceleration in the rate at which system capacity is reached from 3 to 4 years to only 2 years or less—more evidence of an anticipated return to growth after a temporary lull.

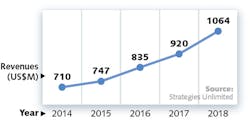

Communications & optical storage

Includes all laser diodes used in telecommunications, data communications, and optical storage applications, including pumps for optical amplifiers.

Communications laser revenue tends to be cyclical, and after peaking near the end of 2016, laser revenue in 2017 was headed downward. This cyclical nature is easy to understand. No matter whether datacom or telecom and wired or wireless, mass deployments of new generations of technology occur in lock-step, worldwide. Currently, most new technology deployments are driven by wireless cellular technology. But upgrading wireless also puts new demands on the wired backbone (fiber and lasers). Upgrades to 4G cellular technology are currently winding down, and the newest 5G cellular technology is not expected to start being rolled out until 2019.

As for optical storage, the future continues to dim for lasers. DVD, CD, and Blu-ray media sales continue to drop and more cloud-based solutions are eliminating the need for large local storage. Heat-assisted magnetic recording (HAMR), which uses a laser to increase storage capacity of magnetic media, has been pushed back again, with Seagate 16 TB, 3.5 in. HAMR drives now expected to hit the market in 2018—a year ahead of Western Digital and Toshiba.

What also makes us collectively optimistic that China will resume healthier buying levels for communications lasers in mid-2018 and beyond is the continuing thirst for bandwidth that led Needham & Co. (New York, NY) to predict the 2017 "mega cycle"43 in fiber-optic networking. In 2018, China Mobile (Beijing, China) is pushing forward with 5G mobile technology (and its associated optical fiber and laser-based backbone infrastructure44) with "meaningful capital expenditure from 2019." And we are all familiar with Industry 4.0, but at TelecomsWorld Asia 2018 in Bangkok, Thailand, two days are devoted to Telco 4.045 with keynotes and panels on "Technologies on the horizon—AI, VR/AR and 5G," "Assessing the impact of an IoT era" (and are our telcos ready to embrace it?), "Connecting the next billion users," and "Cybersecurity in the digital age."

Laser revenues for quantum communications, which directly address this burgeoning need for "cyber security" (assuming certain laser-based means of cracking this quantum code46 are defused), should also boost communication laser revenues in 2018 and beyond. This time, however, the lasers aren’t DBR, distributed feedback [DFB], external cavity, or even VCSELs, but are largely single-photon sources, although other types of quantum emitters47 are being developed.

In June 2017, China reported48 the ‘spooky action’ of quantum entanglement from its Micius satellite to ground stations separated by a record 1200 km distance (surpassing the previous 143 km record). And in September 2017, China set up its first commercial, private quantum communication network in Jinan49 for use by more than 200 government officials. China’s advances, as well as a European Union investment of more than $1 billion for a "quantum technologies flagship"50 program to make quantum computing practical, hold promise for continuing growth in communications laser revenues.

Scientific research and military

While 2017 sales of lasers were respectable for scientific R&D and impressive for military and defense, it is difficult to say how sustainable these numbers will be, particularly for certain science applications in the U.S. In the Trump administration’s first memo51 outlining R&D budget priorities, the top areas were military superiority, security, prosperity, energy dominance, and health.52 Increased spending in the first two would likely be a boon for the laser industry, but other key markets were conspicuously absent from the list—notably space science and climate research.

That said, these are U.S. government recommendations that would primarily affect spending at the National Science Foundation, the National Institute of Standards and Technology, the National Institutes of Health, and the Department of Energy Office of Science. But for many in the R&D sector, government investment from these agencies is critical. Unfortunately, in the administration’s 2018 budget proposal (still being debated in Congress as of this writing), most agencies that support scientific R&D would see double-digit declines53 in their budgets—a scenario that prompted the National Photonics Initiative54 and The Optical Society (OSA) to express concern55 over the potential impact of these cuts on current and future science advancements.

"Sustained R&D funding is vital to the foundation that our industry needs to innovate, produce and market the next generation of cutting-edge technology products and services," said Elizabeth Rogan, CEO of OSA. "Investments in science and technology fuel economic growth, and the optics and photonics industry, in particular, is a leading source of high-quality advanced manufacturing jobs."

Scientific research & military

Includes lasers used for fundamental research and development, such as by universities and national laboratories, and new and existing military applications, such as rangefinders, illuminators, infrared countermeasures, and directed-energy weapons research.

Spending on lasers used for research and development was up modestly in 2017. As with past years, China has been one of the biggest contributors to laser research spending, while spending on lasers in the United States was flat.

As in 2016, military laser spending was strong in 2017, with most lasers being used for gun sights, imaging, ranging, and communications applications. Militaries around the world are increasingly seeing the need to use more lasers. One area that has been gaining traction is smaller directed-energy laser weapons to perform short-range tasks, such as shooting down drones. Infrared countermeasures are also becoming increasing important, for all types of aircraft, as cheap heat-seeking missiles have become readily available to many terrorist organizations.

At present, however, the laser business remains stable in the scientific sector and brisk in military and defense. Spending on lasers used for R&D was up modestly in 2017, with China once again one of the biggest contributors. As Coherent CEO John Ambroseo succinctly noted in the company’s year-end financials call,56 "The scientific market is largely unchanged. Revenue trends in North America, Europe and Asia are stable, and competitive dynamics exhibit the usual give-and-take. With the growth that we’ve experienced in the commercial markets, the scientific market now represents less than 10% of (our) total revenue."

This is to be expected of a mature market where technology innovations yield incremental commercial results. Advances in ultrafast lasers are beginning to open up new applications outside of the technology’s core micromachining market, such as light-matter interactions57 and nanomaterials research.58 Advanced lidar and coherent lidar is finding niches here as well, notably in drones59 and for scientific applications like surveying, civil engineering, archeology, and environmental science. And while not a major market driver in terms of commercial sales, space research projects such as LIGO,60 JWST,61 and LISA62—each of which use a variety of lasers, optics, and optoelectronic components—achieved notable milestones in 2017.

Meanwhile, military laser spending again saw an uptick in 2017, with applications ranging from gun sights and imaging to ranging, communications, directed-energy weapons, and drones for surveillance and security. In the U.S., each military department has a focused program in this area,63 including the Navy’s Laser Weapon System, the Army’s High Energy Laser Mobile Demonstrator, and the Marine Corps’ Ground Based Air Defense System. And given the current administration’s stated intent64 to dramatically increase defense spending going forward, this trend is likely to continue.

As a result, 2017 was a banner year for defense contractors like Lockheed Martin (Bethesda, MD),65 which was on the receiving end of a number of government-funded projects specific to laser systems. The U.S. Missile Defense Agency awarded Lockheed Martin a nine-month, $9.4 million contract66 to develop a Low Power Laser Demonstrator missile interceptor concept; the Air Force Research Lab awarded the company $26.3 million67 to design, develop, and produce a high-power fiber laser as part of its Self-protect High Energy Laser Demonstrator program; and the company was awarded a $131 million contract68 by the Air Force for follow-on production of its Paveway II Plus Laser Guided Bomb kits.

This trend is being echoed around the globe. Increases in defense spending worldwide are expected to push growth in the directed-energy and military laser market—estimated to be $7.4 billion in 2017—to more than $12 billion by 2022, according to a recent report69 from BCC Research (Wellesley, MA). While the Asia-Pacific region accounts for the largest share of this market, BCC notes that developing countries in Africa and South America have huge untapped growth potential.

Medical and aesthetic

As has been the case for many years, aesthetic applications of lasers continue to be the primary driver for this market, which again saw record levels in 2017. Applications include tattoo, wrinkle, scar, and hair removal; fat reduction/body sculpting; and skin lightening. The U.S. and Europe are the largest markets here and both were especially strong, as were emerging areas like China and India.

The aesthetic market has become so attractive it is prompting investment from companies not usually associated with it. In early 2017, Hologic (Marlborough, MA)—best known for its presence in women’s imaging—spent $1.65 billion to acquire Cynosure,70 a market leader in aesthetic applications of lasers, with products ranging from laser hair removal and skin rejuvenation to body sculpting. Founded in 1991, Cynosure (Westford, MA) reported revenues of $434 million in 2016. According to Hologic, the medical aesthetics segment currently exceeds $2 billion globally and is expected to grow at a low-double-digit rate over the next several years.

Medical & aesthetic

Includes all lasers used for ophthalmology (including refractive surgery and photocoagulation), surgical, dental, therapeutic, skin, hair, and other cosmetic applications.

In 2016, sales of lasers used for medical purposes hit record levels, but in 2017, medical lasers in some areas sold even better. For the most part, the actual medical application determined how great medical laser sales were.

Strongest were medical lasers used for beauty and aesthetic applications. Applications here include tattoo, wrinkle, and hair removal, skin resurfacing, and skin lightening. For the most part, these are applications not covered by insurance. The U.S. and Europe are the largest markets here and both were especially strong, as were some emerging areas like China and India.

A second strong area was surgical lasers. For certain types of surgery, like heart, oral, and prostate surgery, lasers are proving that they can produce better outcomes at less total cost. The future for this application looks better every year.

With regard to using a laser for dental and eye applications, these two areas were flat in 2017. The lasers used for eye surgery gained lots of popularity at the same time laser-assisted in situ keratomileusis (LASIK) and similar photorefractive keratectomy (PRK) became popular. The number of these surgeries performed peaked in 2007 at about 1.5 million. Since then, the numbers have dropped to less than half as many and continue to drop. Adoption of lasers by dentists has remained slow.

"Acquiring Cynosure will accelerate our transformation into a higher-growth company by leveraging our core women’s health expertise and OB/GYN channel leadership," said Steve MacMillan, Hologic chairman, president and CEO. "We had identified medical aesthetics as an attractive and complementary growth opportunity."

Another pioneer in the aesthetic laser market, Syneron-Candela (Wayland, MA), was also acquired in 2017 by the private equity firm Apax Partners71 for $395 million. "We have identified the medical aesthetics market as a highly attractive investment area given its long-term growth prospects," said Steven Dyson, partner and co-head of healthcare at Apax (London, England). Syneron purchased Candela, then a competitor, in 2009 for $65 million.

Among aesthetic applications, body sculpting—a technique that typically involves low-level laser therapy in the 532–680 nm range—led the league in 2017. In a direct challenge to Hologic’s acquisition of Cynosure, biopharmaceutical giant Allergan (Dublin, Ireland) acquired Zeltiq Aesthetics for $2.5 billion.72 While Zeltiq’s fat-reducing technique does not use lasers, Allergan clearly sees the opportunity in what is said to be a $4 billion worldwide market. Cutera (Brisbane, CA), another player in this space, saw its 2017 third-quarter revenues increase 26%73 to a record $38.2 million, primarily because of 57% growth in North America systems revenue. It was the company’s 13th consecutive quarter of year-over-year double-digit revenue growth.

Sales of surgical lasers were also positive in 2017. For certain types of surgery (notably cardiovascular, urology, and gynecological), lasers continue to prove that they can produce better outcomes at less total cost, resulting in projected global market growth of more than 9% CAGR by 2021. For example, biolitec (Wien, Germany)—a German firm known for its laser-based phlebology, proctology, and gynecology surgical systems—introduced XCAVATOR,74 a laser fiber that the company says provides the fastest tissue ablation for benign prostatic hyperplasia laser surgery. And in a sign of the anticipated continued health of this market segment, in 2017 Philips (Amsterdam, Netherlands) paid $2 billion to acquire Spectranetics,75 whose product portfolio includes the only excimer-laser based system for the treatment of peripheral and coronary heart disease.

Finally, while many dental and ophthalmic applications remain popular, sales of laser systems for these treatments were flat in 2017. Even so, ophthalmic laser manufacturer Iridex (Mountain View, CA) saw an 11% increase year-over-year76 in its Q3 revenues to $10.9 million. Meanwhile, dental-laser provider Biolase (Irvine, CA) reported revenues of $10.8 million77 for the third quarter of FY2017, down from $13.2 million in the same quarter of FY2016. Biolase said its system sales were negatively impacted by the natural disasters in Florida and Texas, in addition to short-term declines driven by a sales-force reorganization and downsizing.

Looking ahead, emerging application areas such as neurophotonics78 and optogenetics79 are benefitting from some serious investment. In October, the National Institutes of Health announced funding for 110 new awards80 totaling $169 million for the Brain Research through Advancing Innovative Neurotechnologies (BRAIN) Initiative, bringing the total 2017 funding investment for this program to $260 million. In addition, the 21st Century Cures Act, passed in December 2016, dedicates $1.6 billion to the initiative through 2026.

Launched in 2013, the BRAIN Initiative is a large-scale effort to push the boundaries of neuroscience research and equip scientists with the tools and insights needed to study and treat brain disorders such as Alzheimer’s disease, schizophrenia, autism, epilepsy, and traumatic brain injury—tools that include cellular-resolution optogenetic laser stimulation81 to relate neuronal operations to human behaviors.

Instrumentation and sensors

According to our 2017 numbers, the instrumentation and sensing segment is rapidly approaching the size of the medical/aesthetic and research/military laser markets, and has tremendous potential to grow in value because of the sheer volume of sensing-based lasers needed for some of these autonomous or smart applications, such as lidar and 3D sensing for smartphones. Laser-based structural health monitoring is also growing in importance for aircraft, vehicles, bridges,82 railroads, roadways, and any number of critical transportation and infrastructure assets worldwide.

In the instrumentation segment, bioinstrumentation appears to be taking the lead, with applications such as flow cytometry and gene sequencing83 fueling sales for many companies. In flow cytometry, emerging applications range from screening useful nanoparticles for medicine84 to helping discover new treatments for rheumatoid arthritis.85 Climate change research86 is also a growing market for this technology. Spectroscopy continues to find new applications in medical diagnostics, from detecting bacterial infection87 in exhaled breath to improving our ability to detect invasive cancers88 during surgery, while ultrafast lasers89 are opening up new research capabilities in neuroscience. Meanwhile, ultraviolet (UV) and terahertz lasers90 continue to gain traction in the inspection space, particularly in solar cell91 and semiconductor manufacturing.92

Instrumentation & sensors

Includes lasers used within biomedical instruments, analytical instruments (such as spectroscopy), wafer and mask inspection, metrology, levelers, optical mice, gesture recognition, lidar, barcode readers, and other sensors.

Instruments and sensors will have very strong growth over the next few years, driven largely by lidar applications of all types and gesture/facial recognition applications being incorporated in smartphones. Lidar and smartphone applications use "time-of-flight" to measure beam distances and are contributing to strong demand for VCSELs, the lasers often used for many of these applications. Other applications that have been fast-growing in the sensing area include spectroscopy, flow cytometry, and UV inspection. One area that has been decreasing for obvious reasons is lasers used for computer mice.

An interesting trend in instrumentation is that the designers and builders of these instruments are increasingly seeking subsystems, not just lasers, according to a presentation93 by Coherent’s John Abbott at LASER World of PHOTONICS 2017. This shortens their time and cost to market—and, if all goes well, improves the performance, size, and maintenance parameters of the final instrument—but it also means that laser manufacturers must now deliver the same set of improvements to the entire subsystem, as opposed to only the laser.

When it comes to the sensor market, lidar and 3D depth sensing for smartphones reign supreme, and the applications for these devices is expected to continue to grow in a number of directions, which is good news for VCSELs. According to the industrial laser firm Tykma Electrox (Chillicothe, OH),94 popular applications for lidar sensors in 2017 included:

• Field drainage/flood maps and patterns95

• Drone technology97

• NASA auto piloting equipment99

3D sensing for smartphones encompasses everything that depth-sensing, time-of-flight technology delivers. As an article in 3dprint.com100 predicted in February 2016, "… smartphones will instantly become hyper-aware of their immediate surroundings and can be used for everything from VR applications to a version of Google maps with walking directions inside of buildings to enabling accurate sizing suggestions when purchasing clothing and shoes online. … Realistically, the technology could turn the everyday smartphone into an incredibly advanced, handheld 3D scanner." As a result, the market for depth sensing and imaging is expected to expand by nearly 40% through 2022, reaching $9 billion, according to a report published in July 2017101 by Woodside Capital Partners (East Palo Alto, CA) and the market research firm Yole Développement (Lyon, France).

Entertainment, displays, and printing

In 2017, laser revenue for the display and entertainment segment grew the fastest of all non-material processing segments, and there is a key reason for this: lasers are increasingly being used as display devices, especially in cinema projection, where they are becoming the preferred light source. Theaters around the globe must now compete with streaming services such as Netflix and Hulu, pushing them to adopt laser-illuminated projectors.102

This was good news for companies like Barco (Kortrijk, Belgium), which in 2017 achieved a milestone103 of 100 all-laser cinema multiplexes installed worldwide. Theater owners benefit from lower maintenance costs while movie-goers are promised brighter screens, better 3D experiences, and richer color when viewing laser cinema. But the biggest driver here is China, which is undergoing strong growth, including lots of new movie theaters (which feature state-of-the-art laser projectors) and an enthusiastic consumer market. By some estimates,104 China now has more movie theaters than the U.S.

Entertainment, displays & printing

Includes lasers used for light shows, games, digital cinema, front and rear projectors, picoprojectors, and laser pointers. Also includes lasers for commercial pre-press systems and photofinishing, as well as conventional laser printers for consumer and commercial applications.

While short-throw laser projectors have failed to take off, lasers are being used increasingly in business and picoprojector applications, as well as digital cinema applications. This year, we expect over 2600 new cinema screens to use laser lighting.

A second large application segment in this area is laser light shows. The number of lasers for these entertainment applications has exploded over the last few years, largely driven by the availability of a new breed of high-power diode lasers that have replaced more expensive solid-state lasers. In 2017, we see total laser revenue for light shows dropping slightly, as price drops overtake growth.

A second major application segment in the entertainment market is laser light shows. The number of lasers used in light shows has grown dramatically in recent years, largely driven by the availability of a new breed of high-power diode lasers that has displaced expensive solid-state lasers. Even so, in 2017 total laser revenue for light shows declined slightly, as price drops overtake growth. But all is not lost: In November 2017, laser show and system design specialist ER Productions achieved a Guinness World Records title105 for putting on the largest laser show ever. In celebration of its 10th anniversary, the company held a 30-minute laser showcase in Las Vegas, NV that culminated in a seven-minute, record-breaking finale featuring 314 individual laser fixtures. More than 13 tons of equipment valued at approximately $3.5 million was used during the show, which was held at the Las Vegas Convention Center. During the closing sequence, 1377 W of laser power lit up the Nevada skyline, according to the company.

In the desktop printing market, commercial applications of laser printers continue to drive the market. One of the biggest announcements came in the form of a major acquisition,106 with Hewlett Packard (HP; Palo Alto, CA) paying $1.05 billion for Samsung Electronics’ printer business. Through the deal, HP gained 6500 of Samsung’s printing patents and a workforce of nearly 1300 researchers and engineers with expertise in laser technology, imaging electronics, and supplies and accessories. In August, HP announced total net revenue of $13.1 billion107 for the third quarter of 2017, beating market expectations, with printing net revenue for the quarter up 6% year-over-year at $4.7 billion.

About the numbers

The estimates and forecasts of laser revenue are based on both supply and demand side analyses by Allen Nogee, president of Laser Markets Research, for Strategies Unlimited, a PennWell business that has been conducting market research in photonics for more than 30 years. The research considered both quarterly and long-term historical trends—results were then compared and adjusted to correct for known errors. Significantly more information is presented each year at the Lasers & Photonics Marketplace Seminar (www.marketplaceseminar.com), held in conjunction with SPIE Photonics West, and in the annual Worldwide Market for Lasers: Market Review and Forecast, available from Strategies Unlimited in spring 2018 (www.strategies-u.com).

REFERENCES

For the complete list of references, please see www.laserfocusworld.com/jan2018references.html.

Kathy Kincade | Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.

Allen Nogee | President, Laser Markets Research

Allen Nogee has over 30 years' experience in the electronics and technology industry including almost 20 years in technology market research. He has held design-engineering positions at MCI Communications, GTE, and General Electric, and senior research positions at In-Stat, NPD Group, and Strategies Unlimited.

Nogee has become a well-known and respected analyst in the area of lasers and laser applications, with his research and forecasts appearing in publications such as Laser Focus World, Industrial Laser Solutions, Optics.org, and Laser Institute of America. He has also been invited to speak at conferences such as the Conference on Lasers and Electro-Optics (CLEO), Laser Focus World's Lasers & Photonics Marketplace Seminar, the European Photonics Industry Consortium Executive Laser Meeting, and SPIE Photonics West.

Nogee has a Bachelor's degree in Electrical Engineering Technology from the Rochester Institute of Technology, and a Master's of Business Administration from Arizona State University.

Gail Overton | Senior Editor (2004-2020)

Gail has more than 30 years of engineering, marketing, product management, and editorial experience in the photonics and optical communications industry. Before joining the staff at Laser Focus World in 2004, she held many product management and product marketing roles in the fiber-optics industry, most notably at Hughes (El Segundo, CA), GTE Labs (Waltham, MA), Corning (Corning, NY), Photon Kinetics (Beaverton, OR), and Newport Corporation (Irvine, CA). During her marketing career, Gail published articles in WDM Solutions and Sensors magazine and traveled internationally to conduct product and sales training. Gail received her BS degree in physics, with an emphasis in optics, from San Diego State University in San Diego, CA in May 1986.

Conard Holton

Conard Holton has 25 years of science and technology editing and writing experience. He was formerly a staff member and consultant for government agencies such as the New York State Energy Research and Development Authority and the International Atomic Energy Agency, and engineering companies such as Bechtel. He joined Laser Focus World in 1997 as senior editor, becoming editor in chief of WDM Solutions, which he founded in 1999. In 2003 he joined Vision Systems Design as editor in chief, while continuing as contributing editor at Laser Focus World. Conard became editor in chief of Laser Focus World in August 2011, a role in which he served through August 2018. He then served as Editor at Large for Laser Focus World and Co-Chair of the Lasers & Photonics Marketplace Seminar from August 2018 through January 2022. He received his B.A. from the University of Pennsylvania, with additional studies at the Colorado School of Mines and Medill School of Journalism at Northwestern University.