The automotive landscape is rapidly evolving with simultaneous moves toward electrification and autonomy taking center stage. Understandably, such a shift is proving disruptive to the traditional supply chain. While neither change will occur overnight, major manufacturers globally have announced commitments suppliers need to take seriously.

A move towards electrification means significantly fewer moving parts than combustion engines, and the powertrain in most instances will not come from the historical suppliers firmly entrenched within the industry.

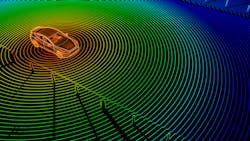

And the potential growth of autonomy creates an entirely different set of changes as automakers rethink how to produce vehicles capable of delivering on the consumer’s evolving expectations (see Fig. 1). Although such disruption is unsettling, it also creates intriguing windows of opportunity.

Consider, for instance, what the growing prospect of autonomy could mean for guidance technologies like LiDAR that are quickly gaining steam—and for good reason. In its report, Demystifying LiDAR: IoT And Automotive Applications, Industries, And Business Models, ABI Research notes, with reserved optimism, LiDAR is ideally positioned to add the vital “third opinion” to the current camera-radar mix once the human driver is taken out of the loop.

“LiDAR technology and its supplier ecosystem will continue to evolve in two important respects. First, the shift from mechanical to solid-state LiDAR sensor technology will drive lower price levels, ultimately dropping below US$500, higher manufacturing scalability, and lower maintenance levels due to reduced tear and wear,” says Dominique Bonte, managing director and vice president at ABI Research. “Second, the LiDAR supplier ecosystem, currently consisting of more than 100 players, will mature and consolidate to between 10 to 20 key players by 2030.”

Sensing an opportunity

The decade-old Durham, NC-based manufacturer Phononic is excited about the potential. Working with fiber-optic communications helped Phononic establish a niche enabling high-end, high-data-rate, high-reach fiber-optic components with precision-controlled temperature management to lasers and detectors within the transceivers.

Automotive LiDAR has a very similar need. After all, when lasers are pulsing at high frequencies, they need to be very high power and possess well-controlled wavelengths, while also operating over a broad temperature range. LiDAR sensors also need to exhibit very long range, with a quick refresh or frame rate, with the ability to provide a high-resolution 3D image of its field of view (see Fig. 2).“It is a lot to ask from one sensor coupled with the need to work in rain or shine and across a broad temperature range, all without being flooded by sunlight or interference from other LiDAR systems that will likely be on the road,” says Phononic’s Alex Guichard. “It also has to be incredibly reliable since it's a safety-critical system.”

As LiDAR finds its footing and possibly captures market share, the successful approach could presumably take two very different directions.

The first being the low-cost, low-range, low-performance systems, which depend on flash LiDAR using pixels. “They're trying to take that low-cost approach today, with the goal of bringing the performance high enough to deliver needed levels of autonomy,” says Guichard.

Alternatively, there are systems on the market today already offering high performance, including the ability to achieve the specs and requirements for high levels of autonomy. Of course, this approach currently has a much higher price tag. “Yet, the thinking is, with more players focused on further innovation, the possibility exists to drive costs out of the already capable systems, while also maintaining the existing performance the advantage,” says Guichard.

Without a crystal ball, it’s impossible to tell which school of thought will win, or if it will be another technology altogether that automakers ultimately adopt. But notable investments in high-performance approaches are gaining steam.

All this activity is good news for Phononic. After all, a predictable, precise, and consistent temperature is crucial, no matter what is happening within the operating environment.

Solving the challenge

Reliability is obviously a huge requirement and big concern, considering the temperature ranges sensors need to be able to not just survive, but operate for an extended period. “They operate past the boiling temperature of water—and compound semiconductor components like lasers and detectors don’t love that sort of environment,” says Guichard.

Phononic’s primary technology offering acts as a local thermal environment regulator for the compound semiconductor component, addressing reliability since the laser itself is not exposed to such dramatic temperature swings (see Fig. 3).When combining long range, wide field of view, high refresh rate, and high resolution, a signal-to-noise problem exists. “The four qualities are fundamentally at odds. If you try to improve one, you’re probably going to squeeze another,” he says. “Active cooling could improve detector sensitivity, as well as the stability and steady-state power output of the laser.”

Overarching issues

Constant learning. At this point, no one knows the requirements. “We know the operation is very similar to fiber-optic communications, but we are focused on understanding the differences,” he says. “For instance, lasers and automotive LiDAR sensors require much higher power, and the operating temperature ranges are more extreme. We’re starting to understand how much more of an extreme environment it is and how it impacts our devices. We need to figure out how much further we can push our offering.”

Expecting the unknowns. What will the adoption rate look like? What’s the anticipated design cycle? As ABI suggests, market uptake isn’t going to reach kind of critical mass for at least another five years—making any investment a long-term play. “Some sort of LiDAR sensing, some sort of very detailed, high-resolution 3D Point Cloud technology is necessary,” says Guichard. “And we believe to achieve the requirements for such high levels of autonomy, you actually need a cool LiDAR.”

Currently, automotive LiDAR is a very crowded market with numerous startups jockeying for position. This scenario represents an exciting time for the industry, with people seeing the unbridled possibility of what could happen. If LiDAR continues to improve with scale, as many anticipate, it represents an enabling technology capable of changing business models for OEMs and changing how cars are made available to the market.

Peter Fretty | Market Leader, Digital Infrastructure

Peter Fretty began his role as the Market Leader, Digital Infrastructure in September 2024. He also serves as Group Editorial Director for Laser Focus World and Vision Systems Design, and previously served as Editor in Chief of Laser Focus World from October 2021 to June 2023. Prior to that, he was Technology Editor for IndustryWeek for two years.

As a highly experienced journalist, he has regularly covered advances in manufacturing, information technology, and software. He has written thousands of feature articles, cover stories, and white papers for an assortment of trade journals, business publications, and consumer magazines.