IR DETECTORS: SWIR cameras: Surveying the market ahead

ANTONIOS VENGEL

The short-wavelength infrared (SWIR) camera market is in the early stage of development relative to cameras in other wavelengths within the electromagnetic spectrum, generating sales revenues of approximately $50 million dollars annually, worldwide. There are a few companies making SWIR cameras in the market and even fewer making the detector material, indium gallium arsenide (InGaAs).

Because SWIR cameras are relatively new to the Warfighter community, a concept of operations (CONOPS)—a military document that describes how the technology and camera will be used by the Warfighter community—remains unwritten for defense customers. To meet this requirement, the U.S. Office of the Secretary of Defense (OSD) has chartered an Integrated Product Team with members from all of the services and led by the Army’s Night Vision and Electronic Sensors Directors (NVESD; Fort Belvoir, VA) to help define the CONOPS for SWIR, including requirements for deployment of the hardware.

The benefit of SWIR imaging is its low power consumption. It uses a thermoelectric (TEC) cooler or no cooler if the dark current is low enough, while still providing good-enough imagery in low-light conditions to alleviate a cryogenic cooler. The collected image is composed of reflected light as opposed to thermal emission; therefore, SWIR provides some of the same benefits of a visible camera. And because it images further into the IR spectrum, typically 0.9 to 1.7 µm, SWIR allows for visibility of battlefield lasers operating at 1.064 µm—one very important feature that SWIR cameras provide to the Warfighter.

SWIR commercialization

Until 18 months ago there were only two providers of SWIR cameras within the United States: Sensors Unlimited (Princeton, NJ; part of Goodrich Corporation) and Teledyne Judson Technologies (Montgomeryville, PA). There were and still are some providers overseas, including Xenics (Leuven, Belgium), Allied Vision Technologies (Stadtroda, Germany), and Chungwa (Yang-Mei, Taiwan).

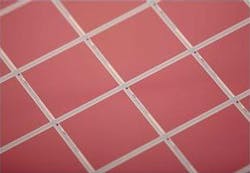

The ability to manufacture the detector—which has a read-out integrated circuit (ROIC) optimized for SWIR—is a critical aspect when companies determine which types of IR cameras to commercialize. For instance, Nova Sensors, at the time a small business, looked to another small business, Aerius Photonics (Ventura, CA), to manufacture the InGaAs detector (see Fig. 1). Figuring that the 320 × 256-pixel market was already saturated, most of their focus is on the 640 × 512-pixel format and larger. Aerius Photonics decided to hybridize their detector to the commercially available ROIC from FLIR Indigo (Goleta, CA)—the ISC0002. The Aerius business model was to be an enabler to the SWIR market—they would build the packaged detector in a TEC-cooled enclosure that anyone can design electronics around.

Consequently, Aerius enabled a group of camera makers to compete with Sensors Unlimited. One of the customers was FLIR, which recently purchased Aerius Photonics for $27 million and is now continuing their merchant-supplier model to the broader FLIR customer base. In addition, Nova Sensors was acquired by Teledyne Technologies (Thousand Oaks, CA) to support the multitude of IR cameras with those same base camera electronics.

Anytime FLIR enters a market, heads turn because it is an indicator of an impending market demand. As a side note—but equally important to that FLIR acquisition—was Aerius' capability in designing and fabricating vertical-cavity surface-emitting laser (VCSEL)-based laser illuminators and altimeters, something FLIR had to buy to include in their gimbals.

Sensors Unlimited, Aerius, and Nova Sensors are in the process of developing SWIR 1280 × 1024-pixel cameras and only Sensors Unlimited is developing a 1920 × 1280 SWIR camera. The larger format will potentially help to solve the unmanned aerial vehicle (UAV) automated "sense and avoid" problem; i.e., for the U.S. Federal Aviation Administration (FAA; Washington, DC) to allow UAVs to fly in commercial air space, the FAA requires a reliable, automated sense and avoid system on board to help avoid collisions. If this technology and larger SWIR format prove successful, the UAV market could take off in terms of additional applications in law enforcement, fire protection/fighting, traffic management, and environmental and agricultural assessment, to name a few.

Future applications and limitations

Beyond the persistent surveillance military market still trying to find its way with SWIR there are other applications where SWIR has clear advantages. These include, but are not limited to, machine vision for semiconductor wafer fabrication inspection, solar cell fabrication (crack and delamination detection), glass inspection, glass fill level inspection, plastic sorting, agricultural sorting, chemical process control, distressed plant life, counterfeit currency detection, and oil slick detection. There is some talk that SWIR may be fused with a bolometer for a hybrid IR system in automobiles to enhance both night and day vision and collision avoidance.

Although there are a multitude of SWIR opportunities in the commercial arena, one limiting factor, at least for U.S.-based companies, is the complex navigation through the International Traffic in Arms (ITAR) requirements levied on businesses developing SWIR cameras. The U.S. State Department, along with entities like the Defense Technology Security Administration (DTSA), closely monitor international trade of products such as SWIR cameras to keep potential adversaries from using U.S. hardware to enhance their ability (or decrease the U.S. ability) to fight, defend, and deter. Still, some opportunities in machine vision are lost to countries that have SWIR capability outside the U.S.

The market demand for larger format and smaller pixels is driven by the need to view larger areas with a single camera, whether it is for machine vision or persistent surveillance. The smaller pixel is being driven by the UAV demand for SWIR, as it allows for better or same ground sample distance with less demanding optics. Reduced size, weight, and power consumption are critical when it comes to the medium-to-small UAV market (see Fig. 2).Challenged by less-cooled detectors

When assessing dark current on a detector, the lower the dark current, the less cooling (and power) is required to obtain an image that accomplishes the mission. But the InGaAs SWIR market is directly threatened by the onslaught of new technologies like hot mercury cadmium telluride (MCT) and other “less” cooled devices in the mid-wavelength infrared (MWIR) region.

Since MCT can operate in SWIR, MWIR, and longwave-infrared (LWIR) regions with one detector, some of the benefits of SWIR can be achieved along with the high image quality from the thermal MWIR camera. Companies having capability in hot MCT are Teledyne Scientific & Imaging (a Teledyne Technologies company), DRS Technologies (Parsippany, NJ, and Arlington, VA), Raytheon (Waltham, MA), Sofradir (Chatenay-Malabry, France), and some others.

Despite the prevalence of IR imaging technology, SWIR imaging is still quite young in terms of its development cycle and the applications to which it is suited. Continuing research and development spending in this arena will come predominantly from the military market, but could also grow from industrial partners as new applications for SWIR are developed and the technology continues its journey to prominent use.

ANTONIOS VENGEL is vice president of business development for Nova Sensors, a Teledyne majority-owned company, 320 Alisal Rd. Suite 104, Solvang, CA 93463; email: [email protected]; www.novasensors.com.