Uncooled IR imaging market: smartphones and new low-cost IR cores pave the way for consumer applications

A new market report by Yole Développement (Lyon, France), called "Uncooled Infrared Imaging Technology & Market Trends, 2014 edition," concludes that existing commercial applications and new consumer applications will drive uncooled infrared (IR) imaging market growth.

The French consulting firm also lists mergers and acquisitions in this area over the last four years, highlights applications including the ultra-low-resolution microbolometers segment, and goes into detail on market forecasts from 2013 to 2019, technology trends, and ongoing developments.

Military decline, commercial growth

After its first significant downturn in 2012, the uncooled thermal camera market continued to decline in 2013, with a -5% compound annual growth rate (CAGR). "The uncooled thermal camera market is plumbed by the ever shrinking military market (with -15% revenues in 2013), which is the historical and most profitable business for uncooled infrared," says Yann de Charentenay, the firm's senior analyst for MEMS and sensors.

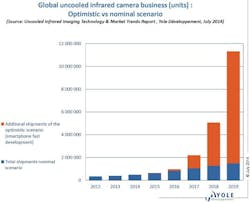

Nevertheless, 2013 overall sales in total shipments have surged again (+15%) because of the dynamic commercial market, where sales have grown by +24%. For the next several years, thermal camera shipments will continue to grow rapidly at +25% CAGR in volume between 2014 and 2019 to reach more than 1.4 million.

Shipments will be driven by these quickly expanding commercial markets:

Thermography: The market will be driven by ultra-low-end cameras with very attractive pricing below $1000. Such prices expand the market for thermal technology. Leaders FLIR Systems (Portland, OR; NASDAQ: FLIR) and Fluke Corp. (Everett, WA) have added many new models in 2013 and 2014 and will continue to lead the price war due to their vertical business model.

Automotive: Autoliv (Stockholm, Sweden; NYSE: ALV), the market leader, will continue to introduce its third-generation night-vision systems on new car models. New EuroNCAP tests could boost the market by promoting, in 2018, nighttime pedestrian collision-mitigation solutions potentially using thermal imaging, but only if the cost is sufficiently low.

Surveillance: New visible CCTV players by Panasonic (Osaka, Japan) and Mobotix (Langmeil, Germany) have recently entered the market and will help to democratize thermal-imaging technology. Price erosion will continue (-12%/year) and will enlarge the scope of commercial applications such as traffic, parking, and power stations.

Consumer applications: These have have moved to a new phase in 2013-2014 and will be the high-growth applications over the next few years, especially in terms of shipments (+61% CAGR); personal vision systems (goggles, sight for security and hunting, outdoor observation), first successfully pioneered by FLIR, will continue to grow due to many new entrants arriving from the outdoor-visibility arena.

Smartphones: The first smartphone modules (FLIR One, Opgal Android) were introduced at the groundbreaking price of $349 by FLIR in 2014. A high number of pre-release reservations for the FLIR One already proves the commercial success of this smartphone platform; indeed Yole Développement estimates greater than 30,000 units.

An additional scenario (see figure) envisions an aggressive rapid ramp-up of the smartphone-based devices based on a huge price erosion and the integration of the IR core inside the phone. "Indeed, smartphone business is an almost one-billion-units market in 2013, and any new sensor adopted induces high volumes produced," says de Charentenay. "Those high volumes will only be possible if a huge cost reduction is obtained by the IR imaging industry."

For more information, see the reports section at http://www.i-micronews.com