China’s industrial laser market shows steady growth in turbulent times

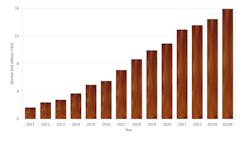

For most laser companies in China, 2023 is a year of striving for excellence and perseverance. Despite the complex and severe international geopolitical situation and the weak global and domestic economic recovery after COVID-19, the Chinese laser market still achieved 6.5% annual growth, reaching $14.43 billion (see figure). Although it is not as high as the double-digit growth in 2021, it is better than last year’s 5%. Moreover, the Chinese laser industry still performs well compared to other regions around the world, demonstrating its market resilience and development vitality. We predict the annual growth for the Chinese laser market in 2024 will be 10.2%, reaching a size of $15.9 billion.

Chinese laser industry 2023 highlights

High power, high brightness, and miniaturization have become the mainstream direction of fiber lasers. High-power fiber lasers are still the main direction. Several companies in China now offer up to 60 kW continuous-wave (CW) fiber lasers. In addition, the focus on miniaturization and lightweight features represents another trend for fiber lasers.

We also see the emergence of blue lasers, up to 3500 W, mainly driven by the production of electric vehicle batteries, metal 3D printing, and consumer electronics markets. The welding demand for pure copper is increasing rapidly in the new energy industry.

Compared with the infrared (IR) wavelength of a standard fiber laser, copper can achieve a better absorption at the blue wavelength, which makes blue lasers very attractive in the field of power batteries. Compared with IR laser processing, a blue laser hardly introduces pores and splashes during welding and cladding processes, ensuring a smooth appearance and avoiding secondary processing. Additionally, using a blue laser enables the welding of pure copper with lower laser power; the welding process has a stable molten pool, which is energy-saving and environmentally friendly. With the cost reduction brought about by the widespread application, blue lasers are something to watch for the next few years in China.

The process of localization is accelerating comprehensively. The withdrawal of some European and American companies from the Chinese market due to either de-coupling or de-risking in the past few years undoubtedly freed up market space for comprehensive domestic replacement. Ten years ago, the localization was mainly in laser sources. Today, it has penetrated from lasers to both upstream and downstream of the laser devices, such as semiconductor chips, fibers, fiber Bragg gratings, high-speed scanning mirrors, laser machining heads, motion control, and process monitoring systems. Domestic-made fiber lasers and high-power laser cutting systems have taken the majority of the market share in China now.

With the continuous improvement of domestic product quality, the localization process of the entire laser product chain is accelerating comprehensively. For example, the domestic ultrafast laser makers have produced high average power output (300–600 W) and high single-pulse energy (3.5 mJ, 800 fs, 50 kHz to 1 MHz), which is accelerating the ultrafast laser replacement market in China.

New markets continue to emerge. Green energy, new materials, and next-generation information networks are significant new markets for Chinese economic development today, and the Chinese laser industry has increasingly integrated into these megatrends. As a result, market potential constantly impacts fields like electric cars, 3C, healthcare, aerospace, high-speed trains, shipbuilding, and advanced manufacturing. Promoting green manufacturing is crucial for China to address climate change and achieve its carbon peak and carbon neutrality goals.

The impact of the Russia-Ukraine conflict on the global energy supply has not only profoundly reshaped the global energy supply landscape. The energy storage industry has become a stage that China and developed countries worldwide must compete for, both currently and in the coming years. The maturity of high-power laser processing technology and the improvement of high-power laser matching head performance have enabled laser technology to perform better in reducing carbon emissions, energy storage applications, and advanced manufacturing.

Industrial laser clusters blossoming in multiple locations in China. In eastern China, laser processing equipment has played a crucial role in promoting the industrial upgrading and transformation of traditional manufacturing in provinces like Jiangsu, Zhejiang, and Shandong. Although the local governments’ financial situation is not well in recent years, they still tend to welcome and invest in these heavy capital expenditure enterprises in the local economy. Laser enterprises have also enjoyed continuous dividends in cooperation with local traditional industries. Cities like Jinan, Linyi, Wuxi, Suqian, Wenzhou, Taizhou, and others continue to attract laser investment and recruit laser technology-related talents to the regions as they work to create a new laser technology-based advanced manufacturing eco-environment for the local economy transformation.

In the central region of China, Hubei province, after experiencing the hardships of the epidemic, has begun to burst out with even more vigorous vitality and vigor. Its capital city, Wuhan, as an important birthplace of industrial laser technology in the country, has accumulated and developed rapidly new laser companies. Surrounding cities such as Xiaogan, Ezhou, and Huangshi have begun to take on the spillover of achievements from places like the Optics Valley. In the southwestern region, cities such as Yibin and Mianyang have taken multiple measures to promote investment in the laser industry. They have attracted many laser-battery processing equipment makers to explore and develop the Southwest power battery market. The laser industry has blossomed in multiple locations across the country, from central to eastern and southeast to southwest China.

Joining groups and crossing boundaries becoming mainstream. In the past few years, server price competition in fiber lasers, laser cutting systems, and even ultrafast lasers has led downstream manufacturers to demand more profit margins from their suppliers. Therefore, the practice of upstream suppliers transferring some profits to downstream customers will become the norm.

In light of economic weakness and depleted profits, strong cooperation between enterprises will replace vertical integration and become the trendy business model of the Chinese industrial laser industry in the post-epidemic era. In addition, some downstream large companies have crossed the border and entered the field of laser equipment manufacturing. For example, battery manufacturer CATL teamed up with JPT to develop laser production machines, and HG Laser worked with world-leading fiber manufacturer YOFC to cooperate on laser applications in the semiconductor manufacturing industry. Semiconductor equipment giants such as Maxwell and Wuxi Lead Intelligent Equipment have already entered the field of laser equipment manufacturing to further consolidate their leading positions in the market by leveraging their technological and sales channel advantages.

Capital investment becomes the primary theme of financing. Laser companies have become the darling of Chinese investors in recent years. More and more capital is entering the field of laser-related investment: Huawei's subsidiary Hubble Investment invested in EverBright Photonics, Focuslight, and Hitronics; Yingke PE invested in Max Photonics. However, today’s investors are more pragmatic. They are more interested in investing in hidden champions of the industry or leading public laser companies by splitting their high-quality assets in segmented markets and then listing them in the public market, thus achieving rapid liquidation of their investment. The hot areas include laser processing equipment, LiDAR, laser medical device manufacturing, laser CNC control systems, and laser optical components.

Chinese laser market landscape in 2023

Although the actual market numbers will be available after this article is published, we anticipate that the performance of various laser markets was better than last year.

Specifically, we estimate the Chinese fiber laser market will have grown 6.4% annually to $1.79 billion in 2023. Laser cutting and welding systems will have grown 7.6% and 44% annually, reaching $5 billion and $4.2 billion, respectively.

We expect market sizes for laser additive manufacturing and laser cleaning to have reached $2.8 billion and $105 million, with an annual growth rate of 21.7% and 31%, respectively, in 2023.

Driven by demand from the semiconductor and display manufacturing sectors and glass processing applications, China’s market for ultrafast lasers is growing rapidly. Currently, 80% of ultrafast lasers sold in these Chinese sectors are picosecond sources, though the market share for femtosecond lasers increased from 10% to 20% last year. Domestic-made ultrafast lasers accounted for 30% of the overall market value for ultrafast systems, which reached $913 million in 2022; this market is expected to reach more than $1 billion by 2023.

We highlight the handheld laser welder market—one of China’s fastest-growing laser application markets. We’ve estimated about 70,000 and 150,000 units sold in China in 2022 and 2023, respectively, with an annual growth rate of more than 100%.

Lastly, the Chinese LiDAR market: Against the backdrop of the transformation and upgrading of the automotive industry, LiDAR has become a critical engine for developing China's intelligent automotive sector. In recent years, the Chinese LiDAR industry has received significant attention from governments at all levels and key support from national industrial policies. The country has successively introduced multiple policies to encourage the development and innovation of the LiDAR industry. These policies provided clear and broad market prospects and created a favorable production and operation environment for developing the LiDAR industry.

With the continuous breakthrough and upgrading of artificial intelligence technology, driven by the expansion of autonomous driving demand, the increasing penetration rate of LiDAR applications in advanced assisted driving, and the demand for robotics and smart city construction, the Chinese LiDAR market has entered a fast-growing period.

The market size of China's LiDAR in 2022 is $366 M. We predict that the market size of China's LiDAR will reach $1 billion in 2023 and $1.94 billion in 2024.

Future outlook

The overseas equipment market is becoming the primary theme of the industry. The Chinese domestic laser market is large, but the disorderly competition and server price wars have made it increasingly difficult for domestic equipment manufacturers to survive. Therefore, overseas markets are becoming a way out for many companies.

With the transfer of some of China's manufacturing industry to Southeast Asia due to international supply chain adjustment or de-risking, Southeast Asian countries such as Vietnam, Thailand, and Indonesia began to purchase laser equipment from China several years ago. In addition, India, Turkey, Russia, Brazil, Mexico, and some African countries also have a high demand for laser equipment to help achieve their economic development and industrial transformation goals. The Chinese laser equipment is sought after because of its excellent cost-performance ratio. We expect that by 2025, 30% of the sales revenue of the Chinese laser industry will come from overseas sales.

Customized products become a trend for high profit. In the laser processing equipment field, providing and implementing customized solutions has become a significant source of high profits for equipment manufacturers. Due to technological progress, confidentiality, exclusivity, and the need for flexible and customized production, more customers are willing to choose and pay for customized product solutions to promote intelligent production. Unique and complex environments are also leading to many new industry applications. At the same time, more and more laser processing equipment manufacturers are seeking high profitability. They are no longer satisfied with producing standardized products and are beginning to choose the path of co-developing their products with their customers. It has become common now for CNC machine tool manufacturers to work with laser light source manufacturers and laser processing equipment manufacturers to develop the next generation of intelligent laser manufacturing equipment.

Artificial intelligence propelling laser-intelligent manufacturing. Today, automation and zero-defect production are important trends in advanced manufacturing. Artificial intelligence (AI) plays a critical role in these two aspects. With the development of AI programs such as ChatGPT, AI, through learning and training, can help monitor the entire process of laser product design, manufacturing, and testing. It can also identify potential quality problems and make timely corrections, thereby improving production efficiency and product quality and reducing costs. With the support of digital twin technology, AI can implement the virtual simulation of the design and the working status of devices. AI can also design human-machine interfaces according to customer requirements, improving the usability of laser manufacturing equipment. Many Chinese laser manufacturers are starting to use AI in their processes. We estimated that 15% of Chinese laser companies use AI technology. We expect it will reach more than 60% in three years.

Bo Gu | President and CTO, Bos Photonics

Dr. Bo Gu is the founder, President, and CTO of BOS Photonics, a Boston, MA consultancy providing services to the laser and photonics industry.