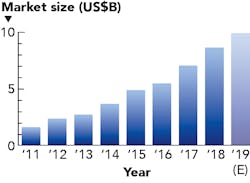

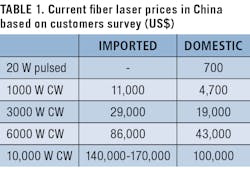

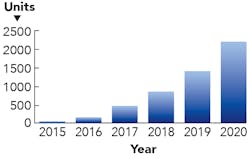

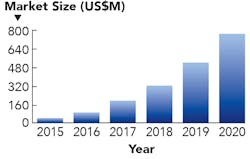

The Chinese industrial laser market is experiencing a difficult time in 2019 after rapid growth over the past two years (FIGURE 1). As this is being written, the uncertain Sino-U.S. trade war has certainly worsened the situation. On one hand, fierce competition has led to a sharp drop in prices of lasers, especially those of fiber lasers and ultrafast lasers. On the other hand, unprecedented low selling prices make the application of laser technology even more cost-effective than many traditional manufacturing technologies, therefore making laser applications spread rapidly, especially in the sheet metal cutting, laser marking, and computer, communication, consumer electronics (3C) manufacturing markets. At the same time, the rise of improved domestic laser products is replacing imported ones, dramatically changing the whole laser industry landscape in the country that dominates global industrial laser revenues.

Chinese economic growth has been slowed for the last few years with annual GDP growth at 6.8% last year and 6.3% in the first half of this year. China’s manufacturing infrastructure is undergoing a transition from low value-added to high-end, smart manufacturing.

The photonics-based industry, with lasers at its core, is playing a big role in this transition. Last year, the strategic high-tech sector grew at much higher rates than the GDP growth at 11.7% and 8.9%, respectively, where lasers have found many applications. Many laser companies are doing relatively well compared to the impact experienced by other sectors, even though the slowing economy is impacting near-term revenues.Conclusions

2019 is destined to be an extraordinary year for China's laser industry. Both the trade war and the price war have brought opportunities and challenges to the development of China's laser industry. The result is the unprecedented consciousness and determination of laser manufacturers to innovate independently and to make more investment in R&D and in order to survive.

Although the global economic situation is still not optimistic, most of the Chinese traditional manufacturing industry is still in the stage of "converting the old to the new." Laser technology not only can promote the upgrading and transformation of traditional industries, but also make use of its advantages to make its own markets space broader. Also, the "one belt and one road" initiative has created a good economic growth opportunity for China's manufacturing industry as well as laser industry in the Middle East, South America, Southeast Asia, and other countries.

Future trends

The emergence of 5G communication generating demand for laser processing will prompt the emergence of new products and new formats from laser manufacturers. Demand for laser processing, especially for ultrafast lasers and its processing systems, will grow rapidly as OLED screens become mainstream products.

Laser cladding and laser repairing applications are entering a growth stage due to the maturity of laser sources and process qualification. This will benefit industries such as power utility, oil and gas, metallurgy, aviation, and space. Both fiber lasers and direct-diode lasers are used in these processes—however, it requires extra high reliability and stability processing under harsh working environments.

Laser welding will also see its growth in China through the growth of electric cars and the power battery industry. TABLE 2 shows the forecast for this market demand and potential capital investment—in particular, capital investment in laser equipment.Summary

The Chinese industrial market is experiencing an ugly price war on both fiber lasers and ultrafast lasers amid the trade war between the U.S. and China. Most domestic companies are struggling with economic downward pressure. Technical hurdles in high-power fiber lasers and ultrafast lasers have been overcome by domestic manufacturers that are changing the domestic market landscape dramatically and very soon, the rest of the world will feel the consequential impact.

Bo Gu | President and CTO, Bos Photonics

Dr. Bo Gu is the founder, President, and CTO of BOS Photonics, a Boston, MA consultancy providing services to the laser and photonics industry.