Annual Laser Market Review & Forecast 2020: Laser markets navigate turbulent times

INTRODUCTION

By Conard Holton, Editor at Large, Laser Focus World

2019 was a tough year for many of these laser market segments. Laser manufacturers, like others in the global economy, faced difficult economic and political currents, and felt the impact of trade barriers and tariffs. As we’ll explain in this, our annual review and forecast, some laser application areas or laser types struggled, while others prospered and look even better for the future. Every segment was different and each has its own story.

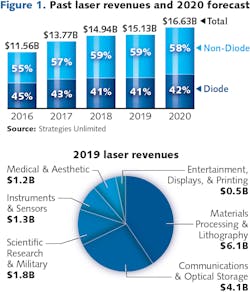

The bottom line: Overall annual estimated revenue growth is forecasted to grow 1.3% in 2019. It had seen a solid 8.5% growth in 2018, and 19.2% in 2017. Pending the final corporate quarterly reports on 2019 (due out in January/February 2020), we expect total laser market revenue in 2019 to be about $15 billion (see Fig. 1).The good news: Our forecast for 2020 sees hope for a bounce-back close to the norm—that is, with a 10% revenue growth rate—barring, of course, a recession and assuming that some of the trade conflicts have been addressed or not made worse.

The global economic currents

Many of the traditional global economic indicators point to the challenges faced by laser manufacturers. In late November 2019, the Organization for Economic Cooperation and Development (OECD; Paris) declared that trade conflict, weak business investment, and persistent political uncertainty are weighing on the world economy and raising the risk of long-term stagnation. It predicted world GDP growth in 2019 will be 2.9%, the lowest annual rate since the Great Recession, and will remain in that range through 2021.

U.S. GDP growth is forecast to slow to about 2% in 2020 and 2021; the EU and Japan should expect growth in the same period of about 1%; and China is forecast to decline to 5.5% in 2021, compared with 6.6% in 2018. Germany, in particular, has been experiencing a deepening industrial slump as tariffs and Brexit concerns impact trading partners.

Political uncertainty is a primary component of the slowdown as it raises the question of whether the rules under which the global trading system have operated for decades will change or vanish. Household spending has been holding up, but shows signs of weakening, and automobile sales declined sharply over the past year. On top of that, the OECD sees deeper, structural changes underway, with digitization transforming business models, and climate and demographic changes disrupting existing patterns of activity.

The news isn’t all gloom, however, as global businesses—including laser companies—adjust to the new conditions to remain competitive, sometimes moving manufacturing operations to countries not impacted by U.S. tariffs. Also, SEMI forecasts that global semiconductor manufacturing equipment sales, down over 10% in 2019, will stage a 2020 recovery and set a new high in 2021. Finally, the U.S. consumer remains a great source of economic strength, with low unemployment, low debt levels, a relatively high savings rate, and spending growing at a rate of almost 3%.

How to read this article

For our market analysis and forecast, we divide the global laser market into six major segments, with each containing multiple technology and application areas that may experience very different market conditions and results.

The major segments are:

Materials Processing & Lithography. Includes lasers used for all types of metal processing (welding, cutting, annealing, drilling); semiconductor and microelectronics manufacturing (lithography, scribing, defect repair, via drilling); marking of all materials; and other materials processing (such as cutting and welding organics, rapid prototyping, micromachining, and grating manufacture).

Communications & Optical Storage. Includes all laser diodes used in telecommunications, data communications, and optical storage applications, including pumps for optical amplifiers.Scientific Research & Military. Includes lasers used for fundamental R&D, such as by universities and national laboratories, and new and existing military applications, such as rangefinders, illuminators, infrared countermeasures, and directed-energy weapons research.

Medical & Aesthetic. Includes all lasers used for ophthalmology (including refractive surgery and photocoagulation), surgical, dental, therapeutic, skin, hair, and other cosmetic applications.

Instrumentation & Sensors. Includes lasers used within biomedical instruments; analytical instruments (such as spectrometers); wafer and mask inspection tools, metrology tools, levelers, optical mice, gesture recognition, lidar, barcode readers, and other sensors.

Entertainment, Displays, & Printing. Includes lasers used for light shows, games, digital cinema, front and rear projectors, picoprojectors, and laser pointers; also includes lasers for commercial pre-press systems and photofinishing, as well as conventional laser printers for consumer and commercial applications.

In the following sections, Allen Nogee, laser analyst for Strategies Unlimited, provides analysis of the markets in each of these six segments in 2019, and a forecast for 2020, along with a graph showing the revenue trends; Jeff Hecht, Contributing Editor, describes some of the major projects impacting communications investment; and Barbara Gefvert, Editor in Chief of BioOptics World, writes about major technology and business trends in medical and aesthetic lasers.A full analysis of the materials processing markets (see http://bit.ly/ILSMktRev) has been written by David Belforte, Editor in Chief of Industrial Laser Solutions, and may be found on www.industrial-lasers.com.

An extensive analysis of the laser markets, with updated data and forecasts, will be presented by Allen Nogee at the 32nd Lasers & Photonics Marketplace Seminar on February 3, 2020, during SPIE Photonics West.

The final report, with the most comprehensive data and analysis, will be available in March 2020 from Strategies Unlimited, which will publish the Worldwide Market for Lasers: Market Review and Forecast 2020.

LASERS & SOURCES

LASER SEGMENTS REVIEW AND FORECAST

By Allen Nogee, President, Laser Markets Research

Materials Processing & Lithography

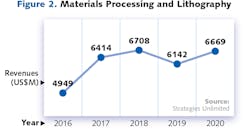

Overall, 2019 was not a great year for lasers used for materials processing (see Fig. 2). While the underlying world economies were generally strong coming into 2019 (with some exceptions in Europe), there were two looming problems: a variety of tariffs on products going into and out of the U.S., and the growing competition of Chinese laser companies.Although competition from Chinese laser companies is nothing new, lately more have been springing up and their fiber lasers have been growing in power. At one time, most Chinese fiber lasers were limited to marking power levels, but in the last few years, many more Chinese fiber lasers have been available in the 2–6 kW range, which represents a large part of the kilowatt materials processing business. The wide availability of higher power fiber lasers from China has decimated laser prices, with average selling prices dropping by 25% or more in some areas in a single year.

While this is not good for laser companies outside of China, the situation is made worse by other factors. Recent trade tariffs imposed by the United States on imports and similar tariffs imposed in retaliation by other countries (mainly China here) have greatly impacted normal laser trade. While large laser companies like IPG Photonics (Oxford, MA) and Trumpf (Ditzingen, Germany) generally have the ability to move manufacturing to different countries to avoid tariffs, such tactics can still have other negative impacts when laser manufacturing is moved, such as added taxes, higher shipping charges, and higher labor costs. Smaller laser manufacturers often have no choice but to absorb the tariffs, which can hit their bottom line hard.

As for the applications and types of materials processing lasers that are sold, welding was stronger than cutting and, overall, high-power lasers that were 6 kW and higher had the strongest growth, especially in welding. This definitely helped companies outside of China, since Chinese manufacturers generally have trouble producing quality lasers at the higher power levels—however, in the next few years, this could change.

Lasers for additive manufacturing had a poor year in 2019, following a not-so-great year in 2018. Most of these 3D printers are made by European companies, and this segment, as well as many areas in Europe, were weak in 2019. Lasers for semiconductor and PC board manufacturing was a relatively strong sector in 2019, but there are many signs that this area is weakening as well. Lasers for solar manufacturing were weak because China is a major consumer of solar panels and China’s weakening economy has impacted growth in solar.

We see 2020 relatively strong for lithography because most of these laser gains are tied to EUV deployments, which should occur regardless of a temporary downturn in the semiconductor business. Materials processing is a bit more difficult to forecast in 2020. Should there be an easing of trade tariffs, especially with China, laser sales could rebound somewhat, but the glut of low-cost China-made fiber lasers will negatively impact prices for years to come.

Communications & Optical Storage

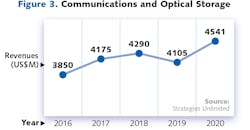

Laser revenue for communications was down in 2019, and this sector is one that was very negatively impacted by Chinese trade tariffs (see Fig. 3). In 2018, communications laser revenue was hitting the bottom of a multi-year cycle, but we believed 2019 would be an up-year. Unfortunately, the burden of the Chinese trade tariffs hit the communications sector, and the recovery never materialized.Communications laser revenue tends to be very cyclical in nature, with new, large-scale deployments tending to occur in lockstep worldwide. In 2017 and 2018, most 4th generation (4G) cellular deployments were complete, with 2019 being the year 5th generation (5G) was starting to ramp up. Generally, that is still the case, but some equipment is being delayed because of the added cost of the Chinese tariffs.

We think 2020 should be at least an average year for laser revenue because even with some slowdown in China, 5G will continue to ramp up and it's unlikely anything short of a major recession will delay that.

As for optical storage, the future continues to dim for the use of lasers. DVD, CD, and Blu-ray media sales continue to drop and more cloud-based and streaming solutions are eliminating the need for large-scale local storage. Heat-assisted magnetic recording (HAMR), which uses a laser to increase storage capacity of magnetic media, has been pushed back yet again, with Seagate 16TB 3.5-in. HAMR drives now expected to hit the market this year, maybe. Western Digital has since moved on to Microwave Assisted Magnetic Recording (MAMR) technology, which is a technology similar to HAMR that does not use lasers. When HAMR finally becomes commercial, this question is, will anyone care?

Scientific Research & Military

Worldwide R&D laser spending saw a small growth in 2019 (see Fig. 4). While the U.S. government had a decrease in laser R&D spending, the Chinese government more than offset this with increases in spending. Europe, despite its economic slowdown, saw laser R&D spending stay essentially flat throughout 2019. R&D laser spending in the business sector was quite variable, with some companies spending more and some less, but toward the end of the year, with recession fears looming, most business R&D spending was headed downward.Military laser revenue had a great year in 2018, but that was topped in 2019. Ever since the Star Wars laser missile-defense system proposed by Ronald Reagan in 1983, the U.S. has tried to incorporate lasers for military purposes, but most systems were extremely expensive and ultimately unsuccessful. However, in the last few years, with the new threat of drones and similar small targets, there has been new interest in smaller directed-energy (DE) laser weapons. These have been tested on a ship and on land vehicles, and work is being done to outfit small aircraft as well. Since lasers fire light and not projectiles, these weapons, while expensive to create, can be cheaper to operate in the long run.

Military laser revenue growth is forecast to stay high through the next several years. Directed-energy laser weapons are seen as a perfect solution to the growing problem of drones and the other small aircraft and boats increasingly being used by terrorist groups. We also expect R&D in China to increase in 2020, while it is expected to stay flat outside of China.

Medical & Aesthetic

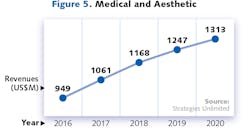

After several years with annual revenue growth rates exceeding 10%, the medical laser sector took a breather in 2019, with laser revenue growth slowing to a still-very respectable 6.7% (see Fig. 5). Medical laser revenue can be broken down into four distinct segments: dental, aesthetic, ophthalmic, and surgical.Dental laser sales were up slightly in 2019, after an unusually strong 2018. While dental lasers make life easier on both dentists and patients, insurance companies have been slow to reimburse dentists for their use, and since most dental offices are small, the cost of lasers can be prohibitive.

Surgical laser revenue had a fantastic showing in 2019, after the U.S. FDA approved new lasers for use in prostate surgery. Surgical use of lasers is growing, as lasers can often provide a more precise result, and, unlike surgical tools, a laser beam itself cannot spread germs.

LASIK surgeries and other laser ophthalmology uses of lasers have been on the upswing for the last three years. This reflects a strong economy in many places and a growing population that can afford such procedures because, in most cases, these surgeries are elective. Of late, we do see some slowing occurring in this segment.

For aesthetic and cosmetic laser revenue, things were not so rosy. For many years, this segment has performed very well, helped not only by the transition to lower-cost laser diodes, but also by an aging population that sees the value in non-surgical procedures. However, in 2019, laser revenue growth rates that had been typically over 10% have dipped to 4%. It is likely that China/U.S. trade tariffs have had some impact here since there are large numbers of aesthetic lasers going to and coming from China and U.S. The slowdowns in the economies of China, Europe, and other parts of Asia have not helped either.

In the future, we expect medical laser revenue to slow from the growth in 2019. Much of the growth has been fueled by a growing middle class in many parts of Asia, but with economic slowing occurring in these areas, elective medical procedures, especially in aesthetic areas, may be reduced.

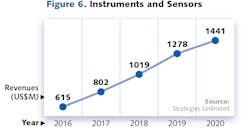

Instrumentation & Sensors

The laser segment is not one of the largest segments, but it is one with a high growth potential (see Fig. 6). This segment includes lasers used for spectroscopy and flow cytometry, lasers used in lidar, and lasers used on smartphones for other 3D sensing applications. Let’s look at these applications to understand why they have a strong growth potential.First, we consider scientific/medical/criminal sensing. In the past few years, the availability of inexpensive laser diodes combined with powerful, low-cost processing power has spawned a variety of portable devices that can be used for rapid safety screening or threat detection (homeland security, airport screening), law enforcement (identification of narcotics and other illegal materials), and rapid purity or authenticity determination (product safety and adulteration detection, product authenticity testing, and anticounterfeiting). Taken together in 2019, these applications represented about 40% of the sensor laser segment.

A second fast-growing application area is for lidar used not only in autonomous vehicles, but starting to be used for commercial vehicles (for example, the 2019 Audi A8), geographic mapping, drone navigation, and building construction. The price of lidar is dropping rapidly, enabling the technology to be used in many more applications, although there are still many people who do not believe lidar will ever be required for autonomous vehicles.

A third fast-growing application area encompasses vertical-cavity surface-emitting lasers (VCSELs), edge-emitting laser diodes, and 3D sensing. Sensing applications that use lasers for high-volume applications date to the first Microsoft Kinect for the Xbox, introduced in 2010. Since then, applications have included laser “tape measures” and laser distance measuring for smartphones. In 2017, Apple started incorporating more lasers in its phones for uses including a face unlocking feature called Face ID. Once Apple started doing this, most other phone makers wanted it as well; it took the Android developers until 2019 to get the technology working reliably. Overall, revenue and growth in this segment is the greatest of all the sensing areas, and it could double in the next few years. In 2019, 3D sensing laser revenue was up only slightly, because Android-based phones and Chinese phones with these lasers were slow to be adopted.

In 2020 and beyond, more smartphones will be adopting sensor technology, which will help this segment. However, as worldwide economies slow, purchases of smartphones will also slow, which could negatively impact revenues. To date, the use of lasers for lidar and other self-driving automotive technology seems promising, but is relatively small overall.

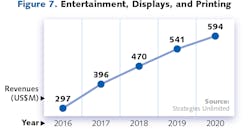

Entertainment, Displays, & Printing

Lasers used for displays and entertainment is a smaller segment than most, but one that has been growing in past few years (see Fig. 7). This segment contains three primary laser applications areas: light shows, business and home TVs and projectors, and cinema projection systems used in movie theaters.The laser light show market took a hit in 2019, after several years of growth. Many light-show lasers come from China, and this market has been impacted by trade tariffs that can greatly increase costs. Lasers for light shows make up about 30% of the entertainment and display segment.

For business and home TVs and projectors, this application area has been growing, as lasers are slowly being incorporated into more business projectors and also into short-throw TV projectors. Recently LG, Hisense, and Sony have all introduced high-end products for the home market.

The largest laser application market in this segment is the most interesting, using a laser or lasers as the light source to replace xenon lamps in commercial movie theaters. There are typically two methods of accomplishing this—either using a red, blue, green (RGB) laser blended together to produce white light, or using a blue laser and a yellow phosphor wheel to create the full color spectrum. RGB lasers are typically used for larger theaters, while laser phosphor is usually used in multiplexes. China has been driving this market, building over 9000 screens in 2018 alone, surpassing the total number of theaters in the U.S.

In 2020, the number of laser-powered digital cinemas being built in China will likely continue, but there are indications that the market is saturated. Lasers for TVs and projectors will continue to grow, especially as prices rapidly drop. Trade tariffs with China have negatively impacted the laser light-show area, and this may continue in 2020.

COMMUNICATIONS LASERS

A new wave of networks is coming amid uncertainties

By Jeff Hecht, Contributing Editor

Telecommunications is a global business, and uneasy relations between the two biggest players, the U.S. and China, are getting 2020 off to an uncertain start. The Pacific Light Cable Network (PLCN), heralded two years ago for its record transmission capacity of 144 terabits per second, has become a particular hot spot, with final approval for its connection to the U.S. network stalled by security concerns.

Announced two years ago, the transpacific cable was to begin service last year (2019), carrying 24 Tbits/s over 12,000 km on each of six fiber pairs using both the C and L bands of erbium fiber amplifiers between Hong Kong and Los Angeles. Facebook and Google are partners in the project, with each owning one fiber pair in the cable. The remaining four fiber pairs in the $300 million system are owned by Dr. Peng Telecom & Media Group (Chengdu, China), China's fourth-largest telecom company.

In January 2018, the U.S. Department of Homeland Security asked the Federal Communications Commission to delay its approval of putting the cable into operation with the U.S. network pending completion of a security review. The FCC said in December 2019 that the security review was still in progress, but at the end of September 2019, it had allowed construction and testing of the cable to continue for 180 days, through March 2020. Security concerns are said to be based on Dr. Peng's contracts with the Chinese government, including a fiber-optic surveillance system for the Beijing police and on Huawei's role as a major supplier.

As of press time, the fate of the Pacific Light cable remains to be determined. Transpacific traffic continues to rise rapidly and blocking use of a nearly completed major international cable would have political as well as business implications.

Broadband delivery, fiber to the home, and 5G

Despite the heavy promotion of 5G by wireless carriers, uncertainties also surround its deployment. The FCC has blocked wireless companies from using federal subsidies to buy telecom equipment from two other Chinese companies it considers security threats, Huawei and ZTE. Important questions remain about its technological implementation.

Nominally, 5G is intended as the next generation of cellular networks, but it's also intended to boost bandwidth for a broader range of users, including the Internet of Things, autonomous vehicles, and mobile video and gaming. End users eventually will receive much of the additional wireless bandwidth on frequencies above 26 GHz, where the atmosphere has high absorption, so base stations will need to be more numerous and closer to end users.

Fiber is widely used today for "backhaul" from service provider networks to cell towers, and it should come closer to home subscribers as bandwidth increases. However, installing high-gain adaptive antennas at base stations can extend the range of high-frequency fixed wireless so fiber may not have to extend all the way to homes to deliver 5G broadband.

So far, fiber to the home or building has attracted the most customers among houses passed by fiber in east Asia and in small countries installing new networks. For example, fiber serves 90% of households in Singapore, 80% in South Korea, 70% in Japan, and 60% in China. Uruguay and Latvia have over 50%. The U.S. and larger European Union nations are laggards in comparison, with only 15% of households subscribing to fiber, according to the FTTH Council Europe.

The difference reflects both fiber passing only about 40% of homes in the U.S. and five major EU countries, and fewer of those homes subscribing to it, says Richard Mack, principal analyst at the CRU Group. Cable-television systems with modern technology supply are competitive in both regions, and 40% of U.S. homes subscribe to broadband cable services. In some European markets, fiber stops at a neighborhood node to which homes connect with enhanced VDSL.

Federal and local governments, utilities, and other groups are working to expand fiber to the home systems, especially in rural areas. In the U.S., the Fiber Broadband Association is campaigning to extend all-fiber networks to most homes, and its CEO Lisa Youngers says "it is possible to reach 90% of all U.S. households with fiber broadband networks in the next 10 years by spending an additional $70 billion."

A laser backbone for satellite Internet services

From planned low Earth orbit, intersatellite laser links will play a vital role in fleets of communication satellites that deliver broadband service to the half of the world's population still beyond the reach of the global fiber-optic network. That technology is coming fast. In 2019, Elon Musk's SpaceX launched two groups of 60 test satellites for its Starlink system. The first test satellites carrying laser transmitters for in-space communications are likely to be deployed late this year, says Paul Cornwell of Mynaric AG (Gilching, Germany), a maker of laser transmitters.

The idea is to orbit constellations of hundreds or thousands of small satellites in low Earth orbit that would fly in formation to provide Internet connections to ground stations all around the world. The goal is to make broadband services accessible in regions now poorly served, including much of Africa and South America, central Asia, rural central North America, and the Arctic. Links to and from the ground could be by microwaves or lasers, but most planned systems would use laser links to relay data between satellites. The network would route data to their destination through a series of laser intersatellite links. With the satellites orbiting at hundreds of kilometers above the ground, signals routed through space could have latency lower than terrestrial fiber-optic cables, and much lower than possible with satellites in geosynchronous orbit. In addition to transmitting data—initially at 10 Gbit/s—the laser links would help keep the beams properly aligned between satellites and the satellites in their proper orbits.

Over 30 companies have announced plans for such small satellites. The most ambitious is SpaceX, which has filed applications to orbit up to 42,000 satellites. Amazon and Boeing have announced plans for thousands of satellites, and other companies have proposed hundreds. SpaceX plans to use four laser transmitters, each 7 to 15 kilograms, on satellites each weighing a couple hundred kilograms.

The first commercial intersatellite link, from Tesat Spacecomm GmbH (Backnang, Germany), carried data from low-orbit imaging satellites to geosynchronous orbit for microwave transmission to orbit. Mynaric, which is producing laser transmitters to link pairs of low-orbit satellites, has a contract to deliver multiple units to an unidentified customer for validating tests in orbit. Such tests, essential to make sure the systems can meet requirements for constellation flight as well as communications, are expected to start this year. Cornwell says "2020 looks very much like the year that we will see the first operational satellites with intersatellite lasers [launched] to serve end users." That's a remarkably fast takeoff for a new technology.

Reviving multimode fiber

Schools, hospitals, factories, and military bases are saving money by using new beam-shaping technology to transmit 10-gigabit/s signals through legacy multimode fiber. "In legacy [graded-index] fibers, you are limited to a hundred megabits per second after a few hundred meters," says Jean-François Morizur, CEO of Cailabs (Rennes, France). The new beam-shaping technology can couple 99.5% of the light from a single-mode light source into one of the many modes of graded-index fiber. The light then remains in that mode for up to 10 km, avoiding the modal dispersion that normally limits the range of graded-index fiber. A matching coupler then extracts light from that mode.

So far, Morizur says, Cailabs has installed systems spanning more than 4 km. The next step, he says, is upgrading data rates to 100 Gbit/s. The system also can support wavelength-division multiplexing. "You can upgrade over a weekend," he adds. So far, the company has been doing most of its business in Europe, but in November 2019, it signed a deal with Exclusive Networks to market the system in the U.S. and Canada. However, Richard Mack warns that that operators of premises networks usually prefer standards-compliant equipment.

MEDICAL & AESTHETIC LASERS

GLOBAL MARKETS, GROWING DEMANDS

By Barbara Gefvert, Editor in Chief, BioOptics World

The number-one takeaway from Lasertel‘s annual white paper on the global laser medical/aesthetics market published is this: while technological advances and concomitant reduction of treatment costs are helping drive the market’s double-digit CAGR, the greatest factor by far in this growth is “exploding consumer demand for laser skin treatments.”

The report points to four reasons for this explosion:

1. Greater awareness and acceptance of laser-based cosmetic treatment. The increased inclusion of hair removal, skin smoothing, and other laser-based treatments (and recognition of these as highly effective and economical), along with traditional services at spas, is evidence of this trend.

2. Rising disposable income. Increased income coupled with falling costs mean that laser treatments are finding a vastly broader audience.

3. Changing lifestyles. Increased leisure time and shifts in how such time is spent has boosted demand.

4. Medical tourism. In combination with the other factors, decreasing airfare has encouraged many individuals to travel internationally for treatment, and some countries to build specialized, resort-like cosmetic treatment facilities.

The white paper, titled Aesthetic Laser Market Outlook: Where Are the Opportunities for Medical Device Manufacturers in 2019?, reports that the global medical aesthetics market—involving all technologies—will exceed $21 billion by 2024. Lasers’ share of this will grow at a CAGR of 10.8% to account for $1.93 billion by 2026. The fact that smaller and more energy-efficient diode lasers have largely replaced gas lasers for aesthetic treatments is key here. Continual advancements in the semiconductor industry directly benefit diode laser development, and intense competition in the aesthetics industry drives demand for new clinical instruments that take full advantage of these advances.

While North America accounts for the most revenue in the aesthetic laser market, according to Lasertel, the Asia Pacific region has the fastest-growing demand for laser-based skin treatments, having increased more than 20% in the last three years. That rate is expected to persist as some countries (for example, Japan) continue relaxing aesthetic laser regulations. Changing attitudes have also driven a 16% annual increase in treatments in Europe, the Middle East, and Africa. Lasertel expects a flattening of that rate in Europe once treatment resources match demand, but while specific predictions for the other regions are hampered by economic volatility, both are considered significant untapped markets.

In its earnings call for the period ending September 30, 2019, IPG Photonics CEO and board chair Valentin P. Gapontsev reported that sales within the company’s medical laser business nearly doubled year-over-year. In IPG Photonics' case, the growth was driven by recent U.S. FDA approval for its thulium fiber laser solution in urology applications.

Laser eye treatment debates

Early 2019 saw an explosion of news reports questioning the safety of laser vision correction, following the December 2018 suicide of a 35-year old TV meteorologist and mother apparently related to small incision lenticule extraction (SMILE), a variant of laser-assisted in situ keratomileusis (LASIK), which degraded her vision instead of improving it. Reporting included stories of others who suicided after laser treatments left them with chronic, debilitating eye pain, and reintroduced the perspective of Morris Waxler, Ph.D., formerly Chief, Diagnostic & Surgical Devices Branch, Division of Ophthalmic Devices at the U.S. FDA, who led the team that approved LASIK in 1999. For more than a decade now, Waxler has expressed regret for the approval and has called for more transparency regarding risks and adverse outcomes for the important minority of patients adversely affected.

It is hard to say whether such news reporting has had an effect on demand for procedures. As Allen Nogee reports in this Market Review and Forecast, ophthalmic application of lasers, including vision correction surgery, has grown over the past few years, but has recently slowed.

On a more positive note, March saw the publication of a study in The Lancet reporting a multisite randomized controlled trial comparing selective laser trabeculoplasty (which was U.S. FDA-approved in 2001) with use of eye drops for first-line treatment of ocular hypertension and glaucoma. The study concluded that this painless laser procedure, with a good safety profile, provides effective treatment in a single outpatient visit and improves the prospects of affected patients.

Sales and acquisitions

Although 2019 was not a big year for acquisitions in the medical and aesthetics laser market, three announcements ended the year.

Lumibird Group’s subsidiary Quantel Medical announced its acquisition of Optotek Medical (Ljubljana, Slovenia), developer of optical and laser solutions for medical applications, in September. This acquisition caps the two companies’ long-term collaboration through OEM contracts to develop and supply devices for Quantel’s anterior chamber lasers—a partnership that has enabled innovative solutions for treatment of secondary cataracts and glaucoma, according to Quantel Medical. “We are not only further strengthening our range of laser treatment products for ophthalmology, but we are also expanding our selection of OEM solutions for buoyant markets such as dermatology or ENT surgery with articulated arms,” said Lumibird chairman and CEO Marc Le Flohic.

In October, AngioDynamics, provider of minimally invasive medical devices for vascular access, peripheral vascular disease, and oncology, announced its acquisition of Eximo Medical (Rehovot, Israel) for $46 million up front and up to $20 million more contingent on technical and revenue milestones. The sale expands AngioDynamics’ Vascular Interventions and Therapies (VIT) product portfolio by adding Eximo’s proprietary 355 nm laser technology, which in late 2018 received 510(k) clearance for treatment of peripheral artery disease (PAD; see Fig. 8). AngioDynamics’ president and CEO Jim Clemmer said, “The market is ripe for disruption, and the level of precision, safety, and efficiency offered to physicians by this laser technology creates a substantially differentiated alternative to legacy atherectomy devices.” Eximo’s laser reportedly represents a technological breakthrough by delivering short, high-powered pulsed-laser energy without compromising the integrity of its fiber-optic cables. The acquisition enables key versatility and promises to enable an expansion of applications “within vascular and elsewhere.”In November, Hologic (Marlborough, MA), maker of technology for women’s health, sold the subsidiary it created upon purchasing medical aesthetics laser company Cynosure (Westford, MA) two years ago. The purchase is expected to close by press time; private equity firm Clayton, Dubilier & Rice is buying Cynosure for $138 million—that is, less than a tenth of the $1.6 billion Hologic paid. “Since we acquired Cynosure in 2017, it has significantly underperformed our expectations,” said Hologic CEO Steve MacMillan in a statement. This underperformance relates in part to FDA’s 2018 warning about energy-based “vaginal rejuvenation” treatment in general, and the decision not to approve Cynosure’s MonaLisa Touch laser system for that application. The company responded by marketing the product more narrowly and by temporarily removing another similar product, according to the Boston Globe.

U.S. FDA guidance and approvals

Activity of the U.S. FDA regarding lasers included issuance, in early May, of guidance regarding conflicting national and international standards for laser equipment used in aesthetic and medical applications. The publication (Laser Products – Conformance with IEC 60825-1 Ed. 3 and IEC 60601-2-22 Ed. 3.1) explains that because the U.S. FDA has determined that conformance with International Electrotechnical Commission (IEC) standards provides adequate protection, the agency does not intend to enforce its own requirements with manufacturers conforming to certain IEC clauses. The U.S. FDA intends to eventually align its requirements with those of the IEC to provide a universal set of device-specific criteria.

The U.S. FDA also issued plenty of approvals for use of laser products in aesthetic and medical applications.

In April, Infraredx (Burlington, MA), a Nipro (Osaka, Japan) company, announced U.S. FDA 510(k) clearance to expand the indications for use for its Makoto Intravascular Imaging System. The approval is based on results of the 1563-patient, 44-site research project known as the Lipid-Rich Plaque (LRP) Study. This work demonstrated that the use of near-infrared spectroscopy (NIRS) to detect lipid core plaque (LCP), when combined with intravascular ultrasound (IVUS) technology, can identify patients and coronary plaques at an increased risk for major adverse cardiac events (MACE). Gregg W. Stone, MD, Director of Cardiovascular Research and Education at New York Presbyterian Hospital/Columbia University Medical Center, said the technology promises to enable development of new therapeutic approaches to improve the prognosis of high-risk patients.

In July, Erchonia (Melbourne, FL) received 510(k) clearance to market its FX 635 low-level laser for the temporary relief of chronic, nociceptive musculoskeletal pain. The clearance followed submission of results from double-blind and placebo-controlled clinical trials with 255 patients showing that patients treated with the FX 635 documented a 49% average reduction in pain post-treatment with no adjunctive therapies. Erchonia VP Charlie Shanks noted that all other U.S. FDA clearances have been for specific areas of the body, and “now Erchonia has the only whole-body indication based on Level 1 clinical data.” Still, the clearance was based on the company’s prior Level 1 blinded and controlled clinical trials on chronic neck and shoulder pain (2002); plantar fasciitis pain (2014); and low back pain (2018). Erchonia’s 510(k) clearances for post-surgical pain (2004 and 2008) were not part of this submission, as they studied acute, not chronic, pain.

The company compared its results to those of the the SPACE randomized clinical trial published in JAMA in 2018 that compared opioid and non-opioid (mainly NSAIDs) medications for treatment of overall chronic musculoskeletal pain. This study showed a pain reduction of only 20% with opioids and 26% with non-opioids at three months. This study also implemented many adjunctive therapies such as exercise, physical therapy, and chiropractic care.

Erchonia announced its second U.S. FDA 510(k) clearance of the year in October: This one approves marketing of its EVRL violet light laser for temporary relief of chronic musculoskeletal pain in the neck and shoulder (see Fig. 9). Erchonia noted that violet light had previously been applied only for dermatological conditions. A study, designed to determine the EVRL’s effectiveness when both red and violet diodes are activated simultaneously, examined effects when the lasers were active for 13 minutes without use of adjunctive therapies. The U.S. FDA predetermined individual subject success of 30% pain decrease, and the study showed that all enrolled subjects experienced pain reduction (average reduction = 50%), and many also reported increased range of motion. “What makes the study results more impressive is the average duration of pain was 76.58 months. These subjects were living with chronic pain for an average of 6+ years, and with just a single treatment from the Erchonia EVRL Laser, they experienced a significant reduction in pain,” said company president Steven Shanks.Meanwhile in September, LAP LLC announced that its Apollo MR3T became the first (and is so far the only) product of its class to receive U.S. FDA 510(k) approval. The magnetic resonance (MR)-compatible laser is used for high-precision positioning of patients prior to administration of radiation therapy. The Apollo MR3T is available as a single laser or as a customized laser bridge.

Also in September, Korean medical device company WONTECH announced U.S. FDA approval of Holinwon Prima (which it says is the first holmium laser medical device developed in Korea) for applications such as benign prostate hyperplasia (BPH) treatment, endoscopic surgery for spinal diseases such as herniated nucleus pulposus (HNP), and removal of stones from the urinary tract (see Fig. 10). The company developed its Holinwon Pro series products with Prof. Seung-jun Oh of Seoul National University Hospital (SNUH), a global authority on Ho:LEP surgery. WONTECH reports that it is exporting products to 60 countries.In December, Biolase (Irvine, CA), which calls itself the global leader in dental lasers, announced U.S. FDA 510(k) clearance for its Epic Hygiene, a system designed by dental hygienists for use by dental hygienists. The system allows hygienists to provide minimally invasive, virtually pain-free non-surgical periodontitis treatments that not only reduce procedure time, but also speed recovery.

While Johnson & Johnson Vision’s October U.S. FDA approval was not for a laser product, it will directly affect laser procedures—the U.S. FDA approved Johnson & Johnson’s iDESIGN Refractive Studio software for application to wavefront-guided photorefractive keratectomy (PRK). New clinical data presented at the 2019 American Academy of Ophthalmology conference reported that at six months post-op, the software had enabled 99% of patients to achieve 20/16 or better binocular uncorrected visual acuity and left 99% of subjects feeling very satisfied to completely satisfied with their vision. “This expands a patient’s options for truly personalized laser vision correction, and opens the door for wider adoption of this amazing technology," said Christopher Blanton, MD, President of Inland Eye Institute (Colton, CA).

And in a move expected to result in U.S. FDA clearance, Conversion Labs (New York, NY) announced that it had filed a 510(k) submission for approval of its Shapiro MD Laser Cap System, a portable photobiomodulation device for hair regrowth designed to complement its line of hair growth-stimulating shampoos and conditioners. The move aims to build “the most robust portfolio of clinically proven/studied hair loss products in the United States,” said Conversion Labs CTO and COO Stefan Galluppi, who expects the Laser Cap to “contribute meaningfully to revenue growth over the coming 12 months.”

About the Author

Conard Holton

Conard Holton has 25 years of science and technology editing and writing experience. He was formerly a staff member and consultant for government agencies such as the New York State Energy Research and Development Authority and the International Atomic Energy Agency, and engineering companies such as Bechtel. He joined Laser Focus World in 1997 as senior editor, becoming editor in chief of WDM Solutions, which he founded in 1999. In 2003 he joined Vision Systems Design as editor in chief, while continuing as contributing editor at Laser Focus World. Conard became editor in chief of Laser Focus World in August 2011, a role in which he served through August 2018. He then served as Editor at Large for Laser Focus World and Co-Chair of the Lasers & Photonics Marketplace Seminar from August 2018 through January 2022. He received his B.A. from the University of Pennsylvania, with additional studies at the Colorado School of Mines and Medill School of Journalism at Northwestern University.

Allen Nogee

President, Laser Markets Research

Allen Nogee has over 30 years' experience in the electronics and technology industry including almost 20 years in technology market research. He has held design-engineering positions at MCI Communications, GTE, and General Electric, and senior research positions at In-Stat, NPD Group, and Strategies Unlimited.

Nogee has become a well-known and respected analyst in the area of lasers and laser applications, with his research and forecasts appearing in publications such as Laser Focus World, Industrial Laser Solutions, Optics.org, and Laser Institute of America. He has also been invited to speak at conferences such as the Conference on Lasers and Electro-Optics (CLEO), Laser Focus World's Lasers & Photonics Marketplace Seminar, the European Photonics Industry Consortium Executive Laser Meeting, and SPIE Photonics West.

Nogee has a Bachelor's degree in Electrical Engineering Technology from the Rochester Institute of Technology, and a Master's of Business Administration from Arizona State University.

Jeff Hecht

Contributing Editor

Jeff Hecht is a regular contributing editor to Laser Focus World and has been covering the laser industry for 35 years. A prolific book author, Jeff's published works include “Understanding Fiber Optics,” “Understanding Lasers,” “The Laser Guidebook,” and “Beam Weapons: The Next Arms Race.” He also has written books on the histories of lasers and fiber optics, including “City of Light: The Story of Fiber Optics,” and “Beam: The Race to Make the Laser.” Find out more at jeffhecht.com.

Barbara Gefvert

Editor-in-Chief, BioOptics World (2008-2020)

Barbara G. Gefvert has been a science and technology editor and writer since 1987, and served as editor in chief on multiple publications, including Sensors magazine for nearly a decade.