ALLEN NOGEE, Laser Analyst for Strategies Unlimited

Market numbers and their interpretation are at the heart of the annual Laser & Photonics Marketplace Seminar. While 2017 had been a year of unprecedented growth for many fields of laser technology, 2018 meant a return to a more typical growth rate.

Looking at the macroeconomic numbers, Nogee stated that 2018 was quite a good year for the U.S. economy with a GDP growth of 2.9% (2017: 2.3%). Europe’s GDP growth stood at 2.2% (2017: 2.3%), and industrial production growth slowed down from 3.8% in 2017 to 1.1% in 2018. The Asia-Pacific rim showed solid 5.5% GDP growth, with China’s pace slowing from 6.6% in 2017 toward 6.5% in 2018.

Tariff conflicts between China and the U.S. have raised a lot of interest in recent months. Talking to a number of laser companies, Nogee found that the direct impact was low or even negligible. Indirectly, the tariff discussion led to uncertainties in the market that may have caused recession fears. Probably more important was a downturn in Chinese infrastructure investments, which had a negative impact on investment decisions. China consumes about 40% of the world’s lasers—and a more cautious investment policy there plus fewer smartphones or cars produced have had an immediate and severe impact on laser sales.

Comparing quarterly financial numbers from big laser companies such as Coherent, IPG Photonics, and TRUMPF, Nogee found that 2018 started strong, but then the revenues went down for all of them. Accordingly, stock prices were falling in the second half of 2018 for most laser companies. Interestingly, China’s Han’s Laser stock price went down in a similar fashion, so the downturn was not limited to U.S. companies.

How were the separate laser markets faring in 2018? The medical sector grew strongly, with dental and cosmetic systems growing at 13%, while ophthalmic lasers showed only 2% growth. The flat panel business and particularly OLED displays grew well in 2018. When Apple used an OLED screen for iPhone X, many other companies jumped in and used OLEDs as well. But at $110 for an OLED screen, they are still expensive and slowing sales of iPhones means new laser orders have been canceled.

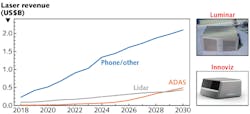

According to Nogee, sensing is the laser market segment currently seeing the biggest growth. Vertical-cavity surface-emitting lasers (VCSELs) have caused a lot of excitement in this segment. Again, Apple had a big influence by pushing VCSEL production in 2017. Several mergers and acquisitions followed: II-VI bought Finisar for $3.2 billion, Lumentum acquired Oclaro for $1.8 billion, and last—but certainly not least—TRUMPF bought Philips Photonics. VCSELs can be used for infrared (IR) illumination in face recognition, 3D shape measurements, and proximity sensing. Therefore, they have potential for smartphones, autonomous driving (lidar), and industrial applications (see figure).

In the material processing market segment, Nogee saw a substantial saturation in 2018. In particular, macroapplications (that is, 1 kW+ power for cutting and welding) grew only 3.7% after an incredible leap of 48.6% in 2017.

The entire laser market is estimated (by Nogee) to be approximately $13.5 billion in 2018. This would be a 5.3% growth over the excellent results from 2017, and includes a moderate +4.8% for kilowatt materials processing lasers, as well as an excellent +28.9% for sensors.

For 2019, Nogee expects strong growth of 12% for photolithography lasers, another +4.2% in macro, and -2.4% in micromaterials processing. Nogee counts in the micro segment all lasers for material processing with <1 kW power, including excimer, but excludes marking lasers.

Medical lasers will also prosper: After approximately 14% growth in 2018, another 9% is expected for 2019. The segment with the strongest growth (almost 25.8%) will be sensors and instrumentation. For all these numbers, it should be noted that Nogee counts the numbers of lasers, but not systems such as those used in material processing.

A final version of the data will be published in a separate report titled The Worldwide Market for Lasers: Review and Forecast, March 2019, by Strategies Unlimited.

CONTINUE READING >>>

DOWNLOAD FULL REPORT >>>

Andreas Thoss | Contributing Editor, Germany

Andreas Thoss is the Managing Director of THOSS Media (Berlin) and has many years of experience in photonics-related research, publishing, marketing, and public relations. He worked with John Wiley & Sons until 2010, when he founded THOSS Media. In 2012, he founded the scientific journal Advanced Optical Technologies. His university research focused on ultrashort and ultra-intense laser pulses, and he holds several patents.