Annual Laser Market Review & Forecast 2019: What goes up...

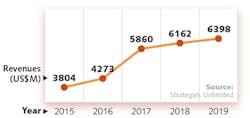

What a difference a year makes. In our 2018 Annual Laser Market Review & Forecast,1 growth in consumer electronics applications like sensing and lidar propelled demand for lasers in semiconductor and materials processing applications to 2017 worldwide sales of $13.07 billion—a 21.6% jump from 2016. And true to our prediction that “We do see 2017, however, as an aberration and expect laser sales growth to return to more moderate growth for 2018 as capital equipment spending cools,” laser sales for 2018 are expected to grow 5.3% to $13.76 billion. But who could predict the volatile macroeconomic conditions that we face heading into 2019? For the first time in nearly a decade, laser manufacturers are concerned that even a “slow and steady” 5–6% sales growth rate could be in jeopardy.

While the same factors that grew laser sales in recent years could easily shrink those sales if the worldwide economies head back into recession territory,2 the laser industry continues to consolidate to maintain market dominance or to create new, vertically organized structures to serve existing and evolving markets amid the economic turmoil. In late 2018, Illumina (San Diego, CA) acquired rival Pacific Biosciences (Menlo Park, CA) to maintain its top position in DNA sequencing instrumentation. And II-VI (Saxonburg, PA) acquired Finisar (Sunnyvale, CA) for $3.2 billion3 on the strength of Finisar’s VCSEL products that are sold into 3D sensing applications for Apple iPhones.

Unfortunately, supplying high volumes of lasers to a single corporate giant like Apple also increases exposure to risk; in late 2018, a series of downward forecasts4 saw stock prices suffer for both Apple and its suppliers.5 Companies like Lumentum (Milpitas, CA) saw its stock drop nearly 29%6 on shipment pullbacks from Apple for 3D sensing lasers.

Besides high-volume supplier risks, an even bigger concern is tariffs. “These tariff and trade-related headwinds were the primary driver of weaker-than-expected performance for our business in China and Europe,” said IPG Photonics (Oxford, MA) CEO Valentin Gapontsev in his Q3 2018 preliminary financials,7 after reporting record Q1 and Q2 earnings of approximately $360 million and $414 million, respectively. The Q3 book-to-bill ratio was just below 1.0, with IPG reporting Q3 sales of $356 million8—down 9% from the same quarter last year. Anticipating more softening in order flow in Q4 2018, Gapontsev sees some relief in Q1 2019 on strength in consumer electronics and metal welding. “However,” he cautions, “our visibility of a trough in the current downcycle is limited by the uncertainty surrounding the global macroeconomic trade and geopolitical environments.”

For Trumpf (Ditzingen, Germany), annual revenue through calendar Q2 (ending June 30, 2018) was up 15.1% from the same period last year to a record $4.13 billion. “Even so, we are monitoring the global economy’s development very closely,” said Trumpf CEO Nicola Leibinger-Kammüller in Trumpf’s preliminary 2017/18 fiscal summary.9 “There are increasing signs that this long phase of recovery could soon be over. We want to be prepared for that,” she added.

Echoing Leibinger-Kammüller, Trumpf CEO for Laser Technology Christian Schmitz said, “For 2019, risks remain that could jeopardize the currently positive trend. These include uncertainties in the areas of foreign trade and the threat of a full-blown trade war between the U.S. and China, most notably. Brexit and the prevailing trends toward nationalism and protectionism may also have repercussions for the real economy.”

Having doubled annual sales from $857 million in 2016 to $1.72 billion in 2017 thanks to the Rofin acquisition and organic growth, Coherent (Santa Clara, CA) fared well in its fiscal 2018 year ended September 30, 2018 with record sales of $1.903 billion.10 However, Coherent president and CEO John Ambroseo expects fiscal 2019 year-on-year sales to decline between 8 and 12% with a weaker first fiscal half, stating that “The demand challenges in China are largely due to U.S. tariffs on Chinese manufactured goods.”

And for our fourth more-than-a-billion-in-annual-sales bellwether laser manufacturer, Han’s Laser (Shenzhen, China), sales grew more than 66%11 to $1.65 billion in 2017. But sales growth slowed for calendar Q3 2018 to 5.4% on sales of $509 million.

The global economic recovery phase since 2008/2009 has indeed been long, but also spectacular. Since reaching more than 16,800 in October 2007 and halving to around 8400 in February 2009, the U.S. Dow Jones Industrial average12 has seen unprecedented growth, fluctuating between 24,000 and 26,000 since late 2017—more than triple its bottom value during the Great Recession. The UK’s FTSE 10013 bottomed at around 3500 in spring of 2009, returning to highs nearing 8000 in the summer of 2018. And at only 7000 in early 2009, the Nikkei 22514 recovered to between 22,000 and 24,000 by 2018—again more than tripling in value.

Should we be worried that by August 2018, the U.S. stock market achieved the longest bull run15 in American history? Will fears of a downward forecast in consumer-driven laser markets continue to pummel stock prices? Does a bull run have to be followed by a bear market? Or concerning laser sales in 2019, should we embrace the phrase—commonly attributed to Isaac Newton as he pondered gravity—that “what goes up must come down”?

Today, the economic indicators cannot be ignored. The World Trade Organization (WTO; Geneva, Switzerland) reduced its world real GDP growth16 from 3.1% in 2018 to 2.9% for 2019. And the International Monetary Fund (IMF; Washington, DC) cut its 2018 and 2019 global economic growth forecast17 from 3.9% to 3.7%, citing uncertainty in NAFTA and EU Brexit negotiations; signs of decreased investment and manufacturing; weakness in Argentina, Mexico, Brazil, Iran, and Turkey; and trade tensions between the U.S. and trading partners.

The trouble with tariffs

Statistics show in general that the first year of a U.S. president’s administration18 is a reflection of the momentum and policies put in place by the previous administration. In January 2016, President Trump inherited 4.9% unemployment that had steadily improved19 under Obama from a high of around 10% in 2007/2008, a 2016 $585 billion Federal deficit20 that had shrunk each year since the whopping $1.413 trillion of 2009 (but has since grown to $833 billion in 2018), and a steadily rising stock market (prior to recent setbacks) after its catastrophic drop because of the housing crisis and derivatives speculation.

But for 2018, a growing U.S. Federal deficit21 and protectionist tariffs threaten to undermine the economic gains enjoyed for nearly a decade. On February 5, 2018, the largest single-day drop in the Dow (closing down 1175 points after dropping nearly 1600 at one point) may have been a warning sign. The Dow was down again almost 800 points (3.1%) on December 4, 2018, before continuing its slide in late December to just below 22,000 after reaching more than 26,000 in late 2018. We all know that a U.S. economic crisis impacts the global laser markets: The Great Recession saw laser sales fall 24.1%, while the 2000 telecom bubble caused a 36.1% drop in laser sales22—especially harsh, but understandable in that telecom laser sales accounted for 58% of the total laser market in 2000.

Historically, tariffs have been disastrous.23 There is a reason why the Smoot-Hawley protectionist tariffs implemented in 1930 by U.S. President Hoover after the 1929 stock crash are widely believed to have initiated and prolonged the Great Depression: tariffs stifle global trade and ultimately hurt consumers with higher prices and job losses. In stark contrast to U.S. tactics, Japan and the European Union signed a trade deal24 in the summer of 2018 that eliminates nearly all tariffs.

Regarding the recent tariffs imposed by the U.S. on China, laser and photonics companies worldwide are spooked. “The [U.S.] administration will kill American high-tech companies,” said IPG Photonics’ Gapontsev in an early August 2018 Washington Post article.25 On September 17, 2018, the Telecommunications Industry Association (TIA; Arlington, VA) issued a press release stating that “These tariffs will impact a broad range of communications equipment, with the financial damage expected to reach hundreds of millions of dollars for the telecom equipment industry in the United States.”

On November 19, 2018, the U.S. Bureau of Industry and Security issued a call for possible export restrictions26 (with comments due December 19th) on 14 technologies that could seriously impact the photonics and laser industry, including biotechnology, artificial intelligence (AI), quantum information and sensing technology, additive manufacturing, and advanced surveillance technologies. Just the potential for these technology restrictions prompted Zacks Equity Research (Chicago, IL) to predict that growth prospects are dull27 for the Laser Systems and Components Industry.

Even steel and aluminum tariffs are hurting laser manufacturers. Bicycle assembler Kent International (Manning, SC) has halted hiring and equipment purchases.28 “The idea was to work first on the welding and then eventually purchase the automatic bending and laser cutting equipment, but this is now on hold,” said Kent CEO Arnold Kamler in mid-2018.

So who is benefiting from the tariffs? Some say it is Chinese laser manufacturers like Han’s Laser and Wuhan Raycus Fiber Laser, with the latter’s revenue29 growing 66% for the first nine months of 2018 to about $156 million. At the expense of companies like IPG Photonics, a Seeking Alpha article30 argues that “With the tariffs now in place, Chinese companies have an even more compelling argument to go with local suppliers [for fiber lasers] in those applications where performance is equivalent or at least close enough.”

China’s new normal

The IMF31 puts China’s GDP at 6.6% for 2018, falling slowly from double-digit values prior to the 2008/2009 Great Recession to 6.9% in 2017. Contrast this with 2017 GDP values for the U.S., UK, France, and Germany of 2.2, 1.7, 2.3, and 2.5%, respectively, and it is obvious that China—despite slowing growth—is still a very important market for laser manufacturers.

“China is transforming from a steel and concrete economy towards a consumption- and advanced-manufacturing-driven economy. And although its annual GDP growth has slowed to less than 7%, its photonics industry may see much higher growth,” says Bo Gu, founder of BOS Photonics (North Andover, MA) and an independent consultant advising photonics companies doing business in China and Asia. Gu believes that both the U.S. and China are trying to avoid the trade war and may reach some short-term agreement to alleviate worldwide anxiety. “However,” he adds, “It will be difficult to reach a long-term agreement before some fundamental issues are resolved.”

Gu cautions, “Unfortunately, aggressive price reductions may have the 2019 laser market seeing single-digit growth. This price competition might be beneficial for end-user consumers for the short term, but it means that the laser industry is not making the margins it deserves, especially in China. And this is not healthy for everyone in the long term.”

Nothing to fear

Regardless of what happens in 2019, it is important to remember that even though the Great Recession saw that 24.1% laser sales decline from 2008 to 2009, our answer to the question we posed back then, “How wide is the chasm?”,32 was less than two years: by 2010, laser market sales had nearly recovered to 2008 levels.33

And despite the economic downturns of the past 20 years, some consumer demands that drive laser sales never retreat. According to Nielsen’s Law of Internet Bandwidth,34 for example, user Internet connection speed has grown 50% per year from 1983 to 2018. For lidar lasers enabling autonomous vehicles,35 global automobile sales36 have ramped exponentially from around 40 million in the nine-year period from 1990 to 1999 to an estimated 80 million in 2018 alone. And for fans of sustainable technology, “Electric vehicle growth will drive applications associated with conductive materials joining for battery and motor production, with a shortage of skilled manual welders driving the demand for automated laser-based solutions,” says Geoff Shannon, director of strategic marketing, materials processing at Coherent. “Just in America, this shortfall is expected to be around 400,000 welders by 2020, representing significant growth potential.”

Laser companies that survived the telecom bubble of the early 2000s reinvented themselves, investing in R&D and transitioning from telecom-only to a diverse range of laser products that served growing markets. And should another recession materialize and significantly impact industrial laser sales, for example, other laser market segments will emerge and thrive.

While not entirely recession-proof, medical laser markets see no sign of slowing as we head into 2019. Deloitte (New York, NY) predicts global healthcare spending37 to grow at an annual rate of 4.1% from 2017 to 2021, driven by aging and increasing populations, developing market expansion, medical treatment advances, and rising labor costs. Similarly, global military spending38 will grow for its fifth consecutive year to reach $1.67 trillion in 2018, according to IHS Markit (London, England), on Middle Eastern and, increasingly, Eastern European geopolitical instability.

For 2019, despite obvious signs that the past decade of global growth may not be sustainable, we forecast 6.11% growth to $14.6 billion as medical, military, and certain niche industries maintain positive momentum for the laser industry. We can only hope that tariffs will be reversed, stock markets will not crash, and fears of an impending economic downturn are “fake news.”

LASER MARKET SEGMENTS

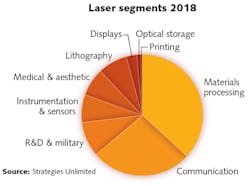

Materials processing and lithography continue to dominate laser sales in 2018—not far behind is communications and data storage, with instrumentation, medical, and displays following the lead. Unfortunately, materials processing continues to be subject to external threats from tariffs and macroeconomic challenges, while laser sales for communication applications surge ahead as the thirst for bandwidth continues.

Materials processing and lithography

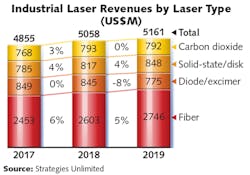

We can’t recall a time, in recent years, when we have seen the term ‘headwinds’ used so widely in comments made by senior management at the leading manufacturers of industrial lasers. That, and the aforementioned tariff issues, are identified as major concerns in the financial reports of many of the companies whose laser revenues represent about 80% of the total market. The obvious unstated conclusion is that turmoil in the markets for industrial lasers has led to modest growth in 2018 (2017 was a banner year), with prospects for the same in 2019. Even so, 2018 was another record year for industrial laser sales, cracking the $5 billion revenue level.

To begin, understand that 2017 was a great year for industrial laser revenues, so no matter how 2018 was forecast or turned out, it was going to be hard to match the prior year growth numbers—and analysts knew that going in.

We also knew world economies were living against the odds—many key market-driving economies had been strong for months, long overdue for an adjustment. We heard the same uncertainty in late 2017 from various segments of the global manufacturing sector about possible soft- or flat-growth pictures for manufacturers in the automotive, semiconductor, farm, and heavy-duty equipment sectors. Considering that 2017 was a strong growth year, a modest contraction was palatable and so we tempered our 2018 growth projections for industrial laser revenues. Consequently, Industrial Laser Solutions (ILS) forecast single-digit growth in 2018.

Exceptional growth in Q4 2017 (which exceeded guidance numbers) and a strong Q1 2018 caused leading industrial laser companies to issue very positive views on the health of their global market in 2018. However, as the year progressed, turmoil in the key China market (one-third of all industrial laser sales) as it tightened money lending policies, along with overcapacity in strategic fiber laser markets such as sheet-metal cutting (where a selling-price war broke out), and the threat and then imposition of tariff policy changes by the U.S. president, precipitated a slowdown in sales for cutting and welding lasers.

The immediate impact was that two of the four largest laser manufacturers backed off on guidance for Q3 2018 and again in Q4 as these effects heightened concerns. The result was 2018 growth in the low single digits, which mirrored the late 2017 ILS projection.

The bar chart above shows ILS revised 2017 laser revenues and our estimates for 2018 revenue and projections for 2019. We are projecting total industrial laser revenues will rise by about 4%, led again by sales of high-power fiber lasers for metal-cutting operations, up by about 4%. Strength in newly developing fine-metal-processing applications in Europe and China and growth in non-metal processing (led by the aircraft and automotive industry conversion to composites) was not enough to offset diminished capital investment in the semiconductor/display sectors and current overcapacity in additive manufacturing, holding microprocessing to a bit more than 5% growth.

In the macroprocessing segment, sheet-metal cutting grew close to 4%, in spite of turbulence in the low-power end of the business in China brought about by a pricing war among the very large machine suppliers. The predicted rise in welding’s share of the market instead remained at 4% as conversion of quotes to sales in key industries such as automotive, specifically electric vehicle battery applications, did not materialize.

Simply put, for the above reasons (plus global manufacturers’ tightening of capital investment), the pace of industrial laser sales moderated. The 2018 industrial laser market was about $5 billion—up 4% from a very healthy $4.9 billion 2017 performance.

For 2019, ILS expects mixed, single-digit growth across the board for industrial lasers, with high-power laser applications in the macro sector and a modest rise in marking countering flat growth in the micro sector that will result from the predicted scale-down of installations in faceplate processing. Lest readers disparage a projected low 2% revenue increase, we suggest that a $100 million increase in a slow market year is not to be easily dismissed. Beyond is talk of a paced increase as new applications for UV lasers revive markets for additive manufacturing systems and ultrashort-pulse (USP) laser processing sales expand.

In the lithography light-source sector, we estimate that sales will reach $1.104 billion in 2018 and are forecast to grow reasonably to $1.237 billion in 2019 (roughly 51% DUV and 49% EUV sales). But despite semiconductor capital equipment sales growth39 of 9.7% to a record $62.1 billion for 2018, SEMI is now forecasting a 4.0% sales drop in 2019 before a return to growth in 2020, and also revised total fab spending downward40 by 13% in the last half of 2018, citing “trade tensions.”

Privately held Gigaphoton (Oyama, Japan) estimates that as of May 2018, its market share in China is 70%,41 and revealed that its sales of light sources for flat-panel annealing and semiconductor lithography in 2015 and 201642 averaged to about $90 million each year. Projecting forward and considering the growth scenario in 2018, Gigaphoton sales for the six months between April and September 2018 were reported at 20 billion yen,43 or $180 million. Similarly, ASML (Veldhoven, Netherlands), parent company of Cymer (San Diego, CA), says it shipped 18 EUV systems in 201844 and expects to ship 30 in 2019. We think a healthy lithography laser segment in 2019 ensures growth overall for the materials processing and lithography laser segment.

Materials processing & lithography

Includes lasers used for all types of metal processing (welding, cutting, annealing, drilling); semiconductor and microelectronics manufacturing (lithography, scribing, defect repair, via drilling); marking of all materials; and other materials processing (such as cutting and welding, rapid prototyping, and micromachining). Also includes lasers for lithography.

While 2017 was a fantastic growth year for materials processing lasers, it should come as no surprise that these large gains were not sustainable. Going into 2018, laser revenue remained strong, but several negative influences predominated. First, China—the largest consumer of lasers for materials processing—continued to slow economically. Second, Europe’s economy was hit from all sides; the European Central Bank estimates that eurozone growth will slow to 2% this year from 2.5% in 2017. Europe, which had been growing more quickly than the U.S. as recently as last year, is falling behind. And then there are the trade tariffs that President Trump has been so freely enabling against China, Europe, and some other countries. In response, these countries are enacting their own tariffs against the U.S. that include lasers and other optical components. While the tariffs have caused some slowdowns in laser revenue directly, perhaps an even bigger impact is the effect they have on dampening expectations for future growth and delaying or eliminating future laser purchases and other capital expansions. Blended together, 2018 was a year of modest gains in materials processing. As for photolithography and semiconductor manufacturing, 2018 is the year that EUV lithography systems finally ship. However, EUV technical challenges remain and Intel recently announced a delay in the commercial use of EUV until 2021. As for DUV excimer lasers, 2018 was a strong year overall, and with so many EUV delays, it looks like DUV will be around for many years ahead.

Communications and optical storage

Regardless of how the global economy undulates, lasers for telecommunications will be in demand for the foreseeable future. “Global Internet Traffic is set to double in the next 3 years, from around 100 Exabytes per month in 2017 to an estimated 200 Exabytes a month in 2020,” said telecommunications expert Michael Lebby in a late 2017 interview by Jonathan Marks,45 editor at large of PhotonDelta (Eindhoven, Netherlands). “Multiply this by 12 and we are in the ‘Zetta-byte’ era with the view of ‘Yotta-bytes’ not that far away,” added Lebby.

Last year, our forecast discussed a downward trend in the second half of 2017 and into 2018 for communications lasers because of a pause in 4G equipment buildouts before 5G infrastructure investments took hold in 2019. Manufacturers had also cited weakness in China that was expected to be eclipsed by surging datacenter demand in 2019 for high-speed transceivers.

Indeed, Q3 2018 financials (for the three-month period ended September 30th) echoed this forecast: Infinera (Sunnyvale, CA) saw Q3 revenue of $200.4 million—down slightly from $208.2 million in Q2 2018. And although Oclaro (San Jose, CA), which was acquired by Lumentum for $1.8 billion in early 2018, had Q3 revenue of $131.7 million (up from $120.9 million in Q2), revenue was down significantly from the $155.6 million in the same quarter in 2017.

There were some exceptions, however: Finisar, which was acquired by II-VI Incorporated in late 2018 on the strength of its wavelength-selective switch (WSS) and VCSEL portfolio for telecom and 3D sensing applications, respectively, reported revenue of $325.4 million for the three-month period ended October 28, 2018—a 2.5% increase from the previous quarter. Finisar’s success continues to be fueled by the surge in VCSEL sales that we reported in last year’s market review and forecast.46

Besides the 4G buildout pause and weakness in Chinese purchases, Chinese telecom giant ZTE (Shenzhen, China) was banned in April 2018 from buying U.S. telecom products over sanctions related to Iran and North Korea. Oclaro attributed its Q3 2018 revenue growth to “recovery of shipments to ZTE [Shenzhen, China]” after the ban was lifted47 in July 2018. The ban, while instituted over sanctions, hurt U.S. companies just as much as it did ZTE. The ban itself serves as a model for how tariffs are broadly anticipated to negatively impact the optical communications sector.

United States FCC Commissioner Jessica Rosenworcel told attendees at a telecom industry event48 that the new tariffs would be “wildly detrimental” to the U.S. rollout of 5G wireless networks. And because technologists at Corning (Corning, NY),49 Ciena (Hanover, MD),50 and L-Com (North Andover, MA)51 all agree that 5G networks will require lots of optical fiber and, consequently, lots of laser transceivers, so sales of communications lasers will suffer if tariffs continue to be levied.

On the optical storage front, cloud-based solutions continue to outpace CD, DVD, and Blu-ray devices that use optical storage lasers. By early 2017 in the United Kingdom, digital video (film and television streaming and downloads) revenue of $1.66 billion had already surpassed DVD and Blu-ray sales52 of $1.14 billion. And in Q1 2018, U.S. customers paid nearly $3.0 billion for subscription streaming services (representing 29% growth) compared to only $1.1 billion for physical discs (a 10% decline from the prior year).

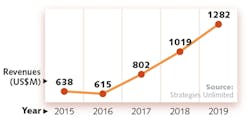

Overall, a collision of these negative factors brought sales of lasers for communications and optical storage down in 2018 to $3.82 billion after seeing steady year-over-year growth to a peak of $4.15 billion in 2017. For 2019, we expect modest recovery in this segment to $3.98 billion, assuming the impact of these factors is mitigated, an all-out trade war does not materialize, and new opportunities like quantum communications53 see further commercialization. The industry also expects consolidation in the optical communications components sector to continue, especially considering the high premiums paid for Finisar and Oclaro.54

Communications & optical storage

Includes all laser diodes used in telecommunications, data communications, and optical storage applications, including pumps for optical amplifiers.

Communications laser revenue was down in 2018, partly from decreased demand and partly from price drops. We expect things to improve in 2019. Communications laser revenue is cyclical in nature, and big new deployments tend to occur in lock-step worldwide. Contributing to the 2018 slowdown is the general slowdown occurring in China that has led to less communications infrastructure investments.

Regarding the use of lasers for cellular backbones, most 4G deployments are complete worldwide, with 5G deployments and upgrades yet to occur. In addition, many wireless service providers anticipated 5G needs when they installed their 4G upgrades, reducing the upgrades required when 5G finally materializes. As for optical storage, the future is dimming for lasers: DVD, CD, and Blu-ray media sales continue to decline as more cloud-based solutions eliminate the need for large local storage. Heat-assisted magnetic recording (HAMR), which uses a laser to increase storage capacity of magnetic media, has been pushed back yet again, with Seagate 16 TB 3.5-inch HAMR drives now expected to hit the market in 2020. Western Digital has since moved on to Microwave Assisted Magnetic Recording (MAMR) technology that does not require lasers at all.

Scientific research and military

The technology behind lasers for scientific research, which include the most technologically advanced coherent light sources available such as few-cycle ultrafast lasers, optical parametric oscillators and amplifiers (OPOs and OPAs) with expanded wavelength capabilities, supercontinuum sources, frequency combs, and others, are often the prototype for lasers used in industry. Future direction for scientific laser companies comes at least in part from academia and other research institutions that are also fertile ground for commercial startups.

Andreas Tünnermann, director of the Fraunhofer Institute for Applied Optics and Precision Engineering (Jena, Germany), predicts that for 2019, “fiber-laser geometry will continue to increase its market share as new active fibers and technologies such as coherent combining open up new wavelength ranges and allow further scaling of output power in continuous and pulsed operation with excellent beam quality and highest efficiency. Particularly interesting are fiber laser-based secondary sources with emission wavelengths in the extreme ultraviolet (EUV) and terahertz regions, which basically open up new applications.”

Optical frequency combs are used in diverse areas of scientific research, including spectroscopy,55 quantum cryptography,56 and precision timekeeping,57 among others. While many of the frequency-comb generators for these projects are custom-made, commercial versions are becoming increasingly available—for example, from TOPTICA Photonics (Munich, Germany), Alpes Lasers,58 Menlo Systems,59 and Laser Quantum.60 Laser Quantum was acquired in 2018 by medical and advanced-manufacturing optical-products company Novanta,61 illustrating the value that the technology behind scientific lasers holds for commercial use in spectroscopy, metrology, and chemical sensing.

Test and other applications that use high-end lasers in large quantities are of obvious interest to companies that have a strong lineup of lasers for scientific research, such as Coherent, Spectra-Physics (an MKS Instruments brand; Andover, MA), TOPTICA Photonics, the Amplitude Laser Group (which includes Amplitude Systèmes and Continuum), and others.

Wilhelm Kaenders, cofounder and president of TOPTICA Photonics, says, “My prediction is that 3D sensing in all shapes and forms will prevail to be the hottest topic in the industry using pulsed or wide fast-tuning devices [lasers]. Ultimately, for cost reasons, these devices will become diode-laser-based, in particular for consumer and automotive applications. But there are many other smaller markets—still multiple-thousand units—that want to do better in time and spatial resolution and that will continue to feed alternative laser technologies. For TOPTICA, nondestructive testing using laser-based terahertz sources is a big champion that we would like to see grow for testing plastics or carbon-fiber materials, but also for inline production processes [layer thickness, delamination, curing, and so on].”

Years ago, the U.S. Missile Defense Agency’s Airborne Laser program’s “top-down” attempt at a one-off invention of megawatt-scale military laser technology led to the project’s demise.62 The current crop of high-power military lasers, with much of its development taking advantage of well-established industrial laser technology, looks much more promising (although limited to lower maximum output powers in the hundred-kilowatt range).

The U.S. Navy has asked Lockheed Martin Laser and Sensor Systems to develop a 65 kW laser weapon called the High Energy Laser and Integrated Optical-dazzler with Surveillance (HELIOS),63 with possible increases to 150 kW; the U.S. Army is testing a 50 kW version of its High Energy Mobile Laser Test Truck (HELMTT)64 at the White Sands Missile Range in New Mexico, with an upgrade to 100 kW planned in 2022; and the U.S. Air Force is working with Ball Aerospace aircraft-mounted laser weapons to disable or destroy enemy aircraft missiles.65 Based on diode-pumped solid-state (DPSS) or fiber-laser technology aided by techniques such as spectral beam combination,66 this class of military weapon will become more prominent in the years to come. Benefits to the laser industry include production of laser diodes needed to pump these weapons.67

Numerous specific military needs continue to benefit the laser industry, such as lasers for infrared (IR) countermeasures, including further R&D into higher-brightness solutions,68 as well as for laser-guided missiles.69 In a look at the future, lidar is being taken up by the U.S. military for uses ranging from aerial infrastructure inspection70 to detection of biological and chemical agents.71 In both its remote-sensing and surroundings-sensing incarnations, lidar seems a perfect fit for the military.

Two of the largest laser-related aerospace companies had relatively level 2017/2016 year-over-year income results: Lockheed Martin72 had net earnings of $1.9 billion in 2017 vs. $3.8 billion in 2016, but it should be noted that the company took a one-time loss of $1.9 billion in the fourth quarter of 2017 because of the impacts of the Tax Cuts and Jobs Act passed on December 2017; and Northrop Grumman73 reported net earnings of $2.015 billion in 2017, lower than its 2016 net earnings of $2.200 billion—it, too, took a one-time loss because of the Tax Cuts and Jobs Act, including a $300 million tax expense.

II-VI,74 which is developing high-energy laser systems for the military, had revenues for 2018 of $1.159 billion vs. $972.0 million in 2017 (fiscal year ending June 30). nLight (Vancouver, WA), which launched its initial public offering (IPO) in April 2018,75 showed, for the three months ended September 30, 2018, revenues of $51.025 million for 2018, compared to $36.547 million in 2017—a growth of almost 40% on the strength of its lasers for industrial, aerospace, and military customers.

The announcements by President Trump in December 2018 that the U.S. will pull all its troops from Syria and 7000 from Afghanistan could possibly have some influence on the military laser market next year. However, it’s the technology race between the U.S., Russia, and China that is the wild card. China and Russia have programs to develop hypersonic missiles76—could laser antimissile weapons ever enter into the equation? And China is developing space-based lidar with the idea of tracking submarines77—is this a threat in any way, and how would the U.S. respond?

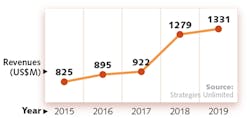

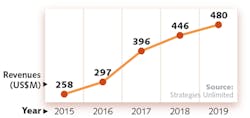

As for the numbers, laser revenues for the scientific and military segment grew from $922 million in 2017 to $1.279 billion in 2018, with 2019 revenues forecast to grow modestly to $1.331 billion.

Scientific research & military

Includes lasers used for fundamental research and development, such as by universities and national laboratories, and new and existing military applications, such as rangefinders, illuminators, infrared countermeasures, and directed-energy weapons research.

R&D laser spending saw modest growth in 2018. The U.S. saw a small increase in laser R&D spending, with China maintaining its high laser R&D spending (43% of the worldwide total and growing) as in past years while Europe, despite its economic slowdown, was flat. Military laser revenue had a great year in 2018. After some successful testing in previous years, the U.S. and a few other countries are moving forward with plans for more directed-energy laser weapons. These weapons are not intended to destroy intercontinental ballistic missiles as once hoped, but instead are geared toward defending against drones and other smaller, fast-moving targets.

Medical and aesthetic

The sale of lasers for medical applications continued its upward trend in 2018, with cosmetic and dermatology applications leading the sector. In its March 2018 aesthetic laser market forecast, laser components and solutions provider Lasertel (Tucson, AZ) noted78 that growth in this segment is being driven in large part by the replacement of gas lasers by small, energy-efficient diode lasers. But Lasertel’s report also notes that growth because of technological advances and decreased treatment cost pales in comparison to that arising from consumer demand for laser skin treatment (such as tattoo, wrinkle, hair, and scar removal and skin lightening).

At 20% growth from 2016 to 2017, Asia is at the forefront of aesthetic laser treatments (facilitated by the addition of Taiwan and Korea as medical tourism destinations). In Europe, the Middle East, and portions of Africa (areas that have previously not embraced aesthetics), the laser aesthetics market grew 16%.

Such growth has attracted the interest of investors, as demonstrated by multiple acquisitions in 2018. In September, Syneron Candela (Wayland, MA) acquired Ellipse (Denmark), a privately held company (financial terms were not disclosed) known for its Intense Pulsed Light (IPL) and laser-based platforms for medical and aesthetic dermatologic applications. The acquisition strengthens Syneron Candela’s position in multi-application, multi-technology devices. A key Ellipse product is an IPL-and-Nd:YAG platform targeting vascular and pigmented lesions, hair removal, and (with a fractionated 1550 nm add-on handpiece) skin resurfacing. Incidentally, the provision of systems to address multiple specific applications is a trend in product development—not only in aesthetics, but also in surgical lasers.

In November 2018, private equity firm CVC Capital Partners (Luxembourg) was nearing finalization of its acquisition79 of medical and aesthetic laser company Lumenis (Yokneam, Israel). The deal is valued at roughly $950 million, compared to the approximately $510 million paid for the company in 2015 by another private equity firm, XIO (London, England). For fiscal year 2014, Lumenis’ last as a public company, the firm reported $289 million in revenue. The company’s current annual sales are reportedly around $500 million, which represents entry into new medical markets.

Growth in the aesthetic sector was also facilitated by a number of U.S. Food and Drug Administration (FDA) approvals that expand dermatology applications: Alma Lasers (Caesarea, Israel) was approved for its three-wavelengths-in-one compact applicator; Syneron Candela won clearance for its 595 nm pulsed dye laser (PDL) cosmetic device that adds a 1064 nm wavelength to treat a broad range of skin conditions; and Lutronic (Korea) was cleared for its device offering pico- and nanosecond modes with precise control over pulsewidth, wavelength, and fluence for cases that have resisted other Nd:YAG treatments. Strata Skin Sciences (Horsham Township, PA), which reported Q3 2018 revenues of $7.9 million (an increase of 8% over 2017), received approval for an excimer laser tip able to custom-filter narrowband UVB light for a maximum non-blistering dose. And Korean developer Hironic got clearance for its hybrid acne treatment device that pairs a 1450 nm diode laser with bipolar radiofrequency and cryogenic cooling.

Hair restoration received a number of FDA approvals in 2018 as well, including the Theradome (Pleasanton, CA) LH80 PRO (now approved for men), the HairMax (Boca Raton, FL) RegrowMD for treatment of androgenetic alopecia in both men and women, and the InMode (Lake Forest, CA) Triton, the only device to provide concurrent emission from the three most-popular hair-removal lasers—alexandrite, diode, and Nd:YAG.

But the FDA’s influence on the laser aesthetics market wasn’t all rainbows and sunshine. On July 30, 2018, it issued a warning concerning systems it had approved for treatment of “serious conditions like the destruction of abnormal or precancerous cervical or vaginal tissue…” saying that the “FDA has serious concerns about the use of these devices to treat gynecological conditions beyond those for which the devices have been approved or cleared.” The agency was targeting the marketing of such products for “vaginal rejuvenation” procedures and stated that adverse event reports and published literature highlighted numerous cases of burns, scarring, and recurring or chronic pain.

The agency notified seven device manufacturers (Alma Lasers, BTL Industries, Cynosure, InMode, Sciton, Thermigen, and Venus Concept) of concerns about inappropriate marketing. The manufacturers—and providers of such services—were quick to respond, and even National Public Radio weighed in,80 saying that gynecologists have reported good results from CO2 lasers in particular.

The FDA delivered another wake-up call to manufacturers of laser-based biomedical systems. In April 2018, following Medtronic’s (Minneapolis, MN) Class 2 recall of its Visualase Cooled Laser Applicator System (VCLAS) for MRI-guided laser brain surgery, the FDA issued a Class I recall(the most serious type) for Monteris Medical’s (also in Minneapolis) NeuroBlate MRI-guided ablation system because of unexpected heating of laser delivery probes. Soon afterward, the FDA issued a general warning about the risk of tissue overheating during use of such systems, owing to inaccurate magnetic resonance thermometry. To address the problem, the manufacturers provided guidance to users, and Monteris obtained 510(k) clearance for a fiber-optic-controlled, cooling-equipped laser probe.

Additional FDA approvals in 2018 included a laser endomicroscopy system for use in neurosurgery from Mauna Kea Technologies (Paris, France); a Lensar (Orlando, FL) laser for presbyopia treatment and another from Carl Zeiss Meditec (Jena, Germany) that extends laser-based myopia treatment to patients with astigmatism; the first 355 nm laser for clearing plaques responsible for peripheral artery disease from Eximo Medical (Rehovot, Israel); and a Multi Radiance Medical (Solon, OH) system for neck and shoulder pain relief that uses advanced laser diodes to “super pulse” up to 50 W of power (more than most Class IV lasers) and aims to maximize treatment by discouraging the body from adapting to its effects.

Acquisitions were also numerous in 2018, demonstrating heightened anticipation of growth in the medical laser industry. In October 2018, Novanta (Bedford, MA) completed its purchase of Laser Quantum (Manchester, England), supplier of solid-state and ultrafast laser sources to medical OEMs. The $45.7 million deal is a follow-on to Novanta’s (formerly GSI Group) January 2017 increase in Laser Quantum’s equity stake to 76%.

In a deal valued at $28 million, optics and photonics supplier Gooch & Housego (G&H; London, England) acquired Integrated Technologies (ITL; Ashford, England), maker of medical devices including in vitro diagnostic tools. The August purchase helps fulfill some of G&H’s strategic goals: ITL business will double G&H’s existing life sciences revenues, and the company’s system-based products move G&H “up the value chain.”

Also in August, fiber and CO2 laser manufacturer OmniGuide (Cambridge, MA) acquired Lisa Laser (Katlenburg-Lindau, Germany), maker of thulium and holmium lasers for treatment of benign prostatic hyperplasia (BPH)—an application area of growing importance, given that it was also an area of investment for Boston Scientific (Marlborough, MA), provider of the Greenlight XPS Laser Therapy system and holmium platforms.

While dental lasers are still a minor player in the field of laser medicine, their total revenues rose dramatically in 2018. Biolase (Irvine, CA), which calls itself the global leader in dental lasers, reported that U.S. laser revenue for Q3 2018 had increased 22% year-over-year. In its Southern California Model Market, laser revenue increased 127% year-over-year for the quarter and 175% over the last two quarters—growth the company attributed to “early success as we test different go-to-market approaches.” Biolase also announced a partnership with the Dallas Mavericks basketball team to raise awareness on the benefits of dental lasers.

Considering the future of the laser market, Praveen Arany, president of the World Association of Laser Therapy (WALT),81 points to the first-ever congressional briefing on “innovative medical technologies for pain management”82 and subsequent passage of the Opioid Crisis Response Act (OCRA) of 2018, mandating development and adoption of pain treatment alternatives as an indicator of what’s to come for new applications. “There is tremendous excitement about photobiomodulation for pain management and oral mucositis,” he said, referencing commercial opportunities for laser treatment of opioid addiction and painful ulcers in chemo-radiation-transplant oncology patients. Indeed, even macroeconomic softening cannot deflate the ever-expanding medical laser markets for 2019 and beyond.

Medical & aesthetic

Includes all lasers used for ophthalmology (including refractive surgery and photocoagulation), surgical, dental, therapeutic, skin, hair, and other aesthetic applications.

In 2018, sales of lasers for medical purposes had a great year after a very strong 2017. Cosmetic and dermatology lasers had the strongest showing, driven by positive economic conditions in most regions—and especially in Asia.

Applications include tattoo, wrinkle, hair, and scar removal, and skin lightening. Dental laser sales were also up sharply in 2018, but in terms of total revenue, remain a relatively small medical application—only 6% of the total medical laser revenue. After a great 2017, surgical laser revenue had a good showing in 2018. The most exciting part of the surgical laser business is the expansion of its use: a surgeon who uses a laser for one procedure is more likely to feel comfortable with it for other types of surgery, advancing the probability of its purchase by a surgeon for its practice. In addition, laser light, and disposable laser probes, are less likely to carry germs between patients and usually don’t require sterilization.

Instrumentation and sensors

Laser-based optical instrumentation for test, measurement, and sensing is a diverse market segment, as it encompasses numerous types of optics and photonics technology. Often, the laser itself is a minor, if essential portion of the instrument or sensing system. This technologically mixed market also includes a number of billion-dollar companies that “do it all.”

MKS Instruments, which throughout its history has been especially known for serving the semiconductor market, strengthened its presence in the optics and photonics arena in 2016 with its acquisition of Newport for about $1 billion, including Newport’s own previous acquisitions: Spectra-Physics, Ophir, Femtolasers, and others. In 2018, MKS announced its intent to acquire laser micromachining maker Electro Scientific Industries,83 also for about $1 billion, in an example of a further diversification of MKS. From 2016 to 2017, MKS’ net revenues grew from $1.3 billion to $1.9 billion, while its net income (profit) grew from $105 million to $339 million, indicating that its course of action has been working out well for the company. In 2018, MKS has shown net revenues of $554 million in Q1, $573 million in Q2, and $487 million in Q3.

Although MKS is an optical instrument maker, it is still most influenced by the semiconductor industry. “Despite the recent moderation in the semiconductor market, we are pleased with our strong financial results for the third quarter [of 2018],84 reflecting our ability to manage through these cycles,” says Gerald Colella, CEO of MKS. “Although we foresee the semiconductor market will continue to face headwinds in the near-term, exiting the third quarter we have seen that our semiconductor business has been more steady and consistent. We are very optimistic on the long-term growth drivers within the semiconductor market. Moreover, we have continued to diversify our markets, customers, and product portfolio and are on target to grow our advanced markets more than two times faster than the overall market.” It is obvious that diversification is key to MKS’ growth.

In 2018, PerkinElmer (Waltham, MA), which makes scientific, medical, and industrial instrumentation including confocal microscopes, many types of spectrometers, and time-resolved fluorescence instruments, brought Shanghai Spectrum Instruments (China) and RHS (Australia) under its wing. In addition, PerkinElmer sold its Phenoptics multispectral imaging portfolio for quantitative pathology portfolio to Akoya Biosciences.85 PerkinElmer’s revenues for 2017 were $2.256 billion, rising from $2.116 billion for 2016.86 This $140 million boost in 2017 was almost evenly divided between the company’s Diagnostics division ($76 million) and its Discovery and Analytical Solutions (DAS) division ($66 million), which produces spectrometers. Prahlad Singh, who becomes PerkinElmer’s new president and CEO on January 1, 2019,87 will likely work at increasing the synergy between the company’s DAS and Diagnostics divisions.

From 2016 to 2017, total revenues for Bruker (Billerica, MA) rose from $1.61 billion to $1.77 billion.88 The Bruker Scientific Instruments segment, which includes all optical instrument production, saw its revenues rise from $562 million to $571 million in the same time period. Bruker was no slouch in acquisitions in 2018: JPK Instruments,89 which provides microscopy instrumentation for biomolecular and cellular imaging; Anasys,90 which develops nanoscale infrared spectroscopy and thermal measurement instruments; an 80% majority interest in Hain Diagnostics; and optical metrology products maker Alicona Imaging91 are now part of Bruker’s portfolio.

“While semiconductor metrology markets have slowed, booking rates for the majority of Bruker’s portfolio remained quite healthy,” said Frank Laukien, CEO and president of Bruker, adding that year-to-date 2018 order bookings were up mid- to high-single digits on an organic basis, including strong growth in North America and China and good results in Europe.

Jenoptik (Jena, Germany), which can count instrumentation—including laser distance sensors, optical shaft metrology, and custom laser-based industrial instrumentation—among its many products and skills, had revenues of $677.5 million for the first nine months of 2018 compared to $601.6 million in the same period of 2017, helped by demand for optical systems for the semiconductor equipment industry, as well as for healthcare instrumentation. Jenoptik CEO and president Stefan Traeger notes that sensor and data fusion are one way to go to boost future growth (see article).92 “As an industry, we are still positioned so that we produce a digital data set and someone else makes money with it,” he says. “And we forget that sooner or later, the mere production of the digital data set will no longer bring the money. The sensor becomes a commodity. What’s really going to make the money is an integrated solution of sensor and data processing. Within five years, we must have an answer to this question: Do we want to, can we even deal with the Googles of this world? We can’t beat them, of course, so how do we deal with them? I think that’s a challenge that the whole industry has to face.”

Lidar, especially for use in self-driving cars and hazard avoidance, has become a media darling this year and is the focus of much commercial development in the optics and photonics community.93 Practically, though, it has a long way to go: costs are high, many configurations are competing with each other, performance under duress is not proven, and even ethics need to be worked out (should the lidar system try to save the pedestrian, or the driver?). Austin Russell, founder and CEO of lidar developer Luminar Technologies (Portola Valley, CA), predicts that in 2019, “we’re going to see fewer companies offering new, hyped-up alternative methods for solving the problem. This year, we saw a lot of new companies coming in with ‘groundbreaking, novel solutions’ and companies claiming to offer a $100 lidar. We’ll be seeing a lot less of that in 2019. Big claims won’t cut it anymore; we’re getting to the phase in the industry where everyone has to prove themselves through their technology.” Russell is expecting that next year will see a lot more lidar units on the road.

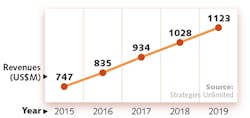

For 2018, laser revenues for instrumentation and sensors grew from $802 million in 2017 to $1.019 billion in 2018. The 2019 forecast calls for laser revenues of $1.282 billion—for all these numbers, the projection includes lasers for scientific, industrial, and medical instrumentation, as well as lasers used for sensing in the consumer world (Apple iPhones, computer mice, and so on). According to Allen Nogee of Strategies Unlimited, VCSELs for sensing in consumer items should have another banner year.

Instrumentation & sensors

Includes lasers used within biomedical instruments; analytical instruments (such as spectroscopy); wafer and mask inspection, metrology, levelers, optical mice, gesture recognition, lidar, barcode readers, and other sensors.

While many laser sensing applications like computer mice are rather unexciting, numerous sensing applications are very promising indeed.

The largest application, which literally just appeared in the last few years, is 3D sensing. This application first appeared in Microsoft’s Kinect sensor for the Xbox, and then in the Kinect 2 sensor. After Microsoft sold nearly 35 million of these Kinect sensors, the company killed the product in 2017. But all was not lost. Apple purchased the company that produced the first Kinect, PrimeSense, in 2013, and in 2017 introduced FaceID and included it in the new iPhone X. In 2018, Apple included FaceID in more phones and in the iPad Pro. The success of Apple FaceID led to Samsung and Chinese phone manufacturers needing this new feature. And even though laser 3D sensors are not yet on many phones, they will be by the end of 2019. Add this to the growing number of lidar applications like autonomous vehicles that also use laser sensors, and you have a laser segment with some serious bite going forward. This is certainly one laser area to watch.

Entertainment, displays, and printing

If you’re in the market for a projector for home, business, or even full-scale cinema use, look to lasers instead of lamps. The verdict is in: lasers outperform lamps and, increasingly, LEDs at all grades of projection applications, with prices ranging from $2000 to $6000 at home/in the office, and around $100,000 for cinema-scale projectors. Whether high-brightness blue lasers and phosphors in 3LCD technology (from Sony, Epson, and Panasonic), MEMS mirrors and red/green/blue (RGB) lasers or LEDs in DLP technology (from LG, ViewSonic, BenQ, Casio, Optoma, Acer, and Dell), or high-power RGB laser engines in digital cinema designs (from Barco and Christie), lasers continue to penetrate lamp- and LED-based systems.

And yet, even in the cinema world, Barco (Kortrijk, Belgium) and Christie (Cypress, CA) suffered some of the same fate befalling consumer electronics, semiconductors, and materials processing markets for lasers in 2018—reduced sales because of trade/currency issues and a slowing in Chinese purchases. For its first half of 2018 (ending June 30, 2018), Barco reported sales94 of nearly $570 million—down 3.8% from the same period last year on “… lower cinema sales, mainly in China,” but actually up 2.7% on a constant currency basis. Ushio, the parent company of Christie, also saw reduced sales95 of around $730 million for its first fiscal half (ending September 30, 2018) compared to $754 million for the same period in 2017.

Running counter to digital cinema equipment sales is actual box-office revenue worldwide.96 IHS Markit reported that total box office revenue in North America (U.S. and Canada) reached $6.18 billion in the first half of 2018—a 9.6% increase on the same total in 2017, when North America represented 28% of global box-office sales. And with theater companies like CGR Cinemas (Perigny, France) planning to convert all 700 of its theaters to pure RGB laser projectors from Christie (100 in 2019 and 100 in 2020), and Cineworld (Chiswick, London) planning to add or replace 600 of its 9538 screens with Barco laser projectors in the next three years, we are still in the early stages of growth for laser-based cinema.

Home and office laser printer markets are seeing slow growth, with the overall printer, copier, and multifunction product markets growing only 0.4% in 2018 according to Gartner (Stamford, CT). And on the business image printing side, lasers used in computer-to-plate applications (UV laser diodes, blue diodes) and in flexography applications (CO2 lasers) will continue to be in demand, but with low-single-digit growth rates of around 2.6% annually at least for flexographic markets,97 according to Smithers Pira (Leatherhead, England).

Laser light shows for entertainment continue to dazzle audiences, both large and small. “The laser entertainment industry has experienced exponential growth in 2018 due to a couple of key innovations. First, the overall price to purchase a laser projector has come down substantially, thanks to lower costs for the laser diodes themselves. In addition, easier laser controls and user interfaces are helping everyday consumers gain access to the tools they need, allowing them to design, create, and then project their own laser content,” says Justin Perry, chief operating officer at Pangolin Laser Systems (Orlando, FL). “As a result, we see lasers being used even more for applications like home entertainment, Christmas and holiday lighting, as well as for classic uses such as nightclubs, tours, and festivals,” he adds.

Entertainment, displays & printing

Includes lasers used for light shows, games, digital cinema, front and rear projectors, picoprojectors, and laser pointers. Also includes lasers for commercial pre-press systems and photofinishing, as well as conventional laser printers for consumer and commercial applications.

While the laser printer segment is flat at best, and lasers for light shows are slowing a bit after peaking a few years back, lasers used for displays and as a light source are only beginning to hit their stride. Lasers used in projectors of one type or another have been around many years, but their revenue remained relatively small until a few years ago, when lasers were incorporated into commercial cinema projectors. Here, lasers are increasingly being deployed as brighter, more energy-efficient, lower-cost-of-ownership light sources for cinema projectors. The transition from xenon bulbs to lasers came at a perfect time because a movie theater explosion was starting in China, and this technology fit the market perfectly. Today, there are more commercial movie theaters in China than in the U.S. A similar, potentially disruptive technology is using lasers for illumination, such as those being used in the headlights of Audi and BMW automobiles. While a minuscule laser revenue source overall, the potential remains for lasers to replace LEDs in many lighting applications of the future.

REFERENCES

For the complete list of references, please see https://bit.ly/jan19references.

About the numbers

The estimates and forecasts of laser revenue are based on detailed market analyses by Allen Nogee, president of Laser Markets Research, for Strategies Unlimited, a PennWell business that has been conducting market research in photonics for more than 31 years. The research considers both quarterly and long-term historical trends—results are then compared and adjusted each year to correct for known errors and sales additions/subtractions from fourth-quarter financial reports. Significantly more information is presented each year at the Lasers & Photonics Marketplace Seminar (www.marketplaceseminar.com), held in conjunction with SPIE Photonics West, and in the annual Worldwide Market for Lasers: Market Review and Forecast, available from Strategies Unlimited (http://www.strategies-u.com).

About the Author

Gail Overton

Senior Editor (2004-2020)

Gail has more than 30 years of engineering, marketing, product management, and editorial experience in the photonics and optical communications industry. Before joining the staff at Laser Focus World in 2004, she held many product management and product marketing roles in the fiber-optics industry, most notably at Hughes (El Segundo, CA), GTE Labs (Waltham, MA), Corning (Corning, NY), Photon Kinetics (Beaverton, OR), and Newport Corporation (Irvine, CA). During her marketing career, Gail published articles in WDM Solutions and Sensors magazine and traveled internationally to conduct product and sales training. Gail received her BS degree in physics, with an emphasis in optics, from San Diego State University in San Diego, CA in May 1986.

Allen Nogee

President, Laser Markets Research

Allen Nogee has over 30 years' experience in the electronics and technology industry including almost 20 years in technology market research. He has held design-engineering positions at MCI Communications, GTE, and General Electric, and senior research positions at In-Stat, NPD Group, and Strategies Unlimited.

Nogee has become a well-known and respected analyst in the area of lasers and laser applications, with his research and forecasts appearing in publications such as Laser Focus World, Industrial Laser Solutions, Optics.org, and Laser Institute of America. He has also been invited to speak at conferences such as the Conference on Lasers and Electro-Optics (CLEO), Laser Focus World's Lasers & Photonics Marketplace Seminar, the European Photonics Industry Consortium Executive Laser Meeting, and SPIE Photonics West.

Nogee has a Bachelor's degree in Electrical Engineering Technology from the Rochester Institute of Technology, and a Master's of Business Administration from Arizona State University.

John Wallace

Senior Technical Editor (1998-2022)

John Wallace was with Laser Focus World for nearly 25 years, retiring in late June 2022. He obtained a bachelor's degree in mechanical engineering and physics at Rutgers University and a master's in optical engineering at the University of Rochester. Before becoming an editor, John worked as an engineer at RCA, Exxon, Eastman Kodak, and GCA Corporation.

Barbara Gefvert

Editor-in-Chief, BioOptics World (2008-2020)

Barbara G. Gefvert has been a science and technology editor and writer since 1987, and served as editor in chief on multiple publications, including Sensors magazine for nearly a decade.