LASER MARKETPLACE 2013: Laser markets rise above global headwinds

Laser suppliers targeting market segments vulnerable to national debt trends and consumer-spending whims will continue to struggle; but overall, lasers are proving themselves as “tools” that continue to displace legacy nonlaser technologies—and sales are climbing.

The Laser Focus World annual review and forecast of the laser marketplace is conducted in conjunction with Strategies Unlimited (Mountain View, CA; a PennWell company) with additional input from Industrial Laser Solutions magazine.

While the feelings of uncertainty and fears of “aftershocks” experienced by laser manufacturers in the post-Great-Recession years persist as global economic headwinds continue to blow, longer-term sales forecasts see laser technology as mature, economically important, and offering upsides in many segments that will be little affected by even another regional or global recession. And despite anticipation that the worldwide debt crisis will limit certain capital equipment expenditures in 2013, lasers enable manufacturing automation and deliver improved efficiency for reduced energy consumption (an international priority), allowing companies to better compete as the economic storms rage on.

More Laser Articles |

The laser is now a proven industrial tool—a growing commodity in many segments that is being marketed not just to outdo its rival laser competitors but to excel over conventional nonlaser technologies like mechanical cutting, torch welding, and thermal processes. At the same time, ultrasmall semiconductor and nanolasers are tools of a different sort, becoming so small and compact that they will soon be ubiquitous not only in optical communications transceivers but in widespread surveillance, environmental monitoring, and in implantable and lab-on-a-chip diagnostic sensor applications.

“While the European sovereign debt crisis and an economic slowdown in China are real, we still see the laser as a 50-year-old ‘emerging’ technology,” says Neil Ball, president of Directed Light (San Jose, CA). “As a laser components supplier and a contract manufacturer with 17 different laser systems churning out medical devices such as implants and probes, cloud-computing components, and performing mold and die repair thanks to US reshoring of the tool and die industry, we think that laser materials processing—and especially microprocessing below 500 W—still hasn’t reached its full potential. Even if another recession does play out, lasers continue to displace legacy cutting and welding technologies worldwide and find new applications that only lasers make possible.”

Laser annealing, lithography, and advanced packaging company Ultratech (San Jose, CA) agrees. “There is no way to do the things we do without lasers,” according to Jeff Hebb, Ultratech’s VP of laser product marketing. “Below the 45 nm semiconductor node, millisecond laser annealing is absolutely necessary to increase device performance and reduce leakage current; conventional thermal and flashlamp annealing just cannot compete.” Hebb points out that laser spike annealing has now gained broad acceptance for logic devices, but has yet to enter the memory markets, which represent a tremendous upside to laser annealing forecasts. Ultratech is also expanding the laser annealing market with its new “dual-beam” technology that uses a solid-state laser in addition to the primary CO2 laser beam to add extra process flexibility.

“Lasers as enablers” is a concept further supported by the biophotonics industry. “Thermal energy sources and broadband light sources just don’t have the wavelength specificity afforded by lasers,” says Ray Choye, senior director of the Advanced Products Group at Lumenis (Santa Clara, CA). “In addition to using specific chromophore-targeting laser wavelengths for fluorescence studies, photodynamic therapy, and even surgical applications, we are also exploring lasers and their controlled thermal profile in the role of scar revision—particularly for our Wounded Warriors—largely due to the ‘healing response’ that lasers can initiate, giving scarred skin restored function and appearance.”

And even in debt-ridden Europe, ultrafast laser manufacturer Onefive (Zurich, Switzerland) is optimistic. “Industrial laser solutions continue to gain traction in applications where traditional mechanical approaches fail; for example, in the medical field, life sciences, and display/lighting sectors,” says Onefive CEO Lukas Krainer. “Macroecononomic events will not directly influence revenues in these application areas, as laser-based solutions offer a clear and huge added value for the end customer, keeping spending at a high level.”

For 2013, certain segments like communications, micromaterials processing, and medical markets will hold their own amid the smart optoelectronic device boom, heavy bandwidth demands, and an aging population; however, the picture is not entirely optimistic. Macromaterials processing, microlithography, and military/R&D will remain vulnerable to gross domestic product (GDP), political, and consumer spending trends—the same macroeconomic forces that negatively affected the laser markets in the recent past.

The debt crisis

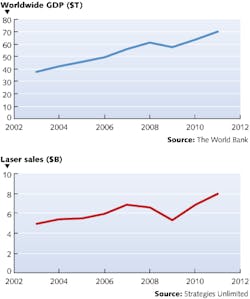

We saw how “history repeats itself” in the mild 1990–1992 global recession and again in the US Great Recession of 2008/2009: Laser sales in many segments decrease (especially in macromaterials processing sectors with their close tie to manufacturing and consumer gadget spending) and track worldwide GDP trends.

And while we are technically out of the recession in the US and see positive (although slowing) GDP figures for the BRIC (Brazil, Russia, India, China) nations, the European sovereign debt crisis has left 17 Euro Area (EA17) countries in a forecasted (negative) GDP growth mode in 2012 at an overall value of -0.3%, with Eurostat presenting even more dire 2012 GDP forecasts for some European countries: Greece at -4.7%; Portugal at -3.3%; Spain at -1.8%; and Italy at -1.4%. And these figures were before early November 2012, when the European Commission revised its 2013 EA17 GDP downward to just 0.1% from the initial 1.0% forecast in late Spring 2012.

The debt crisis that began in the United States has clearly affected Europe and China. As of 2Q12, the Euro area government debt to GDP ratio reached 90% for the EA17 nations. And as Capital Economics (London, England) reported in November 2012, “Private sector credit as a share of GDP [for emerging Asia] has surged over the past few years and is now at an all-time high, leading some commentators to suggest that the region could be planting the seeds of the next financial crisis.”1 Specifically, Capital Economics worries that “[in] China there is little evidence that rapid lending growth has helped to fuel asset bubbles. However, it has led to a sharp rise in capacity in the manufacturing sector. Overcapacity is likely to weigh on medium-term growth prospects.”

“Softness in the Chinese market affects export-oriented economies like Germany,” says Peter Leibinger, president of the Laser and Electronics Division of TRUMPF (Ditzingen, Germany). “The investment climate in Europe is rather soft, which partially is a result of the constant news flow concerning the Euro crisis, and we see a clear slowdown in automotive investments in capital goods in Europe that will impact the laser industry.”

Despite its concerns going into 2013, TRUMPF has enjoyed several post-Great-Recession years of record growth, with $2.58 billion dollar sales in its fiscal 2010/2011 (ended June 30, 2011) growing 15% to another record $2.98 billion for fiscal 2011/2012 (ended June 30, 2012)—a decrease from the 51% growth of the 2009/2010 fiscal year, but quite an achievement nonetheless. Present and past TRUMPF employees attribute much of the company’s success to its roots as a “tool” company. TRUMPF saw early on that manufacturers didn’t particularly care what was cutting or welding its parts; they simply wanted a better, faster, easier-to-operate tool to improve ROI. Today, TRUMPF offers not only conventional mechanical tools but also CO2, solid-state, diode, and ultrafast lasers—any “tool” that will do the job.

“While we don’t expect the rapid growth we’ve seen in the past few years, trends towards lighter materials like aluminum in the automotive industry are positive for the prospects of laser metal processing,” says Christof Lehner, general manager of TRUMPF’s Laser Division. Rumor has it that many automakers may be moving to all-aluminum body panels to meet aggressive vehicle-mileage standards. “And by no means is there a capacity glut where laser processing of electric vehicle batteries and laser cutting machines for hot stamping are concerned. In the flat sheet cutting business we turned the corner in the last decade and sold more laser cutting machines than punching machinery.” Lehner also adds that fiber and disk lasers are replacing lamp-pumped solid-state (LPSS) lasers, except in China where the low-power LPSS business is still quite healthy.

Fiber lasers continue momentum gains

Alongside TRUMPF, Rofin-Sinar (Hamburg, Germany and Plymouth, MI) is leveraging its fiber laser portfolio to improve its sales outlook. For its fiscal 4Q ended Sept. 30, 2012, sales at Rofin-Sinar were down 13% from the same quarter last year to $147 million (and year-over-year sales were down 10%) largely due to softness in macromaterials—and to a lesser extent—micromaterials processing and marking. But while sales fell in Europe and Asia, sales in North America increased.

While Rofin-Sinar sees continued weakness with sales expectations of $130 million to $135 million in the last calendar quarter of 2012 in the semiconductor and electronic and machine tool industries, it plans to optimize the cost structure of its high-power fiber laser product line in 2013 to increase competitiveness. Rofin-Sinar purchased Nufern (East Granby, CT) and its fiber laser portfolio in early 2008.

Beyond fiber lasers, Rofin-Sinar is staying on top of emerging technologies. “Direct diode laser technology has seen a resurgence based on new techniques to improve beam quality,” says Rofin-Sinar technical director Ulrich Hefter. “While some people are ‘hyping’ and ‘prognosing’ the obsolescence of fiber and disk lasers, I don’t see it in black and white and expect that the three different technologies will coexist for a long time.”

Considering that even CO2 lasers continue to enjoy brisk business, Hefter is probably right. But for now, fiber laser technology continues to gain momentum—both in low-power scientific and ultrafast applications, as well as in high-power materials processing applications. “There is strong pressure on laser suppliers to decrease the average $/watt in order to make industrial processes more cost-effective,” says Philippe Métivier, CEO at EOLITE Systems (Pessac, France). “This is leading to an ever more competitive market for high-power fiber lasers.”

This year, IPG Photonics’ (Oxford, MA) calendar 3Q12 revenues (ended Sept. 30, 2012) of $156 million were 21% higher than the same quarter last year, and even exceeded Newport Corp. (Irvine, CA) sales, which reached $143 million for its 3Q ended Sept. 29, 2012. Ranked #9 in Fortune magazine’s fastest-growing companies of 2012, IPG’s three-year average revenue growth was 37% and profit growth was 100%—hard-to-beat numbers that are a testament not only to IPG’s business savvy but to the success of fiber lasers in the laser industry.

“Fiber laser sales continue to be brisk worldwide, especially in North America, with the EU staying on plan,” says Bill Shiner, VP of industrial markets at IPG Photonics. “Car and battery companies are setting up shop in China and specifying IPG systems. The HSS [high-strength steel] components helping automobile manufacturers meet carbon-reduction standards really help lasers; HSS cannot be stamped so laser trimming is the norm.” Shiner also likes the aerospace markets: “With 3 million precision holes needed in each jet engine for cooling, quasi-CW percussion drilling and trepanning is hot and helped by the worldwide shortage in mechanical drilling capacity, not to mention that lasers can achieve 50 holes versus the traditional 2–3 holes per second,” adds Shiner.

Semiconductor markets: Ouch!

While prospects will continue to be good for fiber laser manufacturers in micromaterials processing of smart electronic device components, companies that depend on healthy semiconductor capital equipment purchases are in for a bumpy ride in 2013.

“Capital intensity increases as the semiconductor industry moves from the 45 to the 20 nm node [and beyond] as more fabrication steps are needed to process additional layers and new materials,” says Dan Tracy, senior director, industry research and statistics for SEMI (San Jose, CA). “In 2010 and 2011, the semiconductor industry experienced a solid recovery in capacity expansion as well as migration to leading-edge process technologies. Capacity expansion lessened in 2012 given growing uncertainty in the semiconductor industry, and now a number of analysts are anticipating negative growth for semiconductor capex in 2013.” Tracy adds, “We all know semiconductor capital equipment markets are cyclical, and the recently reported equipment data reflect the much slower industry conditions in the second half of 2012. The October 2012 book-to-bill ratio was 0.75, with bookings nearly 20% lower than October 2011.”

“The microelectronics industry is a real dichotomy this year,” says David Clark, director of marketing for the Microelectronics Segment at Coherent (Santa Clara, CA). “Traditional consumer electronics such as laptops, PCs, digital cameras, hard drives, and TVs are expected to be very weak in 2013, but tablets and smart phones and the components that go into them are growing at an incredible rate—good news since many of these mobile device components are made using our lasers and this part of our business will see continued robust growth.” Clark adds, “If Windows 8-based ultrabooks and tablets gain real traction in the enterprise markets, we believe that this will stimulate significant growth in IC sales this year.”

IC Insights (Scottsdale, AZ) sees a similar trend, predicting 2013 sales of electronic devices growing 5% compared to 3% growth in 2012. Clark is positive about longer-term trends as well, saying, “The 4G-LTE wireless build-out, 3D packaging revolution, continued growth in Internet traffic, and adoption of cloud computing plus the imminent industry migration to 450 mm wafers/EUV [extreme ultraviolet] lithography will drive significant investment in semiconductor capex over the next few years.”

Coherent’s fiscal 4Q sales (period ended Sept. 29, 2012) decreased to $189 million from $208 million in the same quarter last year and bookings decreased nearly 23% compared to the immediately preceding quarter. While Newport saw record sales due to strength in the R&D and industrial markets, it saw weakness in semiconductor capex, with microelectronics sales falling 9.7% to $110 million for the three months ended Sept. 29, 2012 compared to the same three months in 2011.

As a major supplier of lithography light sources to the semiconductor industry, Cymer’s (San Diego, CA) 3Q (period ended Sept. 30, 2012) revenues of around $132 million were essentially flat compared to the same quarter last year but down from $149 million in 2Q12. Acquired by ASML (Veldhoven, the Netherlands) for approximately $2.6 billion in October 2012, Cymer shipped 27 deep-ultraviolet (DUV) systems in 3Q and delivered its first EUV source—with 30 W exposure power—to ASML.

Cymer and Gigaphoton (Oyama, Japan) are leading manufacturers of EUV light sources and should continue to enjoy growing business thanks to the demands of Moore’s law. But laser manufacturers researching ultrashort, ultrahigh-power laser pulses, such as the Extreme Light Infrastructure (ELI) used in light-matter interaction studies, are looking beyond Moore’s law.

“Even back in 2007, a report from the US DOE’s Basic Energy Sciences Advisory Committee said that the limits of Moore’s law will be far surpassed when integrated circuits are fabricated at the molecular or nanoscale level, with a nanochip-based supercomputer fitting comfortably in the palm of your hand and using less electricity than a small house,” says Tim Edwards, director of marketing at Calmar Laser (Sunnyvale, CA).2 “That’s what makes the laser industry so exciting—a molecular-scale future won’t happen without the laser playing a pivotal role. As femtosecond fiber laser manufacturers struggling daily to improve pulse-to-pulse stability for demanding ophthalmic, spectroscopy, DNA analysis, molecular imaging, thin-film solar processing, and metrology applications, all while trying to grab our chunk of the R&D laser market, we wonder why the laser markets aren’t growing faster.”

Onward and upward

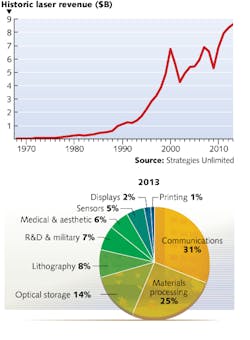

Edwards’ insight as a former employee of Spectra-Physics, TRUMPF, and Coherent and his enthusiasm for the future of lasers is a nice segue into our predictions for the laser markets in 2013 and beyond. While some softening is projected for 4Q12 and early 2013 revenues for some top laser companies, one thing is clear: The turmoil of the past few decades hides an overall positive trend. A simple review of total laser sales since 1968 shows exponential growth amid the noise.

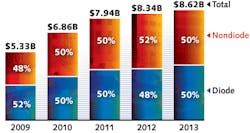

Manufacturers see lasers continuing to enable new markets not possible with conventional technologies. Laser Focus World, Industrial Laser Solutions, and Strategies Unlimited support that thinking; for 2013, we forecast that the laser markets will push ahead and increase approximately 3% to $8.62 billion dollars on 2012 total sales, revised upward from last year’s forecast $7.57 billion to $8.34 billion. Our 1.2% growth forecast for 2012 proved to be too conservative and was more favorable in the 5% range. Despite Europe’s struggles and China’s slowing GDP, laser revenues continue to grow across most application sectors.

THE MARKET SEGMENTS

Communications and optical storage markets combined continue to comprise the largest chunk of laser sales, with materials processing not far behind. As in last year’s forecast, excimer lasers for lithography are included in the materials processing segment. The only change to this year’s market-segment breakdown is that “Pump and other lasers” sales—which reached $297 million in 2012—are now included in the segments for which they are applicable; that is, laser diodes used to pump fiber and diode-pumped-solid-state (DPSS) lasers are included with those laser numbers, and pumps for optical amplifiers fall into the communications segment.

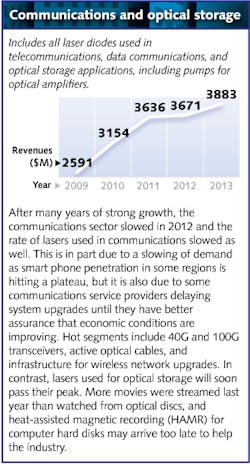

Communications and optical storage

This year, the Internet, cell phone, and cable TV bills exceeded the utility bills for some of our photonics industry colleagues (especially for those with installed solar photovoltaics systems). Yes, we are a technically intensive bunch, but we also have many nontechnical friends with Facebook images in the thousands taken by megapixel cameras and stored as megabyte-sized files and uploaded to “the cloud” or datacenter—not to mention video files. Little wonder that the laser communications segment continues to grow.

Much of the growth comes from upgrades to the wireless infrastructure, translating to increased optical fiber in the communications backbone between wireless nodes; in fact, The Fiber Optic Association (FOA; Fallbrook, CA) even coined the term FTTW for “fiber to wireless.” In addition, fiber-to-the-home (FTTH) applications continue to thrive. The Fiber-to-the-Home (FTTH) Council Americas (www.ftthcouncil.org) released its annual update of FTTH progress, stating that there are now 9 million homes connected by FTTH networks in North America. Lightwave chief editor Stephen Hardy says that FTTX expansion should continue in his 2013 Annual Technology Forecast and also writes that “100 Gbps will become more ubiquitous, with the focus shifting to the metro/regional.”

In the 100G arena, Heavy Reading’s (www.heavyreading.com) Photonic Integration & the Future of Optical Networking report insists that terabit Ethernet and its current 100G forerunner components are indeed a 30-years-in-the-making killer app, and that photonic integrated circuits (PICs)—which drive a large percentage of communications laser sales—have finally arrived to feed ever-increasing optical communications bandwidth needs.

“We believe that photonic integration is poised to accelerate on two fronts,” says Heavy Reading analyst Sterling Perrin. “First, at 100G, greater and greater integration will be required on both the line side and the client side in order to drive down size and costs of 100G modules as they move to mass adoption. Second, as the industry looks beyond 100G to 400G and 1 Tbit speeds, large-scale parallel integration will become a must in order to make these advanced bit rates economically viable.” Perrin concludes, “While commercial deployment of terabit channels is still a ways off, we are seeing suppliers start to make their investments now to be ready for the future.”

Companies like Infinera (Sunnyvale, CA) reflect Heavy Reading’s positive PIC assessment. In 3Q12, Infinera revenues were at $112.2 million, up from $93.5 million in the previous quarter. In the financial press release, Infinera president and CEO Tom Fallon exclaims, “We are at the beginning of what we believe will be an expansive market opportunity for 100G that will extend over many years.”

But hold onto your hats; the “current economic storm” says Ovum (London, England) is causing communications vendors to battle for shrinking business, revealing that “flat is the new up.” “Global optical networking (ON) equipment spending retreated for the third consecutive quarter in 3Q12 … and vendors with strong exposure to weaker North America and EMEA [Europe, the Middle East, and Africa] markets are cutting costs and restructuring operations to ride out the current economic storm.”

The report continues to say that global spending in 3Q12 dropped 1% compared to 3Q11’s $3.7 billion. And even though spending is up 14% for Asia-Pacific regions, it is not enough to offset declines of 11% in North America, 8% in EMEA, and 4% in South and Central America.

Despite the networking predictions, we forecast that sales of lasers into the communications market segment should grow 7% to $2.67 billion in 2013. A supporting example is JDSU’s Communications and Commercial Optical Products revenues, which have grown each of the last four quarters from $163 million to $173 million to $185 million and finally reaching nearly $195 million in calendar 3Q12 (period ended September 29).

Laser sales for optical data storage will continue to suffer as the need for archiving shifts from physical media to the cloud. By mid-year 2012, IHS iSuppli (El Segundo, CA) reported that consumer subscriptions to cloud-based storage services reached 500 million. Based on these trends, we see laser sales for optical storage growing a modest 2% to $1.21 billion in 2013, bringing the combined 2013 communications and storage forecast to $3.88 billion. Now if heat-assisted magnetic recording (HAMR) and holographic optical storage can gain traction in the next few years, the forecast for lasers in this market segment could improve considerably.

Materials processing and excimer lithography

The industrial laser market, consisting of lasers integrated into materials processing systems operating in a manufacturing environment, recovered rapidly from the 2008/2009 global recession, led by fiber laser applications in marking and DPSS laser applications in the microelectronics sector—mainly flat-screen displays, smart phones, and tablets. A summary of industrial laser revenues for the period 2010–2012 clearly shows the impetus that fiber lasers brought to growth in the industrial laser market sector.

Also acting as a market driver was the introduction of industrially rated ultrafast pulse (UFP) lasers, with pulses in the pico- and femtosecond range that quickly found a receptive market in the microprocessing sectors with the fabrication of medical devices. These “cold processing” lasers, producing negligible residual heat effects, prove ideal for precision processes heretofore unachievable such as suture drilling, catheter welding, and micro-hole drilling in filters. In that regard, these lasers are opening new and expanding market sectors for laser processing, a forerunner to revenue expansion in the second half of this decade.

Perhaps the most active industrial laser technology product sector is the fiber laser, both at low- and high-output power levels. Low-power pulsed and CW fiber lasers have revolutionized the global marking and engraving industries as replacements for LPSS and DPSS lasers. Today, thousands of these lasers are shipped to system integrators around the world where they have become the commodity that the laser industry has long wanted, achieving a status akin to today’s inkjet printers in terms of attractive selling price and high product reliability.

High-power fiber lasers rapidly became a disruptive technology in the field of sheet metal cutting, growing from miniscule annual sales in 2007 to today’s market, where, in 2012, more than 1000 of these kilowatt-level lasers have been integrated into flat sheet cutters, capturing 20–25% of the market formerly held by high-power CO2 lasers. Today, more than 28 system integrators in a dozen countries offer a fiber laser system for sheet metal cutting. The rapid rise in user popularity of this laser and its leading supplier, IPG Photonics, has caught the attention of stock market investors such that this company has become the “darling” of Wall Street, creating a cadre of laser-aware market analysts. To compete with IPG, four new high-power fiber laser suppliers entered the market this year.

TRUMPF, the largest industrial laser and system manufacturer in terms of revenue, has adapted its proprietary disk laser technology for high-power cutting, welding, and surface treatment applications. This ruggedly engineered product is a direct competitor to the fiber laser through the use of a fiber beam-delivery system.

Metal processing with high-power CO2 and fiber lasers is the largest materials processing application, generating 70% of total laser revenues. Within this category is sheet metal cutting, generating almost $5 billion of laser system revenues. Today, high-power fiber lasers represent more than 20% of this market sector, growing at a fast pace to supplant the CO2 laser as the dominant energy source.

The market for solid-state and fiber lasers in the field of photovoltaics manufacturing will contract as equipment suppliers experience the fallout from the anticipated slowdown in solar cell implementation and the current overcapacity in that industry; however industry experts expect this situation to improve in 2014.

Laser marking, with a 17% market share of laser revenues, is another sector in which the fiber laser has gained popularity at the expense of LPSS and DPSS lasers. This year, fiber represents 73% of the lasers sold into this application sector. And with the cost/watt of fiber lasers dropping as a result of high-volume manufacturing cost reductions, this laser is now making inroads into the microprocessing market, a long-time solid-state laser sector. Currently, microprocessing represents only about 7% of the applications market, but experts we spoke to believe that it will show the largest percentage gains as the UFP laser opens new manufacturing opportunities.

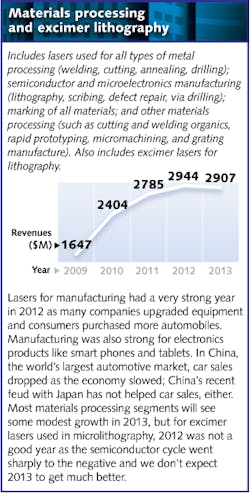

While total global materials processing laser revenues (excluding lithography lasers) showed a modest 7% increase in 2012, this gain was afforded by lasers being sold into fast-growing markets that should take industrial lasers revenues to new heights after an anticipated lull in the growth curve to low single digits in 2013. Industry suppliers are bullish about growth prospects beyond 2013, but they anticipate modest growth from 2012 to 2013 with combined materials processing and excimer laser revenues reaching $2.91 billion.

Scientific research and military

The 2012 Global R&D Funding Forecast is little changed from 2011; the US still comprises the largest spending at $436 billion dollars although growth slowed to 2.1%, while China’s number-two position at nearly $199 billion and Japan’s number-three rank at nearly $157 billion showed 9% growth. All in all, 2012 R&D expenditures grew 5.2% to more than $1.4 trillion in 2012.

For 2013, the worldwide R&D spend is less simple to predict. In September 2012, a US House of Representatives Committee on Appropriations press release approved Resolution 117 to fund the federal government through Mar. 27, 2013, saying, “The bill makes minimal changes to fiscal year 2012 spending levels ...” As fiscal-cliff negotiations were underway at the time of this article, 2013 US science budgets were not available; however, the laser community remains hopeful that the pro-science democratic elect will prevent devastating cuts to programs that directly impact laser research.

In Europe, 2012 R&D expenditures grew 3.5%, despite the sovereign debt crisis. Much of the information we gleaned on the European laser markets this year was thanks to EPIC (Brussels, Belgium; www.epic-assoc.com), the European Photonics Industry Consortium, and the efforts of its new director general, Carlos Lee.

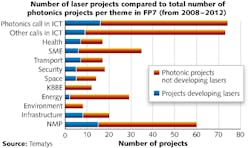

Among the services EPIC provides to its members as it works with the European Commission (EC) to translate industry needs into R&D programs is a newsletter that includes reports from market research organizations like Tematys (www.tematys.com), which released its “Photonics in FP7 [Framework Programme 7] R&D programs” report in December 2012.

The Tematys report says that total funding allocated by the EC to 377 photonics-based projects between 2008 and 2012 was $1.7 billion—about 10% of the overall (public and private) R&D spending for photonics in Europe. “Approximately 20% of these photonics projects aim at developing lasers or laser-based systems, with corresponding funding of about $80 million in 2012,” says Tematys partner Thierry Robin. “Many FP7 laser projects are driven by a specific application need and we find a high proportion of them in themes like Transport or Security (where lasers are used in lidar or LIBS systems), in NMP [Nanosciences, Nanotechnologies, Materials and new Production Technologies] as a component for process equipment, and in Health in imaging technologies like photoacoustics.” Robin adds, “For 2013, the EC plans to provide about $328 million total in photonics funding, which is essentially flat compared to 2012.”

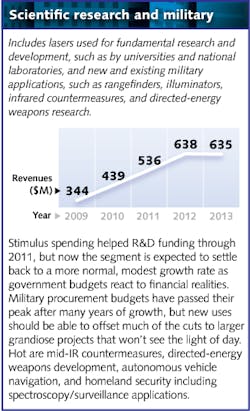

Last year, we forecast R&D and military laser sales to reach $419 million. But it turns out that this market was seriously underestimated, especially in the area of infrared (IR) countermeasures, where multiple international contracts brought sales of hundreds of lasers in this category: case in point, a $334 million contract from the US Air Force to Northrop Grumman (Falls Church, VA) to provide Large Aircraft Infrared Countermeasure (LAIRCM) systems and support. Consequently, we revised our 2012 numbers for R&D and military laser sales up to $638 million in 2012. Unfortunately, that progress will be slowed in 2013 as military spending is pressured by economic realities. As a result, our 2013 R&D and military laser sales forecast is $635 million—a slight drop on the upwardly revised 2012 number.

The US presidential re-election of Barack Obama is widely viewed as a negative for military spending for 2013 and beyond. But a US defense budget that grew from just more than $275 billion annually under President Clinton in 1999 and then mushroomed to around $612 billion in 2008 by the end of the eight-year Bush era (and reached a whopping $700 billion in 2011) was bound to be targeted for cost cutting regardless of the elected administration, especially as the US edged ever closer to the end-of-2012 fiscal cliff. Consequently, many companies serving military and defense and security applications have begun to seek other “commercial” and “civilian” avenues, much like communications companies sought nontelecom applications just after the telecom bubble burst.

“We are keeping our eyes on commercial markets for high-volume applications,” says Falgun Patel, program manager for FLIR Electro-Optical Components (Ventura, CA), makers of laser rangefinders, illuminators, pointers, and high-end laser systems for target designation. “We are seeing growth in laser rangefinders and illuminators for small UAVs [unmanned aerial vehicles], UGSs [unattended ground sensors], and surveillance equipment not only in defense-related applications but also in homeland security and private security applications. Much of the market is driven by product upgrades, and smaller, lighter, eye-safe, longer-range, lower-cost laser technologies are crucial to growing commercial volumes.”

But while laser manufacturers supplying the defense industry are cautious due to US pressures to reduce military spending, an administration change has also taken place in China, with promilitary Xi Jinping replacing Hu Jintao; in addition, emerging economies are increasing their military presence and global defense spending, according to IHS Jane’s (Englewood, CO) forecast, is expected to increase 6.8% between 2011 and 2015.

Medical and aesthetic

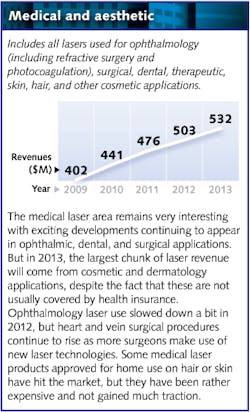

The medical markets (ophthalmic, surgical, dental, and therapeutic) for lasers continue to grow, evidenced by continuing expansion in the BiOS Symposium at SPIE Photonics West 2013 as well as the financial statements of companies like Carl Zeiss Meditec (Dublin, CA), which saw revenues grow 13.6% for the nine-month period up to 3Q12 and celebrated the installation of its 10,000th Cirrus HD-OCT optical coherence tomography system in November 2012 (introduced in 1996). Funding for medical laser companies is also healthy; OptiMedica (Sunnyvale, CA) closed a $35 million growth round in late 2012 to commercialize its Catalys Precision Laser System for femtosecond-laser-based cataract surgery.

Although laser sales for aesthetic procedures did suffer in the recession, 3Q12 revenues for companies like Cutera (Brisbane, CA), Cynosure (Westford, MA), Palomar (Burlington, MA), Solta (Hayward, CA), and Syneron (Yokneam, Israel) were up 28%, 31%, 25%, 28%, and 5.5%, respectively, compared to 3Q11. In all cases, the CEOs of these companies attributed this phenomenal growth to the fact that lasers are easy to use, can be reliably manufactured, and have delivered the clinical benefits promised.

With both medical and aesthetic laser sales on the rise, we expect this market segment to grow 6% to $532 million for 2013. The growth forecast would have been even higher had it not been tempered by a US medical device sales tax that will be implemented as of Jan. 1, 2013. The US Healthcare Reform act of Mar. 30, 2010 calls for a new revenue-raising provision to partially offset the cost of healthcare: an excise tax on sales of any “taxable medical device” by the manufacturer, producer, or importer of the device in the amount of 2.3%.

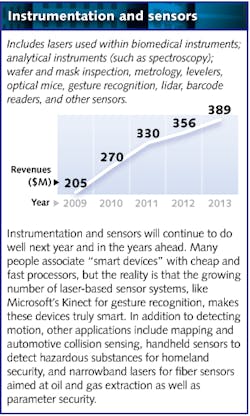

Instrumentation and sensors

“Although most laser segments suffered in 2009 during the Great Recession, the bioinstrumentation market was flat,” says Thierry Georges, president and CEO of Oxxius (Lannion, France). “2013 may be a replica of 2009, which brought a slowing of new product launches; however, fluorescence studies, next-generation DNA sequencing, and UV detection of proteins will keep the biomedical markets active for both diode and DPSS lasers.”

Instrumentation is much more than just “bio” and life-science related, of course, and includes homeland security, environmental sensing, and inspection/metrology equipment from the primary instrumentation companies we use as a metric for this segment each year—Bruker (Billerica, MA), Bio-Rad (Hercules, CA), Becton Dickinson (Franklin Lakes, NJ), and Beckman Coulter (Brea, CA).

Bruker’s 3Q12 revenues were up to $379 million from $367 million in the same quarter last year, no doubt helped by an $11 million contract for x-ray scattering and spectroscopy beamline components in October 2012, $3 million for 3D optical microscopes used for high-pixel-count displays in November 2012, and the recent launch of its IRIS TERS probes for tip-enhanced Raman spectroscopy.

Bio-Rad revenues saw a slight decline of 3.5% in 3Q12 compared to 3Q11 due to some acquisition-related issues, with Bio-Rad president and CEO Norman Schwartz noting that “…macroeconomic challenges continue to have an impact on our performance.” For the same period, Becton Dickinson saw a 1.1% revenue decline, citing weakness in the US research market.

Instrumentation laser sales should see a boost in coming years from increasing penetration of lidar equipment in applications ranging from topographical mapping and environmental monitoring to wind-turbine optimization as renewable energy markets continue to develop.

For 2013, gesture recognition applications will continue to drive IR laser diode volumes in the sensor markets. In addition to the edge-emitting laser diodes that JDSU (Milpitas, CA) supplies for Microsoft’s Kinect, even companies like FLIR—which purchased the former Aerius Photonics in July 2011 and its vertical-cavity surface-emitting laser (VCSEL) technology—are eyeing the commercial possibilities.

“In addition to the expanded presence of high-power VCSELs as laser illuminators for surveillance applications in 850, 975, and 1064 nm wavelengths, we also see VCSELs playing a role in gesture-recognition applications,” says FLIR’s Falgun Patel. “With reduced speckle, high beam uniformity, and far lower production costs due to simpler packaging [no need to carefully cleave, and die-level mirror coat and test] compared to edge-emitting laser diode designs, VCSELs could accelerate the adoption curve for gesture recognition in high-volume smart phone, tablet, and television applications.”

And although JDSU could not comment further on some new developments in gesture recognition that will be announced by Christmas 2013, they did say that early gesture-recognition gaming technology allowed you to “see” hands and arms, but that recent technology advances in resolution will now allow you to see fingers—perhaps qualifying next-generation gesture recognition as a potential “killer application.”

Unfortunately, gesture-recognition technology still has some hurdles to overcome; for example, the $10,000 Samsung ES9000 smart TV includes a camera and laser sensors that lets viewers play the mobile app Angry Birds. The experience brought mixed reviews, and the price is well outside the “disposable income” allowance for most consumers.

Laser instrumentation and sensor sales are forecast at $389 million in 2013, up from our revised $356 million in 2012.

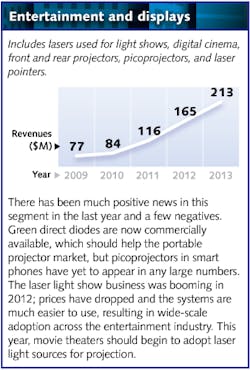

Entertainment and displays

While annual shipments of smart phones are expected to exceed 1 billion devices by 2016 according to NPD Display Search (Santa Clara, CA), television is in trouble: Global TV shipments declined for the fourth straight quarter as of 3Q12 and even domestic consumption of liquid-crystal display (LCD) TVs in China is forecast to grow a negligible 1% in 2012 to 40.5 million units—a “far cry” says IHS iSuppli compared to the 15% growth in 2011. While economic uncertainty is being blamed for the decrease, the thirst for “mobile” entertainment runs high; users want to watch what they want when and where they want, and are just as likely to pop in a Netflix DVD or stream a movie on their laptops as they are to watch programmed TV.

But what does this mean for projection displays? It means that, quite possibly, cinema and large-screen in-home projectors as well as picoprojectors for smart phones could finally begin to enjoy the market growth that has been long-awaited by laser diode manufacturers. “Laser projection and displays have significant growth potential if laser manufacturers can overcome technology and cost pressures,” says Petteri Uusimaa, president and CEO of Modulight (Tampere, Finland). Even the authors of the 2012 US National Academy of Sciences report entitled “Optics and Photonics: Essential Technologies for our Nation”—commonly called Harnessing Light 2—weighed in on the cost issue: “Although projectors are widely used in schools and for presentations to large audiences, price has been the major factor in their adoption rather than the size, the power consumption, or, to some extent, the brightness of these projectors.”

The National Academies report emphasized that among digital light processing (DLP), liquid crystal on silicon (LCoS), and beam-steering projection options, “Each of those technologies has advantages and disadvantages, and there is no clear overall winner yet.” But Uusimaa points to the obvious need for low-cost green laser diodes to improve all RGB-laser-based projection methods and predicts, “Lasers are the ultimate choice for small-pocket projection to business and cinema venues, and this application should be ready for mass markets in the next two to three years.”

Let’s hope Uusimaa is correct; with an estimated 40,000 movie screens across the US alone, laser projection could be big business, and suppliers are already lining up. In late October 2012, Christie Digital (Cypress, CA) said it awed viewers at a theater in Beijing with a record 72,000 lumen laser projection of 3D content, topping Barco’s (Rancho Cordova, CA) 55,000 lumens. And both Modulight and Laser Light Engines (LLE; Salem, NH) are making news with RGB-based laser light engines that are a drop-in replacement to the xenon lamps in existing 2D and 3D digital cinema projectors. “Our platform is designed to ‘plug in’ green multiwatt laser diodes—which may arrive to the market even earlier than anticipated; most likely in less than two years,” adds Uusimaa.

Lasers used in projection displays and entertainment venues should grow in sales to $213 million in 2013. Our forecast in this segment has been revised significantly (we have more than doubled our original projections back to 2009) and reflects our serious underestimation of projection and entertainment sales for the past several years. The continuing popularity of the “mobile” and “big screen” viewing experience coupled with the phenomenal revenue growth—about 50% from 2011 to 2012—for lasers used in entertainment venues and laser light shows will continue to keep this laser sales category healthy.

“Laser effects are becoming a ‘standard’ for all major entertainment events, from TV shows like ‘Dancing with the Stars,’ to sporting events and concerts, and even in tourist attractions like cruise ships,” says Justin Perry, COO of Pangolin Laser Systems (Orlando, FL) and chairman of the International Laser Display Association (ILDA; www.laserist.org) marketing committee. “A big contributing reason for this is that the costs involved in performing a laser light show have dropped exponentially and advances in laser control technology have made creating laser light shows easier than ever before. In the past you needed three-phase power and a water-cooled laser; now, everything is plug and play.”

Perry adds, “In many cases it’s less expensive to use lasers instead of other lighting options like LEDs; it takes a lot of LEDs to have the visual impact afforded by just a few laser projectors.”

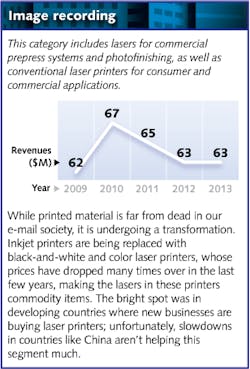

Image recording

Laser Focus World is adamant that print is not dead. At least for our magazine, we still send printed copies to more than half of our 71,000 subscribers (43.5% specifically request digital copies only). InfoTrends (Weymouth, MA) also reports in its 2012 U.S. Photo Printing End-User Survey that 73% of US consumers say they still print photos occasionally. And yet, the New York Times writes, “…it’s clear that the print newspaper business, which has been fretting over a looming crisis for the last 15 years, is struggling to stay afloat.” In keeping with data storage, print will suffer in the years ahead in favor of electronic and cloud storage, compelling us to keep laser sales for image recording markets flat at $63 million again in 2013.

REFERENCES

1. G. Leather, “Is rapid credit growth in Asia something to be worried about?,” Emerging Asia Economic Focus report from Capital Economics (Nov. 1, 2012).

2. US Department of Energy Basic Energy Sciences Advisory Committee, “Directing Matter and Energy: Five Challenges for Science and the Imagination” (December 2007); http://stanford.io/UIgAT7.

FOR MORE IN-DEPTH ANALYSIS

Much more detail on the laser markets is available from Strategies Unlimited in its new report, Worldwide Market for Lasers 2013 (www.strategies-u.com). Details include forecasts to 2016 of laser units, average prices, and revenues by segment, estimates of market share, and discussion of the dynamics within each laser segment. The report is the only comprehensive report on the laser market, and the eleventh in a series that includes fiber lasers and industrial lasers. Special topics reports in the series cover mid-infrared lasers and ultrafast lasers.

Strategies Unlimited specializes in photonics markets, including lasers, LEDs and lighting, and imaging. It was founded in 1979 and is located in Mountain View, CA. Strategies Unlimited is one of PennWell’s many brands, which also include Laser Focus World, Industrial Laser Solutions, BioOptics World, Vision Systems Design, LEDs Magazine, and Lightwave.

ABOUT THE NUMBERS

The estimates and forecasts of laser shipments were based on both supply and demand side analyses by Strategies Unlimited. The analyses used information gathered from interviews conducted throughout the year by Laser Focus World and Industrial Laser Solutions, as well as from financial statements and news reports. The demand side analysis focused on the relevant trends in 2012 and in recent years for sales of laser-based systems and the buying trends of customers of those systems. The supply side analysis focused on the corresponding trends of suppliers of lasers and their suppliers. The effort considered both quarterly trends and long-term historical trends; results were then compared and adjusted to correct for known errors.

The Laser Focus World quantitative market survey remains the only comprehensive market survey of the laser industry. More information will be available from Strategies Unlimited and at the Lasers & Photonics Marketplace Seminar held in conjunction with SPIE Photonics West in San Francisco on Monday, Feb. 4, 2013.

GLOBALIZATION: INTEGRATION

Technology drives globalization. An advanced IT infrastructure expands communications and opens new geographical markets, even for products like lasers. However, broader access to technology also increases competition, lowers prices, equalizes wages across nations, and increases the need for manufacturing automation, especially as products become commodities rather than specialties. And if a company’s goal is to grow revenue by offering an expanded portfolio to meet a global marketplace, one favored path to achieving that goal is consolidation (integration). For instance, why make your own fiber laser when there are plenty of other qualified manufacturers out there?

The wave of photonics industry consolidation that we noted in 2009 has continued in 2012 as laser markets mature and globalization expands. Here are just some of the acquisitions that occurred in 2012: ASML acquired lithography lightsource maker Cymer; Finisar acquired RED-C Optical Networks’ amplification technologies; Solid-state laser maker Laser Quantum acquired femtosecond laser and oscillator maker Gigaoptics; Coherent acquired laser makers Innolight, Midaz Lasers, and Lumera Laser; Electro Scientific Industries acquired fiber laser manufacturer EOLITE Systems; Newport completed acquisition of ILX Lightwave for its photonics test instrumentation and acquired Vistek for its vibration isolation equipment; Cisco acquired silicon photonics maker Lightwire; IPG Photonics acquired JPSA and its UV and DPSS capabilities; and Thorlabs acquired Maxion for its mid-IR semiconductor lasers.

Gail Overton | Senior Editor (2004-2020)

Gail has more than 30 years of engineering, marketing, product management, and editorial experience in the photonics and optical communications industry. Before joining the staff at Laser Focus World in 2004, she held many product management and product marketing roles in the fiber-optics industry, most notably at Hughes (El Segundo, CA), GTE Labs (Waltham, MA), Corning (Corning, NY), Photon Kinetics (Beaverton, OR), and Newport Corporation (Irvine, CA). During her marketing career, Gail published articles in WDM Solutions and Sensors magazine and traveled internationally to conduct product and sales training. Gail received her BS degree in physics, with an emphasis in optics, from San Diego State University in San Diego, CA in May 1986.

Conard Holton

Conard Holton has 25 years of science and technology editing and writing experience. He was formerly a staff member and consultant for government agencies such as the New York State Energy Research and Development Authority and the International Atomic Energy Agency, and engineering companies such as Bechtel. He joined Laser Focus World in 1997 as senior editor, becoming editor in chief of WDM Solutions, which he founded in 1999. In 2003 he joined Vision Systems Design as editor in chief, while continuing as contributing editor at Laser Focus World. Conard became editor in chief of Laser Focus World in August 2011, a role in which he served through August 2018. He then served as Editor at Large for Laser Focus World and Co-Chair of the Lasers & Photonics Marketplace Seminar from August 2018 through January 2022. He received his B.A. from the University of Pennsylvania, with additional studies at the Colorado School of Mines and Medill School of Journalism at Northwestern University.

Allen Nogee | President, Laser Markets Research

Allen Nogee has over 30 years' experience in the electronics and technology industry including almost 20 years in technology market research. He has held design-engineering positions at MCI Communications, GTE, and General Electric, and senior research positions at In-Stat, NPD Group, and Strategies Unlimited.

Nogee has become a well-known and respected analyst in the area of lasers and laser applications, with his research and forecasts appearing in publications such as Laser Focus World, Industrial Laser Solutions, Optics.org, and Laser Institute of America. He has also been invited to speak at conferences such as the Conference on Lasers and Electro-Optics (CLEO), Laser Focus World's Lasers & Photonics Marketplace Seminar, the European Photonics Industry Consortium Executive Laser Meeting, and SPIE Photonics West.

Nogee has a Bachelor's degree in Electrical Engineering Technology from the Rochester Institute of Technology, and a Master's of Business Administration from Arizona State University.

David Belforte | Contributing Editor

David Belforte (1932-2023) was an internationally recognized authority on industrial laser materials processing and had been actively involved in this technology for more than 50 years. His consulting business, Belforte Associates, served clients interested in advanced manufacturing applications. David held degrees in Chemistry and Production Technology from Northeastern University (Boston, MA). As a researcher, he conducted basic studies in material synthesis for high-temperature applications and held increasingly important positions with companies involved with high-technology materials processing. He co-founded a company that introduced several firsts in advanced welding technology and equipment. David's career in lasers started with the commercialization of the first industrial solid-state laser and a compact CO2 laser for sheet-metal cutting. For several years, he led the development of very high power CO2 lasers for welding and surface treating applications. In addition to consulting, David was the Founder and Editor-in-Chief of Industrial Laser Solutions magazine (1986-2022) and contributed to other laser publications, including Laser Focus World. He retired from Laser Focus World in late June 2022.