Photonics stock indices 2020 year-in-review: A thousand points of light

The photonics sector shone bright in 2020 as the U.S. Photonics Index finished up nearly 50%, mirroring the PHLX Semiconductor (SOX) Index, outperforming a hot sector exchange traded fund (ETF) like ROBO Global Robotics and Automation Index, and beating the S&P 500’s 16% gain as well as the International Photonics Index’s 25% gain. The companies listed in the U.S. and International Photonics Indices are available at https://bit.ly/PhotonicsStockIndices.

Diversity within the ecosystem

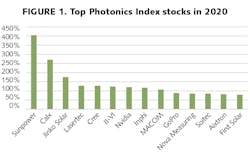

Of the firms in the indices with appreciation over 75%, nine are U.S.-based and five are non-U.S., with both component and system firms represented. Each of the top gainers has a story in which subsector demand tailwinds and company execution are in sync (see Fig. 1).

II-VI Incorporated is a poster child of getting positioned for growth markets with key customers and being rewarded with a market value that rose 3X from its 2020 low, to finish in excess of Lumentum’s value at year-end. Of the 40 U.S. Photonics Index companies, only five were down for the year in comparison to 10 of the 50 in the International Photonics Index. Looking forward, we will de-select 8–10 firms and add others to better reflect the industry and ecosystem. For example, Cree will exit since it is divesting its optics unit, and FLIR will exit because it is being acquired.

For knowledgeable members of the photonics community, it is important to note that most public firms are not pure plays in photonics, thus the indices focus on the ecosystem of suppliers and demand drivers. Many firms are classified in multiple ways; for example, lidar firms are defined as Robotics or Automation by major institutional investors. The ROBO ETF’s end-of-2020 top 10 holdings included IPG Photonics, Keyence, Cognex, Illumina, and FLIR—all firms in our indices. Nvidia of course is classified as a semiconductor firm; however, it is also categorized by investors as a leader in artificial intelligence (AI), robotics/automation, and gaming. For the photonics community, it’s an engine for big data imaging/photonics processing and a demand driver accelerating bandwidth consumption.

Among additions to the indices in 2021 Q1 will be public lidar firms via special-purpose acquisition company (SPAC) mergers, the first pure-play quantum public firm, and several firms previously overlooked, such as Camtek and Lens Technology. In spite of COVID-19 restrictions, many firms in the indices had a V-Shape recovery in 2020, with Camtek and Nova Measuring being two examples of companies that made presentations to investors in early January 2021 of how they grew in 2020 and will continue in 2021.Drivers and opportunities

What are the carryover investment themes from 2020 that will impact the photonics communities in 2021 and beyond? I first used the “1000 points of light” phrase introducing a Uniphase (now Lumentum) investor presentation in the late 1990s, lifting that phrase first popularized by President George H.W. Bush. A 1955 C.S. Lewis children’s fantasy novel went a magnitude better: “One moment there had been nothing but darkness; next moment a thousand, thousand points of light leapt out.”

The breadth of opportunities for innovation and the current availability of capital to the ecosystem now align as accelerants on the demand for photonics. Here are a few key observations:

Capital investment is briskly flowing. COVID-19 in 2020 did not stop investment in advanced technology firms—in fact, it accelerated. M&A activity was as robust as we’ve seen in a long time, with public firm FLIR agreeing to be bought; Acacia on-off-on again with Cisco until it received ~9x revenue in valuation; ISRA Vision being taken at ~10x revenue; Inphi acquired at over 20x revenue; and, furthermore, in January 2021, Lumentum announced it would buy Coherent.

In 2020, venture capital outlays increased; we saw huge IPOs that consume bandwidth; and SPACs opened up deep pools of long-term investment targeted at big-opportunity markets such as electric vehicles (EVs) and automation. What do Tesla and the dozens of EV firms that raised billions of dollars in SPACs have to do with the future of photonics? The answer is: a lot. Between EV and lidar firms, 2020 generated over $100 billion of new public market value. Larry Burns, ex-General Motors R&D manager and now advisor to Waymo, stated that autonomous vehicles (AVs) will only exist if they are EVs: “There’s a synergy between electric cars and driverless cars.”

Cloud computing, AI, and quantum are driving dramatic computing and communications infrastructure investments that create a need for next generations of optical-photonic solutions. The need for bandwidth and speed, fueled by available capital and multiple hard-charging players, has created a once-in-several-decades opportunity to carve out winning positions in new products and markets. Generating recurring revenue from data aggregation and AI to enhance actions is a major theme and will continue as device companies offer such services. For example, GoPro’s value-add move from “just” a device vendor to a becoming a data repository and AI mining engine for imaging is a source of their recent strong results and stock.

Robotics and automation offer a rich set of opportunities at the device, system, and AI offering levels. The investment community has only seen the tip of the iceberg where photonics plays in these fields. We are in the early days of product improvements in lidar and earlier still in quantum. Don’t ignore markets and firms that may seem tangential to your business in the near-term—they can deliver lessons and connections for your next breakout opportunity. An example of ecosystem connections is that GoPro’s CEO was one of the early investors in Luminar and their contract manufacturer is making time-of-flight (ToF) devices and imaging modules for in-auto systems.

“Photonics is great for entrepreneurism, but it’s why the industry is so fragmented and hard to characterize,” states Jay Leibowitz, a long-time industry executive and former sector market researcher. My suggestion is to use the Photonics Indices for gaining insights beyond your immediate ecosystem as a jumping-off point to inspire your business models and expand your outreach efforts. Monitor relevant ETFs, dig into SEC investor documents, and network with those investors and firms that can broaden your vision to help generate thousands of points of light with customers, employees, and partners. Ride the waves and reach for the light!

John Dexheimer | President, LightWave Advisors

John Dexheimer is President of LightWave Advisors. He has been a past Laser Focus World contributor on business trends and investments in the photonics sector. As an investment banker, he managed the IPO of Uniphase, assisted in their early global acquisitions, and invested in and advised several other optical component firms that have since become part of Lumentum’s global business.