COVID-19 Year 2: A photonics story of growth, shortages, and innovation

Few markets have sustained the steady and healthy growth numbers the photonics market has enjoyed since the 1970s. However, when the COVID-19 pandemic hit, it threatened to put an end to the market’s 50-year boom. Fortunately, the photonics market saw far less instability than many anticipated throughout the pandemic. Although the market may not have seen the same growth rates it has enjoyed in previous years, it remained pleasantly stable.

According to recent numbers by Mordor Intelligence, the anticipated growth for the photonics market remains impressive. Specifically, Mordor valued the global photonics market at US$589.82 billion in 2020, and it is expected to reach US$1019.77 billion by 2026. This accounts for an estimated compound annual growth rate (CAGR) of approximately 7.14% during the period of 2021-2026.

Additionally, in June 2021, McKinsey & Co. released its “The Next Wave of Innovation in Photonics” report, which also demonstrated how the track record of dedication to innovation across the photonics markets has enabled the laser-device market to achieve a value of $17 billion by 2020. This same report anticipates a continued growth rate of 10%, yielding market valuation of $28 billion by 2025. Additionally, McKinsey expects to see 8% growth across precision optics sector, as well as 9% growth for photonics sensors. The automotive use of photonic sensors in particular is an area where the firm predicts especially strong growth numbers (21% per annum), attributable to the trend towards autonomy.

The key takeaway from the available numbers? The pandemic remarkably doesn’t seem to have had much effect on the industry, explains Tom Hausken, senior industry advisor with Optica (formerly OSA). “Whereas you hear about downtown office buildings remaining empty and devastating the nearby businesses that serve them, and other lasting impacts from the pandemic, our industry seems surprisingly unscathed,” he says.

“The year 2020 underperformed from what it would have been without the pandemic, and 2021 outperformed as disruptions faded, and pent-up demand drove revenues. Now supply chain issues are restricting growth, but the industry appears to be on track to approximately where it would have been if the pandemic hadn’t happened,” says Hausken. “Looking ahead to 2022, we can expect more of the same. It should be a ‘normal’ year, apart of course from whatever new external disruptions may come our way. But our industry has been strong through two of the most challenging years of our generation.”

One key note: Unlike previous market review articles appearing in Laser Focus World’s January issues, this year’s focus is much broader, looking at the photonics market as a whole rather than narrowing in on the laser subset. The rationale for this shift is significant. Although lasers will continue to serve as a meaningful component of the larger photonics industry, the market has hit a maturity level where it is now important to look at the market in its entirety.

The chip conundrum

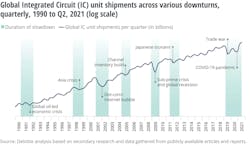

It may feel like everyone is “blaming” the chip shortage for current frustrations. After all, it has become a common sticking point across just about every industry today—but for good reason, the number of semiconductor chips in today’s manufactured goods is mind-boggling. Adding fuel to the fire, the need for more chips is intensifying as smart technology becomes the norm (see Fig. 1). Specifically, the persistent drive to leverage artificial intelligence (AI), machine learning, autonomy, and electronification of mobility solutions will only add to the demand expectations.

Simply considering how many chips one product can contain adds context to the issue. For instance, automakers consume roughly 10% of the current chip production with cars containing a range of 100 (internal combustion engine) to as high as 3000 (autonomous battery electric). Smartphones, appliances, Industrial Internet of Things (IIoT) devices, and even toys are all chip hogs rapidly using up the global supply.

According to a December 2021 report by Kearney, “the demand for leading edge semiconductors will increase with an annual growth rate of 15%.” Kearney sites AI, high-performance computing, edge computing, and wireless communications as the key drivers (see Fig. 2), while also estimating these products will account for “more than 80% of leading-edge semiconductor consumption by 2030.”Part of the solution has been to increase production capabilities—which is both cost-intensive and very much a long-term component to addressing the ongoing shortage. “To be clear, growth in 200 mm is mainly from increasing capacity in existing fabs, rather than the construction of entirely new plants, which account for nearly US$12 billion of capital equipment spending between 2020 and 2022,” write the authors of the Deloitte study. “From a technology perspective, capacity at mainstream nodes and the more advanced 300 mm process nodes (under 10 nm, mainly at 3 nm, 5 nm and 7 nm) will grow more rapidly than more mature process nodes. It is worth noting that demand is growing for both wafer sizes, and at all process nodes, not just the most advanced.”

What’s the relevance?

Beyond all the grumbling, there is a legitimate reason why the semiconductor supply issue plays such an important part of understanding the challenges and opportunities within photonics. There is no doubt the semiconductor market is a growing user of lasers, especially near-infrared (near-IR) and green lasers. In addition, the photonics products (optics, instrumentation, accessories, etc.) sold into the semiconductor manufacturing market are not only expansive, but also growing as the demand for chips continues to escalate.

Extending this further, photonics and semiconductor chip usage often goes hand-in-hand, not only with the leading-edge semiconductor chip manufacturing process, but also (and perhaps more importantly) with the resulting products. Even if players within the photonics market are able to deliver on existing orders, the lack of access to affordable chips often means the end product producer is unable to complete its goods.

How did this chip shortage become such an issue? The answer is multifaceted. Demand spikes have proven to be a serious component from the seemingly unquenchable thirst for smart, automated goods to the pandemic-based, work from home-induced need for considerably more consumer electronics (computers, monitors, webcams, conference speakers, etc.) than the market anticipated, so semiconductor chips took center stage. Just looking at global personal computer shipments in the fourth quarter of 2020, the industry enjoyed a 10.7% increase from the fourth quarter of 2019, according to Gartner. For the year, shipments reached 275 million units in 2020, representing the highest growth for an already steady industry in over a decade.

However, increased demand is only part of the equation. Supply issues have also contributed significantly to the ongoing chip crisis. Most notably, disasters impacted semiconductor production throughout the pandemic. Specifically, the blizzard that crippled Texas in 2021 created power outages and facility damage, resulting in downtime with a notable impact on the supply chain. Big producers like NXP and Samsung each experienced capacity crunches over 25%. Likewise, the facility fire in Japan eliminated an entire quarter’s production capabilities, stopping global automotive users in their tracks.

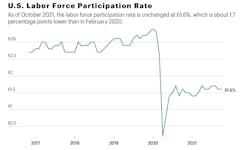

Global workforce shortages are also factoring in on the supply side. These shortages have impacted the photonics industry as well. In addition, the workforce shortage was intensified as the pandemic ushered in a flurry of employment challenges. And the employment issue everyone loves to talk about is actually quite complex.

Burnout, health concerns, and stimulus payments all enter the picture. Yet, it is equally important to consider the priority realignment that has occurred throughout the pandemic. According to this Fortune article by Megan Leonhardt, retirement and career breaks are both meaningful contributors (see Fig. 4). “Of the over 5 million Americans Goldman Sachs estimates have left the workforce since the pandemic kicked off, about 3.4 million were over the age of 55—about 1.5 million of whom were early retirees and about 1 million of whom retired on time, according to a recent analysis,” writes Leonhardt. “Meanwhile, nearly half, or 42%, of working Americans surveyed by LinkedIn have considered taking a break from their career.”When addressing the ongoing labor issues and supply shortages, Hausken addresses it well by essentially lumping the issues into one larger category of shortages. “It’s all related, because the parts are slow in part due to worker shortages,” he says. “Basically, demand exceeds the manufacturing capacity right now. But it’s mostly short-term, and you can say it’s the good kind of problem to have.”

Future-focused

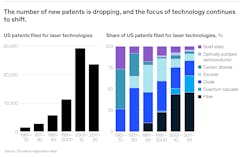

Innovation is a crucial component to carrying the photonics market’s ongoing success into the next generation. As the McKinsey report suggests, the noticeable patent lull points to drops in innovation. However, this does not mean opportunities are drying up. Integrated devices, in particular, represent a significant area of opportunity for companies within the photonics market to expand their reach. This opportunity should prove especially relevant in coming years as device manufacturers actively pursue strategic arrangements with technology developers.

And innovation opportunities are not limited the big players within the industry. Consider for instance the arguments in this New York Times article discussing how the ongoing shortage is responsible for a significant boom for many manufacturers best described as niche players within the broader semiconductor supply chain. These opportunities are not limited to semiconductor companies.

Unfortunately, this is also where the industry maturity level, mentioned early, comes into play. Routinely as industries mature, the rate of pure innovation begins to tail off. And according to the McKinsey report there is real evidence this trend is occurring across the laser and photonics market. McKinsey points to the rate of patent filings as a key indicator. Specifically, from 2001 through 2010, researchers filed more than 29,000 US applications for laser-related patents, accounting for more than double the patent applications from the previous decade (see Fig. 5). However, For the years from 2011 through 2020, however, only about 24,000 applications were filed. This drop was an aberration in an industry where patent filings have traditionally doubled each decade.While there is no denying the patent trend, anyone paying attention to what is happening across the photonics market on a daily basis knows the level of innovation, even when its iterative in nature, remains quite strong. If anything, there are many instances where the pandemic has ignited a new flame, encouraging research and development groups to focus on ways the industry can play a meaningful role in providing better solutions to the world’s problems.

While pandemic was crippling to many industries, the outbreak has actually expanded the scope of photonic devices in the healthcare industry. Hausken provides a perfect example—the role of optics in addressing not just the pandemic, but possibly advancing the big picture fight against viruses altogether.

“The pandemic seemed to come out of nowhere, but pandemics are not new, and the experts say they will become increasingly frequent. At the same time, today’s capability of optics-based technology to identify the virus and help to prove out vaccines is really phenomenal,” says Hausken. “That technology has advanced in throughput and cost enormously in the last few years. We should never take this for granted: what if we were a decade or two behind when COVID-19 took off? As bad as it has been, it would have been far worse.”

There is reason for optimism looking forward, explains Hausken. “With all the investment in this crisis, we now have the opportunity to prepare for future pandemics and even to mitigate much better other viruses, such as influenza and even the common cold,” he says. “That is an opportunity that cannot be wasted, and it’s not possible without optics and photonics. If we’re successful, it’s likely that we’ll all take it for granted, but it’s one of the positive things that can come out of the pandemic.”

About the Author

Peter Fretty

Market Leader, Digital Infrastructure

Peter Fretty began his role as the Market Leader, Digital Infrastructure in September 2024. He also serves as Group Editorial Director for Laser Focus World and Vision Systems Design, and previously served as Editor in Chief of Laser Focus World from October 2021 to June 2023. Prior to that, he was Technology Editor for IndustryWeek for two years.

As a highly experienced journalist, he has regularly covered advances in manufacturing, information technology, and software. He has written thousands of feature articles, cover stories, and white papers for an assortment of trade journals, business publications, and consumer magazines.