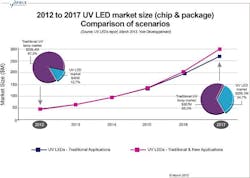

Lyon, France--In its new report entitled UV LEDs: Technology & Application Trends,Yole Développement says that thanks to ultraviolet (UV) curing, UV light-emitting diodes (LEDs) should become a $270M business by 2017, and could hit $300M if new applications (http://www.laserfocusworld.com/articles/2012/02/glass-based-inorganic-uv-led-aims-for-biomedical-use.html) like water purification (http://www.laserfocusworld.com/articles/2012/08/uv-led-water-purification-contract-seti.html) boom. The compact, low cost of ownership, and environmentally-friendly composition of UV LEDs continue to replace incumbent technologies like mercury. The UV LED business is expected to grow from $45M in 2012 to nearly $270M by 2017, at a compound annual growth rate (CAGR) of 43%--whereas the traditional UV lamps market will grow at a CAGR of 10% during the same time period.

For 2012, UVA/UVB applications like UV curing represented 89% of the overall UV LED market. UVC applications are still in their infancy and sales are mainly for R&D purposes and analytical instruments like spectrophotometers. But given some newly published results (increase of EQE over 10%, etc.) and the recent commercialization of the world’s first UVC LED-based disinfection system (2012), the market should kick into gear within the next two years.

UV LEDs are also creating new applications that aren’t accessible to traditional UV lamps--applications that are miniaturized and portable. "In 2012, several new UV LED-based products were launched, including cell phone disinfection systems, nail gel curing systems and miniaturized counterfeit money detectors - and this is likely to continue!," says Pars Mukish, Technology & Market Analyst, LED, at Yole Développement. "We estimate that if new UV LED applications continue emerging, the associated business could represent nearly $30M by 2017, which would increase the overall UV LED market size to nearly $300M," he adds.

This market and technology analysis is a comprehensive review of every UV application (including a deep analysis of UV curing and UV disinfection purification), highlighting: UV working principle, market structure, UV LED market drivers and the challenges/characteristics associated, time-to-market, penetration rate & Total Accessible Market (TAM) for UV LEDs, and much more. Additionally, Yole Développement details the market metrics for traditional UV lamps and UV LEDs over the period 2012 - 2017, with splits by application for each technology (volume & market size, etc.).

The report points out that traditional UV lamp manufacturers are under the most pressure since they have to compensate for the waning lamp replacement market by diversifying their activities in higher supply chain levels. In the end, every UV LED device/system manufacturer faces the same technical issues when it comes to integrating UV LEDs into a system (thermal management, optics, etc.), but experience is gained with each passing year. Once UVC LEDs achieve sufficient performance, there’s no way a manufacturer will allow the opportunity to pass them by. When that moment comes, the whole supply chain will become a mess due to an increasingly competitive environment, and consolidation will be necessary.

AlN on sapphire templates are definitely the substrate of choice for UVA applications, as they provide the right mix between cost and performance. However, for UVC applications (and some UVB applications) the competition with bulk AlN substrate is strong, since such material could allow for improvement at the device level in terms of lifetime, efficiency (IQE and EQE) and power output. Right now, the debate is still on! Such a situation has already occurred with GaN substrate for visible LEDs. Bulk GaN was the ideal technical candidate, but cost was too high and sapphire was widely adopted instead. Will UV LEDs meet the same fate?

In addition to substrate issues for UVC LED development, epitaxy represents another challenge for increasing device performance. Such barriers will have to be surpassed before we see commercialized UV LED-based disinfection/purification systems.

SOURCE: Yole Developpement; http://www.yole.fr/iso_upload/News/2013/PR_UV%20LED_YOLE%20DEVELOPPEMENT_March2013.pdf

IMAGE: Yole Développement says that thanks to ultraviolet (UV) curing, UV LEDs should become a $270M business by 2017 (dark blue curve), and could hit $300M (hot pink curve) if new applications boom. (Image credit: Yole Developpement)